Last updated by BM on February 13, 2023

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was down a bit with a +3.9% YTD price return (capital). Dividend growth of ‘The List’ increased to +5.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were three dividend increases from companies on ‘The List’.

- Last week, there were six earnings reports from companies on ‘The List’.

- Four companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Learn More

“This above all: To thine own self be true”

– William Shakespeare, Hamlet

The line “To thine own self be true” is from Act 1, Scene 3 of Shakespeare’s play, Hamlet. It was spoken by a father giving advice to his son before the latter left for university. We thought this counsel was applicable to those who are new to dividend growth investing (DGI) since they may have to ignore much of the investment guidance they have received to succeed with DGI.

Our belief has always been that to outperform the market, investors must think differently. Our strategy differs greatly from what is commonly found in today’s financial media. DGI hearkens back to a time when an individual’s wealth was determined by the income their assets produced, not the size of their portfolio at a given moment. This mindset is shared by Pat Keogh in his book, Make Your Family Rich, where he urges readers to adopt a similar approach.

According to Keogh, the first step in DGI is to stop viewing it as investing in a stock portfolio and instead, as buying businesses. By doing so, you become the manager of your own part-time asset management business and can shift the focus to making these businesses work for you, rather than the other way around.

The second step, as per Keogh, is to embrace a long-term investing mindset and give dividend growth investing sufficient time to yield results. To achieve this, one must stop thinking about retirement planning and start thinking about succession planning, with the aim of creating a business that will last for generations. By doing so, the pressure to achieve quick success is reduced, and investors are more inclined to adhere to the DGI process. Passing on the knowledge of DGI to family members and continuing to build wealth for future generations is always an option.

Lastly, Keogh recommends that investors shift their focus from constantly monitoring their portfolio value to instead examining the income it generates. By keeping track of the increase in income generated from investments, investors can measure their progress and ask themselves one simple question, “How much did my income increase from the previous year?” as a means of keeping score.

Discovering an investment strategy that aligns with your values and principles can be a challenging endeavour. The best way to determine if DGI is a suitable fit for you is to try it out.

Our asset management business, the Magic Pants Wealth-Builder Model Portfolio (CDN), has recently completed its third quarter, and in a year where most investment strategies produced negative returns, we continued to outperform the markets. More importantly, our income has already started to grow.

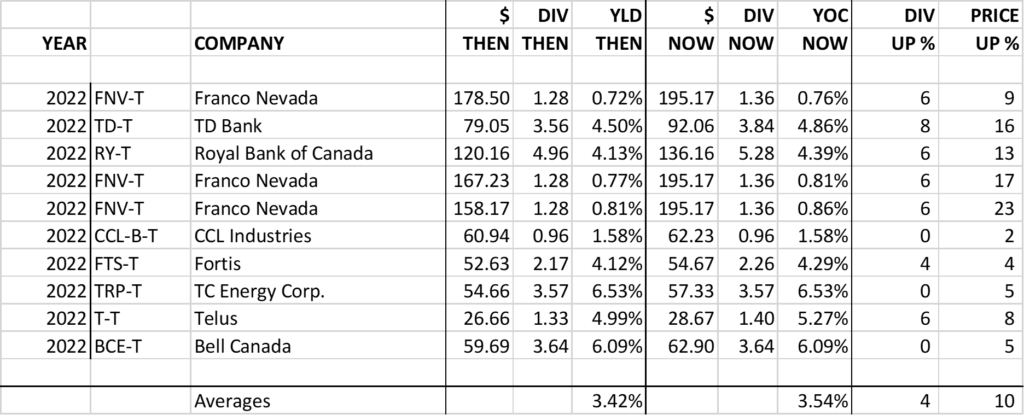

Here is a snapshot of our portfolio transactions and their performance as of January 31, 2023:

Statistically, we don’t always have a 100% success rate on our trades in the short term but we have been able to consistently deliver about 95% over the longer term (3-5 years).

We encourage you to join us, in our journey, as we offer guidance and expand the portfolio according to our business plan. We will send out alerts every time we make a purchase and provide detailed explanations behind our decisions. Starting your own DGI portfolio has never been easier!

