Last updated by BM on February 06, 2023

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was up slightly with a +4.6% YTD price return (capital). Dividend growth of ‘The List’ increased to +4.7% YTD, demonstrating the rise in income over the last year.

- Last week, there were two dividend increases from companies on ‘The List’.

- Last week, there were two earnings reports from companies on ‘The List’.

- Six companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Learn More

“Wide diversification is only required when investors do not understand what they are doing …. Diversification may preserve wealth, but concentration builds wealth.”

– Warren Buffett

Q4 2022 earnings reporting is now underway. Be sure to check out our earnings calendar at the bottom of ‘The List’ page to see which companies beat or missed estimates.

“Diworsification” is a word coined by legendary investor Peter Lynch. It refers to owning an excessive number of stock positions for the sake of diversification.

When we were looking at comparables for our Magic Pants Wealth-Builder Portfolios we not only had a difficult time finding 100% Canadian products but also ones that were properly diversified. The Canadian market is heavily weighted with dividend-paying companies in only two sectors, Energy and Financials. Most indexes and mutual funds consisting of only Canadian stocks have between 40-50% of their portfolios invested in these two sectors alone. Because your options for quality dividend growth companies (< 50) are limited in Canada, we are careful not to overweight in any one sector when we build “The List’ and our portfolios.

We also found that almost all dividend ETFs and mutual funds contained well over one hundred companies in their portfolio. With each security added, their portfolios do become more diversified. However, each additional security diversifies its portfolios to a lesser degree than the last one. Eventually, the benefit of each new security added is more and more muted to the point of being immaterial.

While some diversification is prudent, investors should remember to focus on owning the best businesses with the largest potential returns within their risk tolerance and investment style. Be careful not to diversify just for the sake of it. Many studies show that risk is not mitigated by owning more companies.

Safety is in quality not in numbers.

Performance of ‘The List’

At the end of the post is a snapshot of ‘The List’ from last Friday’s close. Feel free to click on the ‘The List’ menu item above for a sortable version.

Last week, ‘The List’ was up slightly with a +4.6% YTD price return (capital). Dividend growth of ‘The List’ increased to +4.7% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were TFI International (TFII-T), up +8.93%; Stella-Jones Inc. (SJ-T), up +4.57%; and Magna (MGA-N), up +4.57%.

Loblaws (L-T) was the worst performer last week, down -4.75%.

Recent News

How to beat the pros, Part 1: Choose the right number of stocks to hold (Globe & Mail)

“A professional portfolio manager allocating billions cannot own just 15-25 positions – the career risk in underperforming an index is too great of a force. But the small retail investor can stick to that limited number of stock holdings.”

If you ever wondered why you had never heard of dividend growth investing before, you know now. Financial advisors are hesitant to recommend this equities-only strategy for fear of losing their jobs! One losing quarter or two when others do not, and their career is in jeopardy. Professional money managers can’t afford to lose alone. They keep their jobs when they underperform in the market as long as they all do. They have done a pretty good job at this over the years.

A lot of good advice in this article.

- Own a concentrated portfolio of 15-25 positions

- Own quality

- Invest for the long term

Estimated cost of Coastal GasLink pipeline surges to $14.5-billion (Globe & Mail)

https://www.theglobeandmail.com/business/article-coastal-gaslink-pipeline-cost/

“The market remains concerned regarding additional cost overruns on the project,” Scotia Capital Inc. analyst Robert Hope said in a research note. Given the uncertainty over the final cost and timing for construction completion, he added that the “project isn’t out of the woods yet.”

TC Energy (TRP-T) is one of our high-quality dividend growers from ‘The List’. Operational issues recently and now cost overruns are cause for some concern. The company announces Q4 2022 earnings next week so we hope to have more clarification then on how they plan to deal with the cost increases. For now, we are monitoring this situation closely.

Dividend Increases

Last week, there were two dividend increases from companies on ‘The List’.

