Last updated by BM on August 1, 2022

Summary:

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was up close to 3% with a minus -0.8% YTD price return (capital). Dividend growth of ‘The List’ remains at 10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were ten earnings reports from companies on ‘The List’.

- Four companies on ‘The List’ are due to report earnings this week.

- Are you looking for a portfolio of ideas like these? Magic Pants DGI Premium Membership Subscribers get exclusive access to the MP Wealth-Builder Model Portfolio (CDN). Learn More

“Don’t try to buy at the bottom or sell at the top. This can’t be done except by liars.”

– Bernard Baruch

Last week saw the North American stock markets rally off their recent lows. When markets are in a bear market (down 20% or more from their recent high), this short-term rebound amid a longer-term bear market is known as a bear market bounce. This type of rally can be treacherous for investors who think the bear market is over and jump back in prematurely, only to be quickly disappointed as the bear market continues. They then sell into this downturn driving prices down even further.

It is hard to think that a new bull market is just around the corner when interest rates and inflation are rising, the US is in a technical recession (two consecutive quarters of declining GDP), and global markets are sinking fast.

A time-tested investing process will prevent you from getting caught up in bear market bounces. If our good dividend growers are not sensibly priced, we are okay with waiting until they are. We never feel like we are missing out and jump in too soon.

Performance of ‘The List’

Last week, ‘The List’ was up close to 3% with a minus -0.8% YTD price return (capital). Dividend growth of ‘The List’ remains at 10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were TFI International (TFII-N), up 10.74%; Canadian National Railway (CNR-T), up 8.68%; and Intact Financial (IFC-T), up 6.9%.

Canadian Tire (CTC-A-T) was the worst performer last week, down -3.7%.

Recent News

TC Energy’s Coastal GasLink cost estimate jumps nearly 70 per cent (Globe & Mail)

The 670-km Coastal GasLink pipeline is being built to transport natural gas to an LNG Canada facility at the west coast of British Columbia, Canada’s first LNG export terminal.

COVID-related delays, sabotage and rising prices have all contributed to the cost overruns.

FAANGs ain’t what they used to be, so beware the bear-market bounce says this hedge fund manager (Marketwatch)

The S&P 500 index is up 12.6% from its recent low in June of this year and fresh off the best July performance since 1939. This money manager is not convinced the bottom is in just yet.

“He cites three items of what he terms truly bearish news over recent days; the Fed’s 75 basis point interest rate hike; a consecutive negative real GDP print; and “lousy” mega-cap tech earnings.”

Four companies on ‘The List’ are due to report earnings this week.

Waste Connections (WCN-N) will release its second-quarter 2022 results on Tuesday, August 2, 2022, after markets close.

Brookfield Infrastructure Partners (BIP-N) will release its second-quarter 2022 results on Wednesday, August 3, 2002, before markets open.

Bell Canada (BCE-T) will release its second-quarter 2022 results on Thursday, August 4, 2022, before markets open.

Telus (T-T) will release its second-quarter 2022 results on Friday, August 5, 2022, before markets open.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Last week, more than one-third of the companies on ‘The List’ reported earnings. Let’s get started with Canadian National Railway.

Canadian National Railway (CNR-T)

“I am proud of our team of railroaders and pleased with our solid performance this quarter. Our team has the network running well, demonstrating improvements in service levels to our customers, driving greater velocity and generating strong financial results. We are preparing for a busy fall and are well positioned to achieve our 2022 outlook.” – Tracy Robinson, President and Chief Executive Officer, CN

Highlights:

- Record revenues of C$4,344 million, an increase of C$746 million or 21%.

- Record operating income of C$1,769 million, an increase of 28%, and record adjusted operating income of C$1,781 million, an increase of 29%.

- Diluted EPS of C$1.92, an increase of 32%, and record adjusted diluted EPS of C$1.93, an increase of 30%.

- Operating ratio, defined as operating expenses as a percentage of revenues, of 59.3%, an improvement of 2.3- points, and adjusted operating ratio of 59.0%, an improvement of 2.6-points.

- Free cash flow for the first six months of 2022 was C$1,568 million compared to C$1,280 million for the same period in 2021.

- Injury frequency rate increased by 43% and the accident rate decreased by 24%.

- Car velocity (car miles per day) improved by 2% and through dwell (entire railroad, hours) improved by 6%.