For those of you who are readers of the blog but not yet subscribers, go to the link at the bottom of the ‘Subscribe’ page and sign up.

Be true to ‘thine self’ and start building real wealth today!

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was down with a +3.9% YTD price return (capital). Dividend growth of ‘The List’ increased to +5.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were TFI International (TFII-T), up +5.06%; Alimentation Couche-Tard Inc. (ATD-T), up +3.70%; and Waste Connections (WCN-N), up +2.34%.

Magna (MGA-N) was the worst performer last week, down -18.96%.

Recent News

Fallen dividend stars of yesteryear are a reminder of the need for investor vigilance. (Globe & Mail)

“Take a lesson, dividend fans. Never sleep on your holdings.”

An excellent quote from the author of this article. Step three in our process is about monitoring our portfolios. That is another reason we believe in concentrated portfolios. A lot fewer stocks to follow.

The author makes the point that dividend growth rates are hard to maintain and you must be vigilant in watching out for a slowing dividend growth rate. If you are looking for a current example, remember Algonquin Power (AQN-N), a company on ‘The List’ we wrote about earlier in the year after a dividend cut was announced. Its dividend growth rate was slowing.

There will typically be a few dividend growth rates slowing during recessionary periods. The trick is knowing if this is just short term good governance on the part of the company or the start of some longer-term issues.

BMO strategist says investors should be seeking dividend growth stocks, provides list of options (Globe & Mail)

“Despite the slight underperformance year to date, we believe income-based strategies remain well-positioned to outperform again in 2023, particularly as the market struggles with the end of the interest rate tightening cycle, elevated but declining inflationary levels, and recession risk.”

Some good news for dividend growth investors in this article. His list includes some of the names we follow as well.

Dividend Increases

Last week, there were three dividend increases from companies on ‘The List’.

Intact Financial (IFC-T) on Tuesday, February 07, 2023, said it increased its 2023 quarterly dividend from $1.00 to $1.10 per share, payable March 31, 2023, to shareholders of record on March 14, 2023.

This represents a dividend increase of +10.0%, marking the 19th straight year of dividend growth for this quality property and casualty insurance provider.

Telus (T-T) on Tuesday, February 09, 2023, said it increased its 2023 quarterly dividend from $0.3274 to $0.3511 per share, payable April 03, 2023, to shareholders of record on March 10, 2023.

This represents a dividend increase of +7.2%, marking the 20th straight year of dividend growth for this quality telco.

Magna (MGA-N) on Friday, February 10, 2023, said it increased its 2023 quarterly dividend from $0.45 to $0.46 per share, payable March 10, 2023, to shareholders of record on February 24, 2023.

This represents a dividend increase of +2.2%, marking the 14th straight year of dividend growth for this quality automotive supplier.

Earnings Releases

Four companies on ‘The List’ are due to report earnings this week.

TC Energy (TRP-T) will release its fourth-quarter 2022 results on Tuesday, February 14, 2023, before markets open.

Toromont Industries (TIH-T) will release its fourth-quarter 2022 results on Tuesday, February 14, 2023, after markets close.

Waste Connections (WCN-N) will release its fourth-quarter 2022 results on Wednesday, February 15, 2023, after markets close.

Canadian Tire (CTC-A-T) will release its fourth-quarter 2022 results on Thursday, February 16, 2023, before markets open.

Last week, six companies on ‘The List’, reported their earnings.

TFI International (TFII-N) released its fourth-quarter 2022 results on Monday, February 6, 2023, after markets closed