Brookfield Infrastructure Partners (BIP-N) on Thursday, February 02, 2023, said it increased its 2023 quarterly dividend from $0.36 to $0.3825 per share, payable March 31, 2023, to shareholders of record on February 28, 2023.

This represents a dividend increase of +6.25%, marking the 16th straight year of dividend growth for this global infrastructure operator.

Bell Canada (BCE-T) on Thursday, February 02, 2023, said it increased its 2023 quarterly dividend from $0.92 to $0.9675 per share, payable April 17, 2023, to shareholders of record on March 15, 2023.

This represents a dividend increase of +5.2%, marking the 16th straight year of dividend growth for this quality telecom.

Earnings Releases

Six companies on ‘The List’ are due to report earnings this week.

TFI International (TFII-N) will release its fourth-quarter 2022 results on Monday, February 6, 2023, after markets close.

Intact Financial (IFC-T) will release its fourth-quarter 2022 results on Tuesday, February 7, 2023, after markets close.

Telus (T-T) will release its fourth-quarter 2022 results on Thursday, February 9, 2023, before markets open.

Enbridge Inc. (ENB-T) will release its fourth-quarter 2022 results on Friday, February 10, 2023, before markets open.

Fortis (FTS-T) will release its fourth-quarter 2022 results on Friday, February 10, 2023, before markets open.

Magna (MGA-N) will release its fourth-quarter 2022 results on Friday, February 10, 2023, before markets open.

Last week, two companies on ‘The List’, reported their earnings.

Brookfield Infrastructure Partners (BIP-N) released its fourth-quarter 2022 results on Thursday, February 2, 2023, before markets opened.

“2022 was another successful year for Brookfield Infrastructure. We achieved organic growth exceeding our target range, recorded our highest quarterly FFO per unit, secured outsized capital deployment and replenished our capital backlog. We begin this year in a strong position to capitalize on attractive new investment opportunities amidst market uncertainty.”

– Chief Executive Officer, Sam Pollock

Highlights:

- The utilities segment generated FFO of $739 million, compared to $705 million in the prior year, an increase of 5%. This growth reflects an average inflation indexation of 8% that positively impacted almost our entire asset base, and the contribution associated with $485 million of capital commissioned into our rate base. Results also improved from the contribution of two recently completed Australian utility acquisitions. Partially offsetting these results were the impact of higher borrowing costs at our Brazilian utilities because of higher interest rates and incremental debt, as well as the sale of our North American district energy platform completed during 2021.

- FFO for the transport segment was $794 million, compared to $701 million in the prior year, an increase of 13%. Results primarily benefited from inflationary tariff increases across all our businesses, higher volumes supported by strong economic activity surrounding our networks, and the commissioning of approximately $400 million in capital expansion projects during the year. Prior year results included a full contribution from our North American container terminal that we sold in June.

- FFO for the midstream segment totaled $743 million, compared to $492 million in the previous year. This step-change is a function of the acquisition of our diversified Canadian midstream operation that we completed in the fourth quarter of 2021. Results for the base businesses improved due to elevated commodity prices, which led to increased utilization and higher market sensitive revenues.

- The data segment generated FFO of $239 million, consistent with the prior year. Our underlying data businesses performed well as they continue to benefit from increasing customer utilization and network densification requirements. Growth was driven by additional points-of-presence and inflationary tariff escalators across our portfolio. These positive effects were partially offset by the impact of foreign exchange on our euro and Indian rupee denominated cash flows.

Outlook:

There are many views on what lies ahead for the economy. The optimist could argue that inflation has peaked and will come back within the target range by the end of this year, implying fiscal policy to date has been effective. The skeptic might be of the view that a tight labor market and continued wage pressures will make inflation tougher to abate in 2023 and that central banks will continue to raise interest rates higher than currently projected.

While we lean toward a more optimistic view of the year ahead, we expect market volatility to persist until the direction of interest rates is settled. Brookfield Infrastructure as a highly contracted, inflation protected, and well financed infrastructure company, should perform well in either scenario.

