Last updated by BM on September 12, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was up a with a minus -0.2% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were two earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“To make money in stocks, you need to have the vision to see them, the courage to buy them and the patience to hold them. Patience is the rarest of the three.”

– George F. Bakers

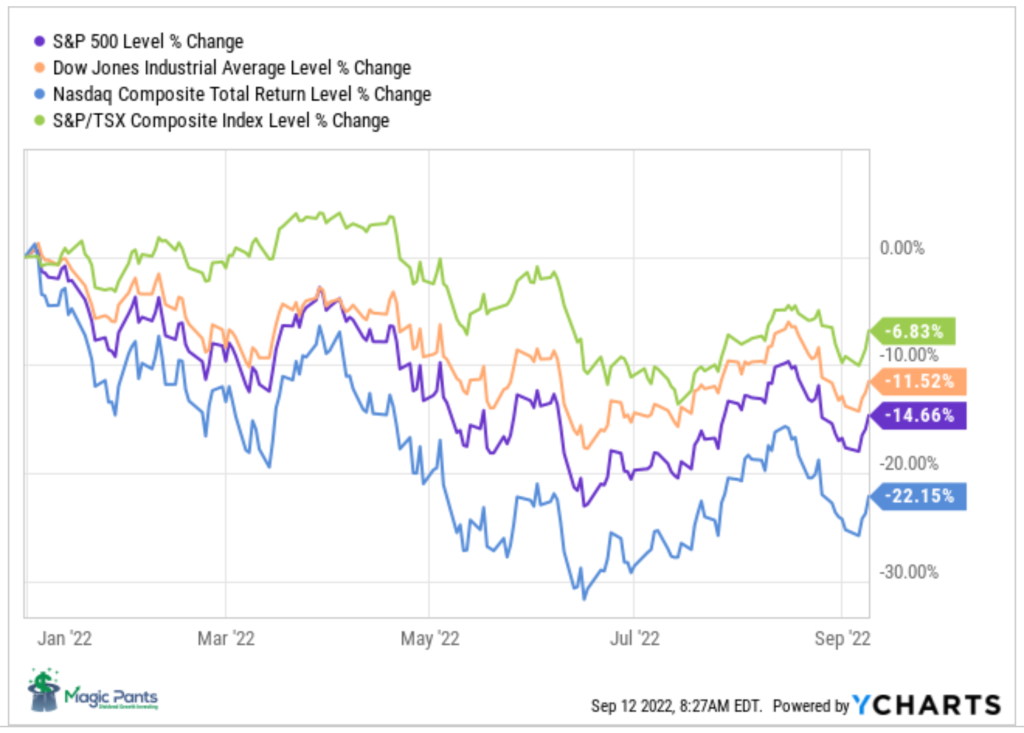

We talked a lot about patience earlier in the year when the Central Banks began their quantitative tightening into a slowing economy. So far, we seem to have been correct. Markets continue their downward trend.

In the quote above, Mr. Bakers talks about the “ …patience to hold them”, in reference to stocks. We agree. Even when markets are heading south, holding onto your good dividend growers is key to our success. The time to trim a position was late last year, not when markets are down.

If a DGI strategy interests you, please subscribe to our Magic Pants DGI Premium Membership, and you can learn how to build a robust dividend growth portfolio of your own.

We provide real-time trade alerts. So, you won’t miss any of the action!

Performance of ‘The List’

Last week, ‘The List’ was up with a minus -0.2% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were CCL Industries (CCL-T), up +6.91%; Intact Financial (IFC-T), up +5.15%; and Waste Connections (WCN-N), up +4.16%.

Enghouse Systems Limited (ENGH-T) was the worst performer last week, down -7.67%.

Recent News

Bullish on Alimentation Couche-Tard Inc. (Globe & Mail)

“Behaviour indicators including the rising 40wMA and the rising trend line confirm the bullish status. There is good support near $54-55; only a sustained decline below $52-53 would be negative.

Point & Figure measurements provide targets of $64 and $69. Higher targets are visible.”

We see articles about ‘bullish’ sentiment in the market almost every day. It makes you wonder who to believe. A process to help determine a sensible price helps decipher the narratives.

ATD-T is one of our quality dividend growers, so we pay attention. The company is still slightly overvalued based on historical fundamentals. We are being patient on this one.

Canada’s jobless rate jumps to 5.4% as hiring falls for third consecutive month (Globe & Mail)

“Canada has now seen three consecutive months of job losses, something that hasn’t historically happened outside of a recession,” said Royce Mendes, head of macro strategy at Desjardins Securities, in a note to clients. “The deterioration in the job market appears to be occurring faster than anticipated.”

The signs are all there. Canada is headed for a recession. How deep and how long are yet to be determined. Are your investments ready?