“TFI International successfully capped 2022 with strong fourth quarter results, generating slightly higher operating income on significantly improved operating margins, a 53% increase in the full-year adjusted diluted EPS and a 26% increase in the full-year free cash flow, despite macro volatility, fuel-related working capital outlays, and the sale of CFI assets last summer that served to strengthen our overall business mix and returns,” said Alain Bédard, Chairman, President and Chief Executive Officer. “As laid out at our recent Investor Day, our unique positioning includes business line diversity, exposure to attractive niche markets and numerous self-help initiatives that are producing remarkable success during turbulent economic times. Most importantly, our relative stability, margin expansion and free cash flow reflect the tireless efforts of our people, who are diligently adhering to our longstanding operating principles regardless of external factors. Capitalizing on this attractive competitive positioning and our sharp focus on the fundamentals, we continue to strategically allocate capital toward attractive acquisitions, with our acquisition pipeline remarkably strong and the majority of these closings expected in the first half of the year. During the quarter, our Board of Directors approved a 30% increase to our quarterly dividend and we continued to repurchase shares, both reflecting our favorable outlook. We enter 2023 in the best position in TFI International’s history and are eager to create additional shareholder value in the year ahead.”

– Chief Executive Officer, Alain Bedard

Highlights:

- Fourth quarter operating income of $216.9 million increased 1% over the prior year quarter

- Fourth quarter net income of $153.5 million increased 6% compared to Q4 2021, while adjusted net income1 of $151.8 million increased 2%

- Fourth quarter diluted earnings per share (diluted “EPS”) of $1.74 increased 14% compared to Q4 2021, while adjusted diluted EPS1 of $1.72 increased 10%

- Fourth quarter net cash from operating activities grew to $248.3 million, up 30% over the prior year period and free cash flow1 grew to $188.3 million, up 56% over the prior year period

- Full year diluted EPS of $9.02 increased from $7.91 in 2021, while adjusted diluted EPS1 of $8.02 increased from $5.23

Full-Year Results

- Total revenue was $8.81 billion for 2022 versus $7.22 billion in 2021. Revenue before fuel surcharge of $7.36 billion was up 14% compared to the prior year.

- Operating income totaled $1,146.0 million, or 16% of revenue before fuel surcharge, an increase of 17% compared to $979.2 million and 15% of revenue before fuel surcharge in the prior year. The increase is mainly attributable to the contributions from acquisitions, including a gain on sale of business of $73.7 million.

- Net income was $823.2 million, or $9.02 per diluted share, compared to $754.4 million, or $7.91 per diluted share a year earlier. Adjusted net income and Adjusted diluted EPS, non-IFRS measures, were $731.7 million, or $8.02 per diluted share, compared to $498.3 million, or $5.23 per diluted share the prior year.

- During 2022, total revenue grew 1% for Package and Courier, 43% for Less-Than-Truckload, 13% for Truckload and 6% for Logistics relative to the prior year. Operating income was up 24% for Package and Courier, 59% for Truckload, down 18% for Less-ThanTruckload, mainly due to the inclusion of the bargain purchase gain in 2021, and down 2% for Logistics.

Outlook:

“We’re holding firm on our profitability,” Bedard commented. “I think that, overall, if you look at 2023, I think 2023 will do better than we did in 2022 overall in terms of dollars of OE for the logistics.”

Given the savings, Bedard entertained some M&A possibilities, talking particularly positively about ArcBest Corporation (NASDAQ:ARCB), a logistics name in which the company currently holds a small stake.

See the full Earnings Release here

Intact Financial (IFC-T) released its fourth-quarter 2022 results on Tuesday, February 7, 2023, after markets closed.

“The resilience of our platform was again evident in 2022 with a mid-teens ROE despite elevated catastrophe losses and inflation pressures. At the same time, we made significant progress on the RSA integration, which contributed 16% to net operating income per share for the full year and drove 23% growth in premiums. With the business operating at a low 90s combined ratio, positive top line momentum across all segments and a strong balance sheet, we are well positioned to deliver on our financial and strategic objectives in the year ahead. We are therefore pleased to increase dividends to common shareholders for the eighteenth consecutive year.”

– Charles Brindamour,, Chief Executive Officer

Highlights:

- Operating DPW growth accelerated to 3% in the quarter, and 5% excluding strategic exits, on favourable market conditions

- Operating combined ratio was a solid 91.5% in Q4-2022 and 91.6% for the full year despite elevated catastrophe losses and inflation

- Net operating income per share of $3.34 in the quarter and $11.88 for the full year reflected higher investment and distribution income, which partially offset lower underwriting margins

- EPS decreased to $2.26 in Q4-2022, but was up 9% for the full year on higher operating income and investment gains

- OROE of 14.3% and ROE of 16.5% reflected strong operating performance in a challenging environment

- Balance sheet remained strong with a total capital margin of $2.4 billion and BVPS of $80.33 despite capital markets volatility

- Quarterly dividend increased by 10% to $1.10 per common share

Outlook:

Over the next twelve months, we expect firm-to-hard insurance market conditions to continue in most lines of business, driven by inflation, natural disasters, and a hard reinsurance market.

