Last updated by BM on September 18, 2023

Summary

- This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was up with a YTD price return of +4.0% (capital). Dividend growth remained the same and is now at +8.4% YTD, highlighting growth in income over the past year.

- Last week, no dividend increases from companies on ‘The List’.

- Last week, one earnings report from a company on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- If you’re interested in creating your own dividend growth income portfolio, consider subscribing to our premium service, which grants you access to the MP Wealth-Builder Model Portfolio (CDN) and exclusive subscriber-only content. Learn More

Identifying companies whose dividend growth aligns closely with price growth can considerably enhance the predictability of future returns. Dividend growth investors know that the dividend drives the price in a predictable way, not the other way around. Fortis Inc. (FTS-T) is another company on ‘The List’ that aligns very closely with this dividend growth vs price growth pattern we like to see.

Introduction

“You have a pair of pants. In the left pocket, you have $100. You take $1 out of the left pocket and put it in the right pocket. You now have $101. There is no diminution of dollars in your left pocket. That is one magic pair of pants.”

This ‘magic pants’ analogy was from a Seeking Alpha article on dividend investing I read about a decade ago and was one of the catalysts for me to take a closer look at this type of investing and see if it truly was magical.

After conducting additional research, I have shifted towards utilizing a dividend growth investing (DGI) strategy as my primary investment approach. While I maintain portfolios consisting of high-quality dividend growers from both the United States and Canada, I have opted to concentrate on Canadian (CDN) dividend growth companies in this blog. This is due to several reasons, including a smaller pool of DGI companies to track, a lack of coverage for the DGI strategy by the North American investment media, and a tendency for those who do cover DGI to narrowly focus on only a handful of sectors (Energy and Financials).

While ‘The List’ is not a portfolio in itself, it serves as an excellent initial reference for individuals seeking to diversify their investments and attain higher returns in the Canadian stock market. Through our blog, we provide weekly updates on ‘The List’ and offer valuable perspectives and real-life examples of the dividend growth investing strategy in practice. This helps readers gain a deeper understanding of how to implement and benefit from this investment approach.

DGI Thoughts

“Investing without understanding valuation is like sailing without a map. You may get lucky, but you’re more likely to get lost.”

-Chuck Carnevale, Creator of the FASTgraphs Research Tools

Last week, we discussed the ‘Dividend Yield Theory’ as a valuation metric to assist us in determining whether our high-quality dividend growth stocks are reasonably priced. This week, we’ll delve into the concept of a company’s ‘valuation corridor’ to guide our entry and exit points.

Analyzing a company’s historical fundamentals provides valuable insights into how the business has been valued over an extended period. Many of the stocks we invest in exhibit a ‘narrow valuation corridor,’ meaning their stock prices tend to follow a path that seldom deviates from their historical trading range. Examining a company’s metrics like P/E (Price to Adjusted Operating Earnings), EBITDA (Price to Earnings Before Interest Taxes and Amortization), OCF (Price to Operating Cash Flow), and Sales (Price to Sales) ranges offers significant insights into how the company has traditionally been valued.

Making a purchase when the stock is at the lower end of this range or selling when it’s at the higher end has proven effective in managing our entry and exit points, ultimately boosting returns.

To visualize a company’s historical valuation, we utilize the Fundamental Analyzer Software Tool (FASTgraphs). Our aim is to see the stock trading within its typical ‘valuation corridor’ based on a ten-to-twelve-year timeline. This approach provides a clearer understanding of how the stock performed during various economic cycles.

We use one of our quality dividend growers on ‘The List’, Canadian National Railway (CNR-T) to demonstrate:

The ‘Black Line’ represents the price of Canadian National Railway over the past decade, while the ‘Blue Line’ indicates the Normal P/E Ratio it trades at over the same time frame. Notably, there exists a clear correlation between price and P/E for this high-quality dividend growth stock, which we refer to as our ‘valuation corridor.’ Historically, buying when the price falls below the Normal P/E Ratio (20.59) has proven to be an opportune moment to invest, and selling when the price line significantly surpasses this threshold has been a favorable time to divest.

The green dots on the graph mark our purchase points for CNR-T, while the solitary red dot represents the single instance when we decided to sell. While we typically maintain our positions in quality dividend growers exhibiting strong fundamentals, we’ve recently discovered that our returns can be further enhanced by selling when these stocks become significantly overvalued. A detailed explanation of our approach is available in our MP Wealth-Builder Model Portfolio (CDN) Business Plan, accessible to all our subscribers.