A dividend growth strategy is one way to protect both your capital and income during recessions.

No companies on ‘The List’ are due to report earnings this week.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Enghouse Systems Limited (ENGH-T) and Dollarama Inc. (DOL-T) released earnings last week. ENGH-T with its third-quarter 2022 results and DOL-T with its second-quarter 2023 results. Let’s start with Enghouse Systems.

Enghouse Systems Limited (ENGH-T)

“Revenue for the third quarter of 2022 was $102.1 million with results from operating activities of $29.8 million and cash flows from operating activities, excluding changes in working capital of $34.1 million. As a result, we closed the quarter with $229.5 million in cash, cash equivalents, and short-term investments with no external debt. This was accomplished while completing two acquisitions for $6.1 million, paying quarterly dividends of $10.3 million and repurchasing $9.0 million of common stock from shareholders. We remain focused on operating a profitable, cash-flow-positive business generating the necessary capital to fund our acquisition strategy without the need for financing.”

–Stephen J. Sadler Chairman of the Board and Chief Executive Officer

Highlights:

Financial and operational highlights for the three and nine months ended July 31, 2022 compared to the three and nine months ended July 31, 2021 are as follows:

- Revenue achieved was $102.1 and $319.5 million, respectively, compared to revenue of $117.6 and $354.1 million;

- Results from operating activities was $29.8 and $96.5 million, respectively, compared to $38.5 and $116.1 million; • Net income was $18.1 and $57.5 million, respectively, compared to $21.2 and $62.6 million;

- Adjusted EBITDA was $32.5 and $104.8 million, respectively, compared to $41.7 and $126.4 million;

- Cash flows from operating activities excluding changes in working capital was $34.1 and $107.3 million, respectively, compared to $41.1 and $125.4 million.

Outlook:

“Enghouse completed two acquisitions late in the quarter, purchasing Competella AB on June 23, 2022 and NTW Software GmbH on July 6, 2022. Competella AB offers a complete contact center platform focused on the Scandinavian and Swiss markets with both a SaaS and on-premise solution. NTW Software GmbH provides an attendant console and contact center offering for organizations that have adopted the Cisco communications platform. Both acquisitions augment our contact center offerings and broaden our cloud hosted solutions portfolio. We believe that acquisition valuations are becoming more favourable in this environment as rising interest rates increases debt servicing costs and reduces profitability for many companies in the technology segment.”

See the full Earnings Release here

Dollarama (DOL-T)

“Our strong performance in the first half of Fiscal 2023 reflects a sustained consumer response to our unique value proposition, especially for everyday essentials, as Canadians from all walks of life adapt to a high-inflation environment. As a result, we are increasing our assumption for annual comparable store sales growth to between 6.5% and 7.5%,” said Neil Rossy, President and CEO.

Highlights:

- Sales increased by 18.2% to $1,217.1 million

- Comparable store sales increased by 13.2%

- EBITDA increased by 25.8% to $369.4 million, or 30.4% of sales, compared to 28.5% of sales

- Operating income increased by 30.3% to $287.4 million, or 23.6% of sales, compared to 21.4% of sales

- Diluted net earnings per common share increased by 37.5% to $0.66 from $0.48

- 13 net new stores opened, compared to 13 net new stores

- 3,690,894 common shares repurchased for cancellation for $274.9 million

Outlook:

“As we strive to provide Canadians with a wide variety of merchandise, I am pleased with our progress rebuilding our inventory, thereby ensuring that our conveniently located stores are well-stocked for our customers ahead of key seasons in the second half of the fiscal year,” Mr. Rossy added.

See the full Earnings Release here

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on September 09, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.1% | $13.77 | -4.0% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.7% | $59.42 | 14.0% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.7% | $63.71 | -3.3% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.4% | $42.25 | 3.7% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.4% | $69.04 | 1.8% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $158.88 | 2.6% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.6% | $160.51 | -12.4% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.3% | $41.02 | 12.0% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $80.59 | 27.1% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.2% | $62.48 | -0.2% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.3% | $54.47 | 10.0% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.4% | $29.61 | -35.4% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.0% | $125.97 | -7.4% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.7% | $58.44 | -3.4% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.0% | $201.21 | 22.9% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $117.46 | 14.3% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 3.1% | $57.99 | -28.9% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.5% | $72.18 | 7.7% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.9% | $127.68 | -6.7% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 1.9% | $41.20 | 1.3% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $63.93 | -8.9% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.0% | $88.07 | -11.4% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.0% | $104.59 | -5.6% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.5% | $104.77 | -7.8% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.6% | $63.26 | 5.9% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.5% | $29.33 | -1.4% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.6% | $146.40 | 9.2% | $0.92 | 8.9% | 12 |

| Averages | 2.8% | -0.2% | 10.2% | 18 |