In Canada, we expect firm market conditions to continue in personal property. Personal auto premiums are expected to grow by mid single digits in response to inflation and evolving driving patterns.

In commercial and specialty lines across all geographies, hard market conditions are expected to continue.

In the UK&I, we expect the personal property market to firm as it reacts to inflationary pressures, natural disasters and a hard reinsurance market. Personal motor has begun to firm and we anticipate this to increase over time.

See the full Earnings Release here

Telus (T-T) released its fourth-quarter 2022 results on Thursday, February 9, 2023, before markets opened.

“Throughout 2022, TELUS achieved strong operational and financial results across our business, including leading our North American peer group with respect to 2022 Operating Revenues, Adjusted EBITDA and Free Cash Flow growth,” said Darren Entwistle, President and CEO. “This is a trend the TELUS team has consistently demonstrated over the long-term. Our robust performance in the fourth quarter, and for the full year, reflects the chemistry of our globally leading broadband networks and customers first culture, driving our hallmark combination of profitable customer growth, alongside strong financial results. Industry-leading net additions of 301,000 represented our best fourth quarter on record, and concluded another year of industry-leading expansion of our customer base. Indeed, in 2022, we delivered an all-time record, surpassing total annual net additions of more than one million for the first time, including another best-ever year for Fixed subscriber growth of 274,000, and delivered our highest Mobile Phone net additions since 2010 with 401,000 net new customers. This industry-leading growth reflects the consistent potency of our operational execution, unmatched bundled product offerings across Mobile and Home, and team member culture focused on delivering exceptional customer experiences over our globally-leading PureFibre and 5G networks. Our team’s passion for delivering customer experience excellence, once again contributed to strong client loyalty across our key product lines, including blended Mobile Phone, PureFibre internet, Optik TV, Security and Voice churn all below one per cent for the year. Furthermore, 2022 represented our ninth consecutive year of industry-leading postpaid wireless churn below one per cent.”

– Darren Entwistle, Chief Executive Officer

Highlights:

- Industry-leading total Mobile and Fixed customer growth of 301,000 up 29,000 over last year, and our strongest fourth quarter on record, driven by strong demand for our leading product portfolio of Mobility and Fixed Broadband services

- Robust mobile phone net additions of 112,000 and record fourth quarter connected device net additions of 106,000; industry-leading postpaid churn of 0.96 per cent and Mobile Phone ARPU growth of 2.2 per cent

- Best fixed customer growth on record with 83,000 net additions, including 42,000 internet customer additions, powered by leading customer loyalty in combination with TELUS’ expansive PureFibre network

- Record high customer additions of 1,043,000 for the full year, driven by consistently potent operational execution, unmatched bundled product offerings across Mobile and Home, and team member culture focused on delivering exceptional customer experiences over globally-leading networks

- Strong quarterly financial results leading to industry-leading full year Consolidated Operating Revenues, Adjusted EBITDA and Free Cash Flow growth of 8.6 per cent, 9.5 per cent and 64 per cent, respectively; Net income for the full year up 1.2 per cent

- Global industry-best growth profile, underpinned by strong operating momentum across our telecom business, bolstered by TELUS International, TELUS Health and TELUS Agriculture & Consumer Goods

