Last updated by BM on December 11, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was up with a YTD price return of +3.7% (capital). Dividends have increased by +9.1% YTD, highlighting the growth in the dividend (income).

- Last week, there were no dividend announcements from companies on ‘The List’.

- Last week, there were no earnings reports from companies on ‘The List’.

- Two companies on ‘The List’ are due to report earnings this week.

The List (2023)

The Magic Pants List includes 27 Canadian dividend growth stocks. Each have raised their dividend annually for the last ten years (or longer) and have a market cap of over a billion dollars. Based on these criteria, companies on ‘The List’ are added or removed annually, on January 1. Prices and dividends are updated weekly.

While ‘The List’ does not function as a portfolio on its own, it serves as an excellent initial reference for individuals looking to diversify their investments and achieve higher returns in the Canadian stock market. Through our newsletter, readers gain a deeper understanding of how to implement and benefit from our Canadian dividend growth investing strategy.

If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service. Subscribers gain access to buy/sell alerts and exclusive content available only to subscribers.

Performance of ‘The List’

Last week, ‘The List’ was up with a YTD price return of +3.7% (capital). Dividends have increased by +9.1% YTD, highlighting the growth in the dividend (income).

The best performers last week on ‘The List’ were Loblaws (L-T), up +4.96%; CCL Industries (CCL-B-T), up +3.56%; and Stantec Inc. (STN-T), up +3.08%.

TFI International (TFII-N) was the worst performer last week, down -5.27%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 8.3% | $6.07 | -9.8% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $76.76 | 27.6% | $0.60 | 26.6% | 13 |

| BCE-T | Bell Canada | 7.0% | $55.20 | -8.4% | $3.87 | 5.2% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $28.16 | -10.1% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.8% | $59.61 | 2.7% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $160.06 | -1.7% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.8% | $144.53 | -1.4% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 5.7% | $31.58 | -14.5% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $99.65 | 24.8% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 5.7% | $49.10 | -6.7% | $2.82 | 5.0% | 16 |

| ENB-T | Enbridge Inc. | 7.5% | $47.46 | -11.0% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.5% | $33.63 | -5.8% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 1.3% | $108.49 | -21.5% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis Inc. | 4.1% | $55.33 | 0.0% | $2.29 | 5.3% | 49 |

| IFC-T | Intact Financial | 2.1% | $210.25 | 7.4% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.4% | $124.05 | 3.1% | $1.74 | 13.2% | 11 |

| MGA-N | Magna | 3.4% | $54.92 | -4.5% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.8% | $68.48 | -9.3% | $1.21 | 12.0% | 28 |

| RY-T | Royal Bank of Canada | 4.3% | $125.24 | -2.2% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.2% | $79.53 | 60.4% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.7% | $105.03 | 60.8% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.7% | $81.01 | -7.6% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.2% | $115.30 | 15.2% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $113.60 | 16.3% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 7.1% | $51.65 | -3.1% | $3.69 | 3.4% | 22 |

| T-T | Telus Corp. | 5.7% | $25.06 | -4.8% | $1.43 | 7.4% | 19 |

| WCN-N | Waste Connections | 0.8% | $138.33 | 5.0% | $1.05 | 10.5% | 13 |

| Averages | 3.4% | 3.7% | 9.1% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

DGI Clipboard

“You are never going to be successful with every single investment. But if you can consistently keep the odds in your favor over time, you can become the casino and not the guy blowing his paycheck drinking watered-down cocktails at The Flamingo.”

– Daryl Jones, HEDGEYE

Be the casino not the gambler

In a standard game of blackjack played with a single deck and employing basic strategy, the house edge typically hovers around 0.5%. This implies that, on average, the casino maintains a slight advantage over the player. However, variations such as multiple decks, rule adjustments, and player decisions can significantly sway the odds in favour of the casino.

For many investors, navigating the stock market may feel akin to sitting at a blackjack table, especially for those seeking short-term capital gains.

Dividend growth investors take a more disciplined approach. They follow a fundamental strategy and adopt a longer-term investing horizon, distinguishing them from other investors. They can afford to patiently await the fruition of their strategy while enjoying the growth of their income.