Chuck Carnevale’s guidance, akin to a map, has consistently steered us in the right direction on multiple occasions.

If you have not yet joined as a paid subscriber of the blog to receive DGI Alerts on the activity and content related to our model portfolio, it’s not too late. Click Here.

Recent News

How TFI International rose from a small Quebec trucker to a North American giant (Globe & Mail)

“We have many great companies in Canada, some of which few people know about.

One that falls into the under-the-radar category is TFI International Inc. (TFII-T). Based in St. Laurent, a suburb of Montreal, it’s a transportation and logistics giant, whose network spans more than 80 North American cities. It has more than 90 operating companies under its banner and employs some 24,000 people.”

When I first ventured into dividend growth investing, I was pleasantly surprised by some of the companies that made it onto ‘The List’. While I was already familiar with TFI International due to my involvement with one of my operating companies, it had never appeared in the financial news. I quickly learned to appreciate the importance of analyzing cash flow when evaluating the quality of dividend growers. We initially purchased TFI International at $54 in 2020, and within just three years, our investment tripled in value! This remarkable performance led us to include it in our MP Wealth-Builder Model Portfolio (CDN) today.

What Canadians don’t understand about our economic situation – which is a lot – can hurt us (Globe & Mail)

This article provides valuable insights into how many Canadians perceive the state of the economy. The author convincingly argues that a lack of deep understanding about the intricate economic forces at play in today’s world is a cause for concern. This knowledge gap compounds the challenges we face in our current economic climate, which includes issues like carbon taxes, government spending, interest rates and inflation.

The List (2023)

Last updated by BM on September 15, 2023

The Magic Pants List contains 27 Canadian dividend growth stocks. ‘The List’ contains Canadian companies that have raised their dividend yearly for at least the last ten years and have a market cap of over a billion dollars. Below is each stock’s symbol, name, current yield, current price, price return year-to-date, current dividend, dividend growth year-to-date and current dividend growth streak. Companies on ‘The List’ are added or subtracted once a year, on January 1. After that, ‘The List’ is set for the next twelve months. Prices and dividends are updated weekly.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 7.0% | $7.20 | 7.0% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $73.39 | 22.0% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 6.9% | $55.15 | -8.4% | $3.82 | 5.0% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $32.72 | 5.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.8% | $57.81 | -0.4% | $1.06 | 10.4% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $157.48 | -3.3% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.4% | $155.29 | 5.9% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 5.7% | $31.53 | -14.6% | $1.79 | 1.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $95.63 | 19.7% | $0.27 | 23.8% | 12 |

| EMA-T | Emera | 5.3% | $51.83 | -1.5% | $2.76 | 3.0% | 16 |

| ENB-T | Enbridge Inc. | 7.5% | $47.60 | -10.7% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 2.7% | $31.13 | -12.8% | $0.85 | 18.2% | 16 |

| FNV-N | Franco Nevada | 0.9% | $143.87 | 4.1% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis Inc. | 4.0% | $56.50 | 2.1% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.2% | $199.89 | 2.1% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.5% | $115.37 | -4.1% | $1.74 | 10.3% | 11 |

| MGA-N | Magna | 3.2% | $57.23 | -0.5% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.7% | $72.78 | -3.6% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 4.3% | $124.12 | -3.1% | $5.34 | 7.7% | 12 |

| SJ-T | Stella-Jones Inc. | 1.4% | $65.12 | 31.3% | $0.92 | 15.0% | 18 |

| STN-T | Stantec Inc. | 0.8% | $90.20 | 38.1% | $0.77 | 8.5% | 11 |

| TD-T | TD Bank | 4.6% | $84.10 | -4.1% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.1% | $131.12 | 30.9% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $112.41 | 15.0% | $1.68 | 10.5% | 33 |

| TRP-T | TC Energy Corp. | 7.3% | $50.68 | -4.9% | $3.69 | 3.4% | 22 |

| T-T | Telus Corp. | 6.1% | $23.27 | -11.6% | $1.43 | 7.4% | 19 |

| WCN-N | Waste Connections | 0.7% | $141.79 | 7.7% | $1.02 | 7.4% | 13 |

| Averages | 3.3% | 4.0% | 8.4% | 19 |

Six Canadian stocks on ‘The List’ declare earnings and dividends in US dollars and are inter-listed on a US exchange in US dollars. The simplest way to display dividend and price metrics for these stocks is to show their US exchange symbols along with their US dividends and price. The stocks I am referring to have a -N at the end of their symbols. You can still buy their Canadian counterparts (-T), but your dividends will be converted into CDN dollars and will fluctuate based on the exchange rate.