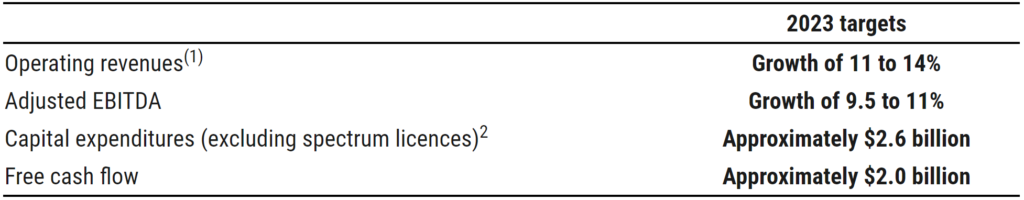

- Targeting 2023 Operating Revenue and Adjusted EBITDA to increase by 11 to 14 per cent and 9.5 to 11 per cent, respectively

- Robust Free Cash Flow growth of circa 57 per cent to approximately $2.0 billion in 2023 supports balance sheet strength and leading dividend growth programthrough2025

Outlook:

TELUS’ consolidated financial targets for 2023 are guided by a number of long-term financial objectives, policies and guidelines, which are detailed in Section 4.3 of the 2022 annual MD&A.

In 2023, TELUS plans to continue generating positive financial outcomes and strong customer growth. We expect growth in EBITDA to be driven by continued demand for data in our mobile and fixed products and services; continued roaming revenue improvement; and continued ongoing investments in our leading PureFibre network and ongoing 5G deployment. Our strategic efforts to enhance operational simplicity and efficiency, in addition to our constant focus on improving the customer experience across all areas of our operations, is also expected to contribute to our growth.

Supporting our growth profile in 2023 are our unique and diversified growth assets: TELUS International, including continued demand in the digital transformation ecosystem and the acceleration of digital adoption across various sectors of the global economy as well as the acquisition of WillowTree; TELUS Health, including growing demand for our expanding portfolio of digital health services and applications as well as the acquisition of LifeWorks; and TELUS Agriculture & Consumer Goods, which is using technology to drive better food outcomes across the agriculture value chain. Our growth profile is also underpinned by a team member culture focused on delivering customer service excellence and our ongoing focus on operational effectiveness.

See the full Earnings Release here

Enbridge Inc. (ENB-T) released its fourth-quarter 2022 results on Friday, February 10, 2023, before markets opened.

“We ended the year with strong utilization, operational and safety performance across our business. Despite the uncertainty and volatility of 2022, our full year results came in at the top half of our guidance range, reflecting the strength of our four core businesses and the resiliency of our low-risk business model.

We made substantial progress delivering on our strategic priorities, which is a testament to the entire Enbridge team. We placed another $4 billion of capital into service and sanctioned $8 billion of new organic growth. We sold non-core assets, demonstrating our commitment to recycling capital at attractive valuations, and our balance sheet continues to be in great shape, with Debt to EBITDA in the bottom half of our range at 4.7x. These actions have set us up well for 2023 and beyond.

As we look forward, it is clear the world needs all forms of energy to meet demand. At the same time, there is a global imperative to reduce emissions. Balancing these priorities is critical and remains foundational to our strategy.

We will continue to expand, modernize and reduce emissions from our conventional business to meet our customers’ needs, and increase investments in lower-carbon opportunities that complement our existing assets. Our balance sheet strength, disciplined approach to capital allocation, and proven execution capability will enable us to drive growth and create value for our shareholders. Our extensive footprint puts us in an enviable position to deliver safe, secure, affordable and sustainable energy to our customers.”

– Greg Ebel, President and Chief Executive Officer

Highlights:

- GAAP Earnings attributable to common shareholders for the fourth quarter of 2022 decreased by $2.9 billion or $1.44 per share compared with the same period in 2021 and includes certain infrequent or other non-operating factors, primarily explained by a non-cash goodwill impairment of $2.5 billion relating to the Gas Transmission reporting unit as a result of the increased cost of capital, partially offset by the operating performance factors discussed in detail below.

- On a full year basis for 2022, GAAP earnings attributable to common shareholders was negatively impacted by the goodwill impairment discussed above, as well as non-cash, net unrealized derivative fair value losses of $1.3 billion ($964 million after-tax) in 2022, compared with unrealized gains of $197 million ($150 million after-tax) in 2021, reflecting changes in the mark-to-market value of derivative financial instruments used to manage foreign exchange risks. These were partially offset by a non-cash gain of $1.1 billion ($732 million after-tax) on the closing of the joint venture merger transaction with Phillips 66 (P66) realigning our effective economic interests in Gray Oak and DCP Midstream LLC.