History has shown that the longer the holding period, with all equities, the more likelihood of a positive return. The chart highlights one of the major differences between how the industry pros invest (Wall Street/Bay Street) and investors with a longer-term investing horizon.

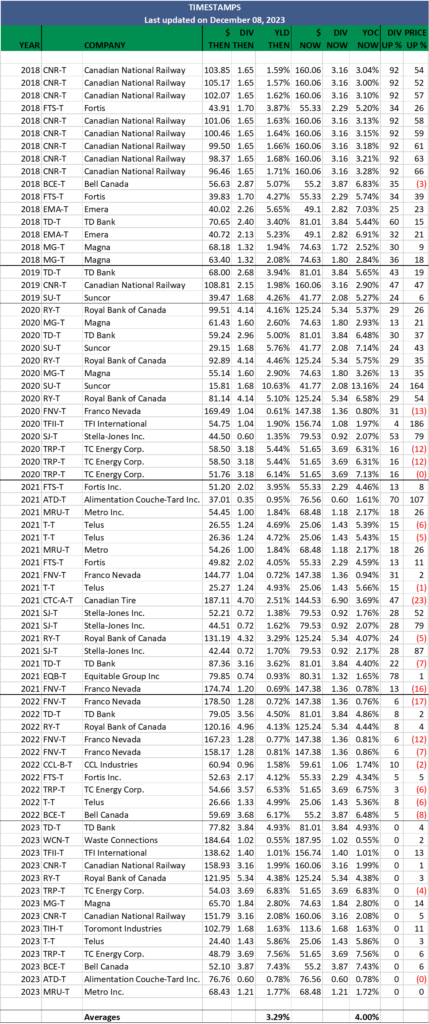

In reviewing our trades (timestamps) over the past six years of our dividend growth investing journey, we see this scenario play out.

The data in our historical DGI timestamp chart can be summarized further by dividing the number of trades with positive returns by the number of trades made for each year. The results support our research into why dividend growth investing is one of the best ways to build wealth. First, a rising dividend income stream will eventually lead to rising stock prices—secondly, the longer the holding period the more significant and more predictable the returns.

Year 1 2023: 86% (12/14) # of positive price returns are volatile.

Year 2 2022: 30% (3/10)

Year 3 2021: 59% (10/17) # of positive price returns stabilizing.

Year 4 2020: 71% (10/14)

Year 5 2019: 100% (3/3) # of positive price returns are highly predictable.

Year 6 2018: 94% (15/16)

Like the casino example, we are able to tilt the odds in our favour with DGI, and by extending our investment time horizon (rule adjustment), we enhance the odds of a positive outcome even further.

If you have not yet joined as a paid subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

Bank of Canada holds key interest rate steady but warns ready to hike again (Globe & Mail)

https://www.theglobeandmail.com/business/article-bank-of-canada-interest-rate-december/

“Governing council is still concerned about risks to the outlook for inflation and remains prepared to raise the policy rate further if needed.”

With many homeowners now facing higher mortgage renewal rates and a slowing economy, the probability of a recession taking hold in 2024 seems more likely. Whether it will be a ‘soft landing’ or not remains to be seen.

Profits in Canadian grocery sector set to exceed record in 2023, expert says (Globe & Mail)

“New research by the centre found that food retailers are now earning more than twice as much profit as they did pre-pandemic.”

After our recent purchase of Metro Inc. (MRU-T) in our model portfolio, this headline appears to be good news. The problem is that the ‘tax the rich’ crowd in Ottawa are zeroing in on the industry for short-term political gain.

Eric La Fleche, president and CEO of Metro Inc. is scheduled to present during the first half of the committee meeting today.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

No companies on ‘The List’ had dividend announcements last week.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter, we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

Two earnings reports from companies on ‘The List’ this week

Dollarama Inc. (DOL-T) will release its third-quarter fiscal 2024 results on Wednesday, December 13, 2023, before markets open.

Enghouse Systems Limited (ENGH-T) will release its fourth-quarter and fiscal 2023 results on Thursday, December 14, 2023, after markets close.

Last week, no earnings reports from companies on ‘The List’.