With the recent closings of HomeServe and DFMG, the ramp up of the Heartland facility over the next several quarters and elevated inflation levels, visibility into cash flow growth has rarely been stronger. This growth should be sustainable over the longer term, given our large capital backlog of organic projects and our proven ability to grow the business through accretive new investments. Favorable sector trends, which have been the catalyst for our recent acquisition activity, continue to support our investment pipeline.

The infrastructure super-cycle is creating long-term investment opportunities that will require trillions of dollars. This is creating large-scale opportunities for well capitalized players that can invest in growing operating platforms or be a partner of choice for government and corporate entities that have less access to the capital markets.

See the full Earnings Release here

Bell Canada (BCE-T) released its fourth-quarter 2022 results on Thursday, February 2, 2023, before markets opened.

“We capped off 2022 with another quarter of consistent and disciplined execution that drove a strong 3.7% increase in total revenue in Q4. We also delivered positive adjusted EBITDA growth, despite unprecedented cost pressures from inflation and record storms, an expensive and highly competitive Black Friday, and media advertising softness, which is a testament to our ability to execute under any condition.”

– Glen LeBlanc, Chief Financial Officer of BCE

Highlights:

- Robust Q4 broadband customer growth with 330,743 total net activations — 122,621 postpaid and prepaid mobile phone, 104,447 mobile connected devices, 63,466 retail Internet and 40,209 IPTV — up 46.6%

- 7% higher BCE revenue delivered positive adjusted EBITDA1 growth in Q4 despite $26 million in storm and inflationary cost pressures2 , increased promotional offer intensity and higher media programming costs

- Q4 net earnings of $567 million, down 13.8%, with net earnings attributable to common shareholders of $528 million, or $0.58 per common share, down 15.9%; adjusted net earnings1 of $654 million generated adjusted EPS1 of $0.71, down 6.6%

- Cash flows from operating activities up 18.0% in Q4 to $2,056 million, driving free cash flow1 growth of 64.2% to $376 million

- Strong Q4 wireless operating results: revenue up 7.7%; 4.1% adjusted EBITDA growth; 41.2% higher mobile phone postpaid net activations of 154,617 as 5G coverage expands to 82% of Canadians

- Record 854,000 new direct fibre connections in 2022 fuelled highest retail Internet net activations in 16 years of 201,762, up 32.5%, driving 8% higher residential Internet revenue; 80% of planned broadband Internet buildout program3 now completed

- Bell Media digital revenue4 up 46% in Q4 contributing to 4.7% higher media revenue as advertising revenue grew 3.8%

- All 2022 financial guidance targets achieved

Outlook:

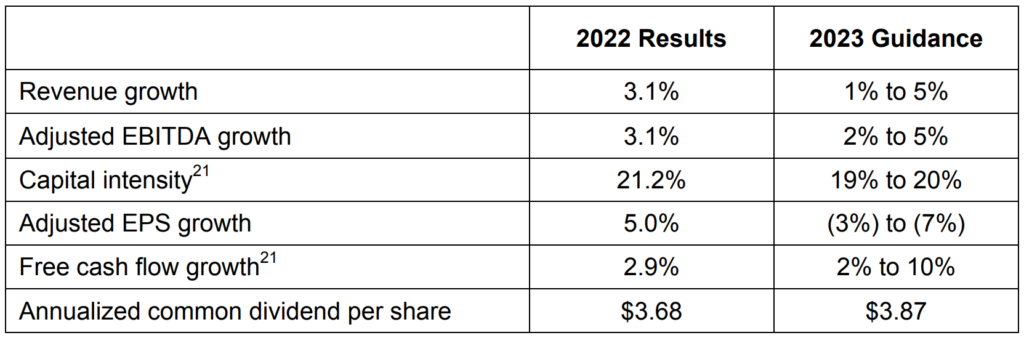

The table below provides our 2023 financial guidance targets. These ranges are based on our current outlook for 2023, as well as our 2022 consolidated financial results that reflected the impact on adjusted EBITDA from inflationary pressures on fuel, utility and labour costs, as well as storm-related recovery costs, and the impact on free cash flow from historic capital expenditures to accelerate the rollout of Bell’s wireline fibre and wireless 5G networks. For 2023, we expect lower tax adjustments, higher depreciation and amortization expense and increased interest expense to drive lower adjusted EPS compared to 2022. For 2023, we expect growth in adjusted EBITDA, a reduction in contributions to post-employment benefit plans and payments under other post-employment benefit plans, and lower capital expenditures will drive higher free cash flow.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not intended to be a portfolio others replicate. Rather, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor reflects the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolios. It is only a starting point for our analysis and discussion of dividend growth investing concepts.

The List (2023)

Last updated by BM on February 03, 2023

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 6.9% | $7.36 | 9.4% | $0.51 | -29.0% | 12 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $60.33 | 0.3% | $0.56 | 19.1% | 13 |

| BCE-T | Bell Canada | 6.2% | $61.77 | 2.6% | $3.82 | 5.0% | 14 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $32.95 | 5.2% | $1.44 | 6.3% | 15 |

| CCL-B-T | CCL Industries | 1.5% | $62.85 | 8.3% | $0.96 | 0.0% | 21 |

| CNR-T | Canadian National Railway | 2.0% | $160.66 | -1.4% | $3.16 | 7.8% | 27 |

| CTC-A-T | Canadian Tire | 4.2% | $165.21 | 12.7% | $6.90 | 17.9% | 12 |

| CU-T | Canadian Utilities Limited | 4.9% | $36.21 | -2.0% | $1.78 | 0.0% | 51 |

| DOL-T | Dollarama Inc. | 0.3% | $79.25 | -0.8% | $0.22 | 2.3% | 12 |

| EMA-T | Emera | 5.1% | $54.10 | 2.8% | $2.76 | 3.0% | 16 |

| ENB-T | Enbridge Inc. | 6.5% | $54.38 | 2.0% | $3.55 | 3.2% | 27 |

| ENGH-T | Enghouse Systems Limited | 1.8% | $40.89 | 14.5% | $0.74 | 3.5% | 16 |

| FNV-N | Franco Nevada | 1.0% | $142.14 | 2.9% | $1.36 | 6.3% | 15 |

| FTS-T | Fortis | 4.1% | $55.07 | -0.5% | $2.26 | 4.1% | 49 |

| IFC-T | Intact Financial | 2.1% | $195.08 | -0.4% | $4.00 | 0.0% | 18 |

| L-T | Loblaws | 1.4% | $115.24 | -4.2% | $1.62 | 5.2% | 11 |

| MGA-N | Magna | 2.7% | $66.81 | 16.2% | $1.80 | 0.0% | 13 |

| MRU-T | Metro | 1.7% | $70.00 | -7.3% | $1.21 | 10.0% | 28 |

| RY-T | Royal Bank of Canada | 3.8% | $138.15 | 7.9% | $5.28 | 6.5% | 12 |

| SJ-T | Stella-Jones Inc. | 1.6% | $49.64 | 0.1% | $0.80 | 0.0% | 18 |

| STN-T | Stantec Inc. | 1.0% | $71.20 | 9.0% | $0.72 | 2.1% | 11 |

| TD-T | TD Bank | 4.2% | $92.42 | 5.4% | $3.84 | 7.9% | 12 |

| TFII-N | TFI International | 1.2% | $118.89 | 18.7% | $1.40 | 29.6% | 12 |

| TIH-T | Toromont Industries | 1.5% | $106.21 | 8.7% | $1.56 | 2.6% | 33 |

| TRP-T | TC Energy Corp. | 6.4% | $56.05 | 5.2% | $3.60 | 0.8% | 22 |

| T-T | Telus | 4.9% | $28.62 | 8.7% | $1.40 | 5.4% | 19 |

| WCN-N | Waste Connections | 0.8% | $132.23 | 0.4% | $1.02 | 7.9% | 13 |

| Averages | 3.1% | 4.6% | 4.7% | 19 |