- The period-over-period comparability of GAAP earnings attributable to common shareholders is impacted by certain other unusual, infrequent factors or other non-operating factors which are noted in the reconciliation schedule included in Appendix A of this news release. Refer to the annual Management’s Discussion & Analysis for 2022 filed in conjunction with the year-end financial statements for a detailed discussion of GAAP financial results.

- Adjusted EBITDA in the fourth quarter of 2022 increased by $224 million compared with the same period in 2021. This was primarily driven by higher contributions from new assets placed into service including the U.S. portion of the Line 3 Replacement Project, which came into service in the fourth quarter of 2021, the acquisition of Enbridge Ingleside Energy Center (EIEC), as well as the recognition of revenues from increased rates on TETLP as a result of its recent rate case settlement. The translation of U.S. denominated earnings also contributed to higher EBITDA in the period. The average CAD to USD exchange rate for the fourth quarter of 2022 was $1.36 compared with $1.26 for the same period in 2021.

- Adjusted EBITDA for the year ended December 31, 2022 increased by $1.5 billion compared with 2021. This is primarily driven by the impact of the operating factors listed above, as well as translation of S dollar denominated earnings. The average CAD to USD exchange rate in 2022 was $1.30 compared with $1.25 in 2021.

- Adjusted earnings in the fourth quarter of 2022 decreased by $105 million, or $0.05 per share, primarily due to higher financing costs from rising interest rates on floating-rate debt, and increased depreciation expense on new assets placed into service in the fourth quarter of 2021; partially offset by higher Adjusted EBITDA contributions.

- Adjusted earnings for the year ended December 31, 2022 increased by $141 million compared with 2021. This is primarily driven by the impact of higher Adjusted EBITDA, partially offset by the higher financing costs discussed above.

- DCF for the fourth quarter of 2022 increased by $176 million, or $0.08 per share, primarily due to higher Adjusted EBITDA contributions and higher equity distributions as a result of strong operating performance from joint venture investments including Alliance Pipeline, as well as increased economic interest in the Gray Oak and Cactus II pipelines, partially offset by higher maintenance capital spend, higher financing costs and higher cash taxes on higher taxable earnings.

- DCF for the year ended December 31, 2022, increased by $942 million compared with 2021. This is primarily driven by the same operating factors as listed above.

Outlook:

The Company reaffirmed its 2023 financial guidance, which includes adjusted EBITDA between $15.9 billion and $16.5 billion and DCF per share between $5.25 to $5.65.

Growth in 2023 is anticipated to be driven by strong Mainline utilization, full-year contributions from the TETLP rate settlement, rate escalators and customer additions at EGI, full-year contributions from projects placed into service during 2022 and the impact of foreign exchange rates, partially offset by higher financing costs and distributions to non-controlling interests from the sale of an interest in certain Regional Oil Sands assets.

See the full Earnings Release here

Fortis (FTS-T) released its fourth-quarter 2022 results on Friday, February 10, 2023, before markets opened.

“2022 was a year of execution with strong financial, operational and sustainability results across our utilities,” said David Hutchens, President and Chief Executive Officer, Fortis Inc. “We invested over $4 billion in capital, delivered strong EPS and rate base growth, and further reduced our carbon emissions. We also outperformed safety and reliability industry averages and were recognized as a leader in Canada for our governance practices.

With a focus on organic growth, we also announced our largest five-year capital plan of $22.3 billion representing steady rate base growth of 6% and supporting annual dividend growth guidance of 4-6% through 2027,” said Mr. Hutchens. “We appreciate the dedication and hard work of our people to make 2022 another successful year.”

