Last updated by BM on September 05, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was down slightly with a minus -1.9% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there was one earnings report from companies on ‘The List’.

- Two companies on ‘The List’ are due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“The desirability of a business with extraordinary economic characteristics can be ruined by the price you pay for it.”

– Charlie Munger

We haven’t done our Monthly Portfolio Reviews in a couple of months because ‘The List’ hasn’t changed much. Companies that meet our minimum valuation criteria have remained the same. What has changed, however, is the price we could have purchased them at. For example, Royal Bank (RY-T) and TD Bank (TD-T) have both found their way into our model portfolio on price weakness recently.

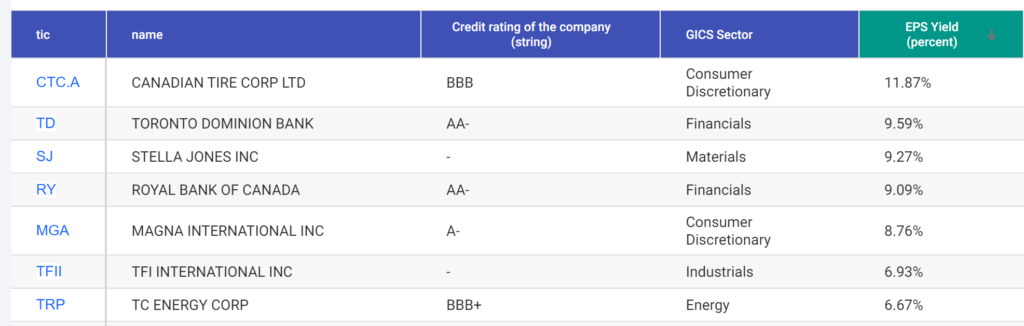

During our monthly reviews, we highlight companies on ‘The List’ that meet our minimum criteria of 6.5% EPS yield. Here is the screen from last Friday’s close:

Once a company shows up on our screen, we dive deeper to learn more about what is causing the price weakness and whether the current price meets our other valuation measures. If we like what we see, we enter a position. There are a few exciting candidates on ‘The List’ we are researching right now.

To find out when we buy or sell a position in our model portfolios, subscribe today and build your dividend growth portfolios alongside ours.

Performance of ‘The List’

Last week, ‘The List’ was down slightly with a minus -1.9% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Alimentation Couche-Tard Inc. (ATD-T), up +4.19%; Metro (MRU-T), up +1.00%; and Waste Connections (WCN-N), up +0.65%.

Canadian National Railway (CNR-T) was the worst performer last week, down -4.7%.

Recent News

Bell to buy Distributel, the latest industry acquisition (Globe & Mail)

“Distributel has vocally opposed Bell in terms of wholesale rates and other arenas, like site blocking,” said Andy Kaplan-Myrth, vice-president of regulatory and carrier affairs for TekSavvy Solutions Inc., a telecom based in Chatham, Ont. “This acquisition is a clear loss of independence that will prevent them from taking those positions in the future.”

Interesting take on this latest acquisition from Bell Canada (BCE-T). In 2019 the CRTC ruled in favour of a rate reduction that big telecoms could charge smaller internet service providers like Distributel. The big telecoms appealed, and the decision was reversed.

The CRTC was warned at that time that small internet service providers would not be able to compete if the prices were raised but chose to reverse the decision anyway.

“In a recent letter to the CRTC, TekSavvy renewed its warnings that small telecommunications companies would go out of business or be acquired in the current telecom landscape, leaving consumers with fewer options and higher bills. The company alleged in its letter that the big telecoms engage in predatory pricing, selling internet to their own flanker brands at cheaper rates than they charge independent competitors.”

As an investor, it appears Bell Canada (BCE-T) came out on top in this battle. One of our quality factors is market capitalization. With BCE-T having a market cap of ~60 billion dollars, they tend to have some added leverage in these disputes.

Bank of Canada expected to raise interest rate for fifth time at pivotal moment for economy (Globe & Mail)

“Inflation appears to have peaked but it’s still running hot and a supersized rate hike from the Bank of Canada next week is widely expected.”

The more expensive it is to borrow money, the less incentive there is for consumers and businesses to borrow and buy things. Central banks hope this will slow the economy and cool inflation. A slowing economy will affect earnings which then puts downward pressure on prices.

Good entry points (sensible prices) on our quality dividend growers could be getting closer!

Two companies on ‘The List’ are due to report earnings this week.

Enghouse Systems Limited (ENGH-T) will release its third-quarter 2022 results on Thursday, September 8, 2022, after markets close.