Note: When the dividend and share price currency match, the calculation is straightforward. But it’s not so simple when the dividend is declared in one currency, and the share price is quoted in another. Dividing the former by the latter would produce a meaningless result because it’s a case of apples and oranges. To calculate the yield properly, you must express the dividend and share price in the same currency.

Performance of ‘The List’

Last week, ‘The List’ was up with a YTD price return of +4.0% (capital). Dividend growth remained the same and is now at +8.4% YTD, highlighting growth in income over the past year.

The best performers last week on ‘The List’ were Dollarama Inc. (DOL-T), up +9.22%; Canadian National Railway (CNR-T), up +7.02%; and Fortis Inc. (FTS-T), up +5.86%.

Loblaws (L-T) was the worst performer last week, down -2.34%.

Dividend Increases

“The growth of dividend paying ability is of significance in the determination of a stock’s quality, or general safety…”

– Arnold Bernhard (the founder of Value Line)

“As a dividend increase is a positive sign of a company’s financial strength, the safest purchase, after research, is a stock with a recent dividend increase.”

– Tom Connolly (the founder of dividendgrowth.ca)

Last week, no dividend increases from companies on ‘The List’.

Earnings Releases

Benjamin Graham once remarked that earnings are the principal factor driving stock prices.

Each quarter we will provide readers with weekly earnings updates of stocks on ‘The List’ during the calendar earnings season.

The updated earnings calendar can be found here.

Earnings growth and dividend growth tend to go hand in hand, so this information can tell us a lot about the future dividend growth of our quality companies. Monitoring our dividend growers periodically is part of the process, and reading the quarterly earnings releases is a good place to start.

No earnings reports from companies on ‘The List’ this week

Last week, one company on ‘The List’ reported earnings.

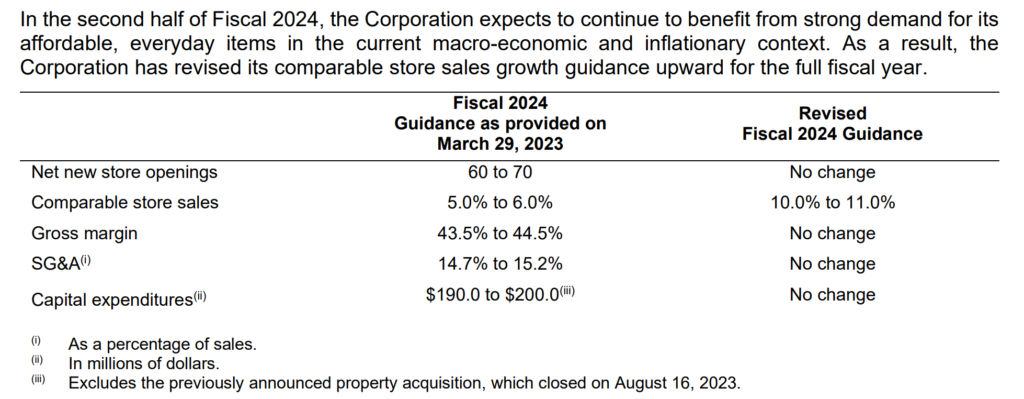

Dollarama Inc. (ATD-T) released its second-quarter fiscal 2024 results on Wednesday, September 13, 2023, before markets opened.

“Once again this quarter, we delivered excellent operational and financial results, including notable growth in comparable store sales, EBITDA and earnings per share. Our performance year to date for this fiscal year reflects our differentiated ability to provide compelling value across our broad product mix and a consistent shopping experience. Dollarama continues to deliver unparalleled value to a growing number of consumers seeking affordable everyday products at low price points, and we expect this strong demand to persist through the second half of the year in the current macro-economic context.”

– Neil Rossy, President and CEO

Highlights:

- 5% increase in comparable store sales

- 8% growth in EBITDA to $457.2 million, or 31.4% of sales which represents an improvement of 1.0% compared to the same period last year

- 3% increase in diluted net earnings per share

- Fiscal 2024 guidance range for comparable store sales growth increased to between 10.0% to 11.0%

Outlook:

Source: (DOL-T) Q2-2024 Earnings Results