– David Hutchens, President and Chief Executive Officer

Highlights:

- Reported net earnings of $1.3 billion, or $2.78 per common share in 2022

- Adjusted net earnings per common share of $2.78, up from $2.59 in 2021, representing ~7% annual EPS growth

- Capital expenditures of $4.0 billion, with over $600 million focused on delivering cleaner energy, yielding ~7% rate base growth

- Scope 1 emissions 28% below 2019 levels; 75% emissions reduction by 2035 target on track in support of 2050 net-zero goal

- Capital structure complaint filed against ITC Midwest denied by FERC

Outlook:

Fortis continues to enhance shareholder value through the execution of its capital plan, the balance and strength of its diversified portfolio of regulated utility businesses, and growth opportunities within and proximate to its service territories. While energy price volatility, global supply chain constraints and persistent inflation are issues of potential concern that continue to evolve, the Corporation does not currently expect there to be a material impact on its operations or financial results in 2023.

The Corporation’s $22.3 billion five-year capital plan is expected to increase midyear rate base from $34.1 billion in 2022 to $46.1 billion by 2027, translating into a five-year compound annual growth rate of 6.2%3.

Beyond the five-year capital plan, additional opportunities to expand and extend growth include: further expansion of the electric transmission grid in the U.S. to facilitate the interconnection of cleaner energy, including infrastructure investments associated with the Inflation Reduction Act of 2022 and the MISO LRTP; climate adaptation and grid resiliency investments; renewable gas solutions and liquefied natural gas infrastructure in British Columbia; and the acceleration of cleaner energy infrastructure investments across our jurisdictions.

Fortis expects its long-term growth in rate base will drive earnings that support dividend growth guidance of 4-6% annually through 2027. This dividend growth guidance will also provide flexibility to fund more capital with internally-generated funds and is premised on the assumptions and material factors listed under “Forward-Looking Information”.

See the full Earnings Release here

Magna (MGA-N) released its fourth-quarter 2022 results on Friday, February 10, 2023, before markets opened.

“2022 was another difficult year for the auto industry as inflation climbed to levels not experienced for decades, geopolitical issues contributed to unprecedented European energy prices and OEM production schedules remained volatile. Nevertheless, we once again generated above-market sales growth, and booked a record amount of business.

In 2023, we are highly focused on improving underperforming operations, limiting discretionary costs and securing further inflation recoveries from our customers. At the same time, we continue to invest to support the significant amount of business growth in front of us.”

– Swamy Kotagiri, Chief Executive Officer

Highlights:

- Sales increased 5% to $9.6 billion

- Excluding foreign currency translation sales increased 13%, compared to a global light vehicle production increase of 5%

- Diluted earnings per share and Adjusted diluted earnings per share decreased to $0.33 and $0.91, respectively, compared to $1.54 and $1.30 last year

- Returned $131 million to shareholders through dividends and share repurchases

- Raised quarterly cash dividend to $0.46 per share

Outlook:

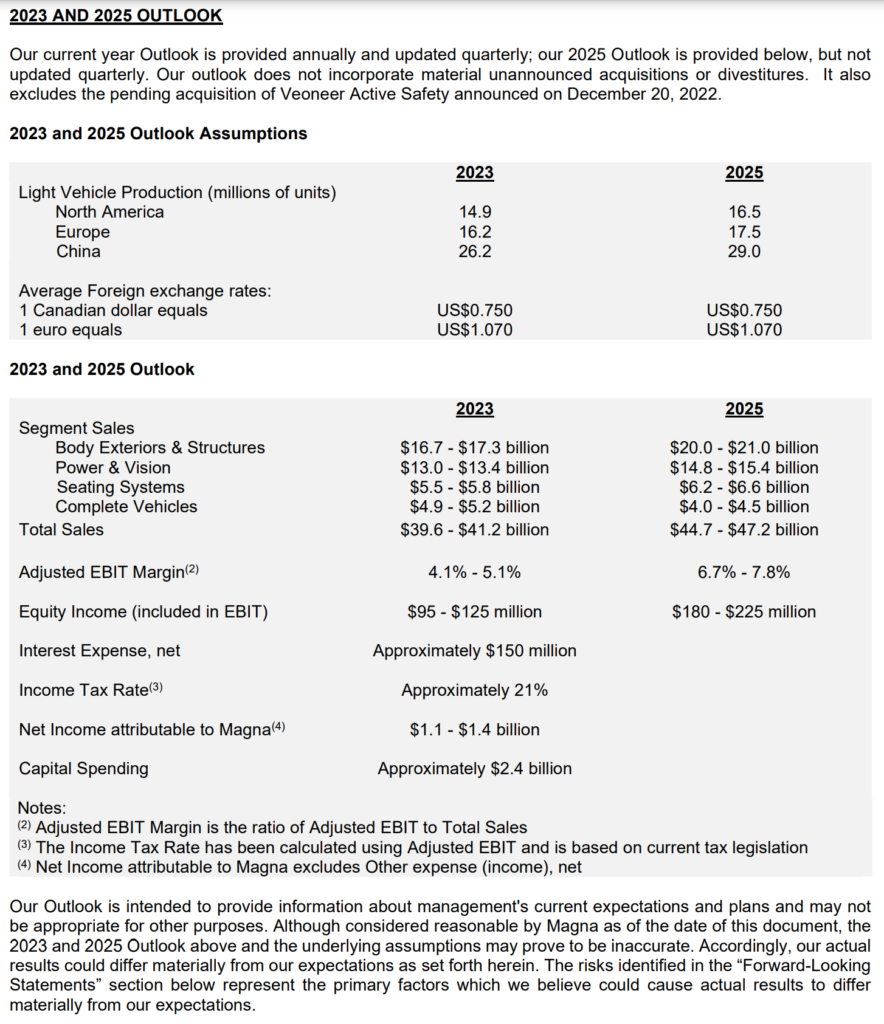

2023 Outlook Highlights

- Sales expected to continue to outgrow global light vehicle production through outlook period

- Expect Adjusted EBIT Margin to expand by 230 basis points or more by 2025

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not intended to be a portfolio others replicate. Rather, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor reflects the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolios. It is only a starting point for our analysis and discussion of dividend growth investing concepts.

The List (2023)

Last updated by BM on February 10, 2023

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 6.8% | $7.43 | 10.4% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $62.56 | 4.0% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 6.3% | $60.82 | 1.0% | $3.82 | 5.0% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $32.95 | 5.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.5% | $62.67 | 8.0% | $0.96 | 0.0% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $159.90 | -1.8% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.3% | $160.19 | 9.3% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 4.9% | $36.43 | -1.4% | $1.78 | 0.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $78.91 | -1.2% | $0.22 | 2.3% | 12 |

| EMA-T | Emera | 5.1% | $54.02 | 2.7% | $2.76 | 3.0% | 16 |

| ENB-T | Enbridge Inc. | 6.6% | $54.15 | 1.5% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 1.8% | $41.76 | 16.9% | $0.74 | 3.5% | 16 |

| FNV-N | Franco Nevada | 1.0% | $136.00 | -1.6% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis | 4.1% | $55.39 | 0.1% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.2% | $197.04 | 0.6% | $4.40 | 10.0% | 18 |

| L-T | Loblaws | 1.4% | $117.11 | -2.7% | $1.62 | 5.2% | 11 |

| MGA-N | Magna | 3.4% | $54.14 | -5.9% | $1.84 | 2.2% | 13 |

| MRU-T | Metro | 1.7% | $70.84 | -6.1% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 3.8% | $138.76 | 8.4% | $5.28 | 6.5% | 12 |

| SJ-T | Stella-Jones Inc. | 1.6% | $48.62 | -1.9% | $0.80 | 0.0% | 18 |

| STN-T | Stantec Inc. | 1.0% | $70.81 | 8.4% | $0.72 | 2.1% | 11 |

| TD-T | TD Bank | 4.1% | $93.01 | 6.1% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.1% | $124.90 | 24.7% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.4% | $107.71 | 10.2% | $1.56 | 2.6% | 33 |

| TRP-T | TC Energy Corp. | 6.5% | $55.47 | 4.1% | $3.60 | 0.8% | 22 |

| T-T | Telus | 5.2% | $27.25 | 3.5% | $1.40 | 5.4% | 19 |

| WCN-N | Waste Connections | 0.8% | $135.32 | 2.7% | $1.02 | 7.9% | 13 |

| Averages | 3.1% | 3.9% | 5.2% | 19 |