Dollarama Inc. (DOL-T) will release its second-quarter 2023 results on Friday, September 9, 2022, before markets open.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

One company on ‘The List’, Alimentation Couche-Tard Inc. (ATD-T), reported their first quarter 2023 earnings last week. ATD-T is another of a handful of companies on ‘The List’ that follows an off-cycle reporting schedule

Alimentation Couche-Tard Inc. (ATD-T)

“In the face of continued and historic inflationary conditions and high fuel prices, we are pleased to report strong results this quarter, especially in convenience where we had healthy same stores sales in our U.S. market. We also continued to generate robust fuel margins across all of our platforms. In this period of high inflation and high prices, we remain focused on delivering a strong and consistent value to our customers and on maintaining cost discipline in our operations” said Brian Hannasch, President and Chief Executive Officer of Alimentation Couche-Tard.

Highlights:

- Net earnings were $872.4 million, or $0.85 per diluted share for the first quarter of fiscal 2023 compared with $764.4 million, or $0.71 per diluted share for the first quarter of fiscal 2022. Adjusted net earnings1 were approximately $875.0 million compared with $758.0 million for the first quarter of fiscal 2022. Adjusted diluted net earnings per share1 were $0.85, representing an increase of 19.7% from $0.71 for the corresponding quarter of last year.

- Total merchandise and service revenues of $4.1 billion, an increase of 0.1%. Same-store merchandise revenues increased by 3.5% in the United States, by 2.8% in Europe and other regions1, and decreased by 1.3% in Canada.

- Merchandise and service gross margin1 decreased by 0.3% in the United States to 33.9%, and increased by 0.5% in Europe and other regions to 38.9%, and by 0.8% in Canada to 33.1%.

- Same-store road transportation fuel volumes decreased by 4.0% in the United States, by 3.7% in Europe and other regions, and increased by 0.4% in Canada.

- Road transportation fuel gross margin1 of 49.00¢ per gallon in the United States, an increase of 12.25¢ per gallon, US 12.26¢ per liter in Europe and other regions, an increase of US 1.94¢ per liter, and CA 14.04¢ per liter in Canada, an increase of CA 3.12¢ per liter. Fuel margins remained healthy throughout the network, due to favorable market conditions and the continued work on the optimization of the supply chain.

- Despite the growth in expenses of 9.4%, the Corporation has deployed strategic efforts to mitigate costs increases and inflationary pressures, which is demonstrated by the normalized growth of expenses1 of 7.3%, remaining below inflation.

- Sequential improvement of the leverage ratio1 at 1.31 : 1, and of the return on capital employed1 at 15.9%, both driven by strong earnings.

- On April 22, 2022, the Corporation renewed its share repurchase program which allows it to repurchase up to 10.0% of the public float. Under the renewed program, shares for a net amount of $478.0 million were repurchased during the quarter.

- On August 30, 2022, subsequent to the end of the quarter, the Corporation also announces that, following satisfaction of closing conditions, it has closed its proposed acquisition of Cape D’Or Holdings Limited, Barrington Terminals Limited and other related holding entities in Atlantic Canada.

Outlook:

Claude Tessier, Chief Financial Officer, added: “We delivered another impressive quarter highlighted by increases of 10.6% in adjusted EBITDA and 19.7% in adjusted diluted net earnings per share compared to the first quarter of fiscal 2022, bringing our last four quarters adjusted EBITDA to more than $5.4 billion. Our customary cost discipline, combined with an improving labor market, have allowed us to limit the normalized growth of expenses to 7.3%, compared to the first quarter of last year, more than 1% below inflation, which was particularly notable once again this quarter. Our financial position remains strong, highlighted by our leverage ratio1 of 1.31, providing us with opportunities for the future. I am especially proud of our teams’ execution this quarter which resulted in sequential improvements on both of our key return metrics.”

See the full Earnings Release here

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on September 02, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.1% | $13.70 | -4.5% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.7% | $59.46 | 14.1% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.7% | $63.57 | -3.6% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.5% | $41.18 | 1.1% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $64.58 | -4.7% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.9% | $153.76 | -0.7% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.7% | $157.65 | -13.9% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.4% | $40.24 | 9.9% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $80.29 | 26.6% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.3% | $61.31 | -2.0% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.3% | $54.31 | 9.6% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.2% | $32.07 | -30.1% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.1% | $121.59 | -10.7% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.7% | $58.25 | -3.7% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.1% | $191.36 | 16.9% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $117.33 | 14.2% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 3.2% | $56.42 | -30.8% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $70.77 | 5.6% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 4.0% | $123.04 | -10.1% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.0% | $40.03 | -1.6% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $61.52 | -12.4% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.2% | $85.53 | -13.9% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.0% | $103.31 | -6.7% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.5% | $101.33 | -10.9% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.7% | $63.11 | 5.7% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.5% | $29.71 | -0.2% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $140.55 | 4.8% | $0.92 | 8.9% | 12 |

| Averages | 2.9% | -1.9% | 10.2% | 18 |