- Fuel efficiency improved by 4% to a record of 0.838 US gallons of locomotive fuel consumed per 1,000 gross ton miles (GTMs).

- For the month of June, origin train performance, defined as the percentage of actual train departure time compared to designed train departure time at selected yards, reached 91%, an improvement of 14% compared to 80% for the same period in 2021.

Outlook:

Reaffirming 2022 financial outlook

CN confirms its 2022 outlook targeting to deliver approximately 15-20% adjusted diluted EPS growth in 2022. CN continues to target an operating ratio below 60% for 2022 as well as a ROIC of approximately 15%. CN maintains its free cash flow target in the range of C$3.7 billion – C$4.0 billion in 2022.

See the full Earnings Release here

Toromont Industries (TIH-T)

“We are pleased with our operating and financial performance. While end market activity levels remain solid, the persistent supply constraint pressures and inflation variables contributed to a fluid and complex operating environment. The Equipment Group reported good activity in rental and product support, while global supply chain challenges persist and continue to impact timing of equipment and parts deliveries. CIMCO revenues decreased in the quarter on timing of project construction schedules, against a strong comparable last year, while product support activity improved. Across the organization, there is continued attention to our operating disciplines, while working closely with our customers and stakeholders to manage through uncertain conditions.”

Highlights:

- Revenues decreased 4% in the quarter against a tough comparable. Revenues in 2021 benefited from timing of project construction activity, as well as accelerated purchasing by customers as COVID restrictions began to ease and reflecting historically high activity. Equipment sales were down 19% compared to prior year, with the Equipment Group down 16% and CIMCO package revenues down 38%, as both groups continue to experience delays in construction project schedules and deliveries due to supply chain constraints in the current year. Product support revenues were 14% higher on increased demand and technician headcount, with work-in-process levels remaining high, while rental revenues grew 19% on a larger fleet and higher utilization.

- Revenues on a year-to-date basis were largely unchanged at $1.9 billion, as the improved activity in rentals (up 23%) and product support (up 12%) offset reductions in equipment and package revenues (down 12%) against a tough comparable last year, coupled with continuing supply chain issues in the current year.

- Operating income increased 28% in the quarter on a favourable sales mix (higher percentage of rentals and product support revenues to total revenues) and improved gross margins. Expense levels were up slightly at 12.1% of revenue (11.7% in Q2 2021), reflecting continued cost focus in an inflationary environment, consistent with gradual business openings.

- Operating income increased 26% in the first half of 2022, and was 12.5% of revenues compared to 10.0% in the similar period last year, reflecting the continued favourable sales mix and improved gross margins, offset by a higher expense ratio.

- Net earnings increased $26.3 million or 31% in the quarter versus a year ago to $111.7 million or $1.35 EPS.

- For the first half of the year, net earnings increased $37.9 million or 28% to $171.2 million, or $2.08 EPS.

- Bookings for the second quarter were 34% lower compared to last year and were 25% lower on a year-to-date basis. Both the Equipment Group and CIMCO reported strong bookings in 2021, after a period of lower activity stemming from COVID restrictions. Backlogs were $1.5 billion at June 30, 2022, compared to $957.8 million at June 30, 2021, reflecting strong order activity over the past year coupled with ongoing supply constraints.

Outlook:

We are closely monitoring global economic factors, in particular, inflationary pressures from price and wage increases, including increases from our key suppliers. Initiatives are underway across all of our operations to improve efficiency and leverage the learnings from the last two years, including use of technology and innovative ways to engage with customers, employees and other partners with reduced discretionary spending.

The ongoing challenges in the global supply chain have resulted in delivery date delays for equipment, components and parts and this is expected to continue. We continue to actively manage supply chain constraints by taking appropriate mitigation steps in collaboration with our key suppliers and our customers, such as actively sourcing used equipment, optimizing preparation time on equipment, and offering rebuilds and rental options. We expect a tight supply environment to continue.

There is ongoing concern and uncertainty regarding COVID-19. Staff shortages, reduced customer activity and demand, product availability and other supplier constraints, inflationary impacts and increased government regulations or intervention, are some of the factors that have and may continue to negatively impact our business, consolidated financial results and conditions of the Company. As a result, it is not possible to reliably estimate the length and severity of these developments as well as the impact on the consolidated financial results and condition of the Company in future periods.

The protection and support of our people remains a priority, particularly, our front-line technical workforce who provide valuable service to our customers. Workforce planning initiatives, including hiring and scheduling, continue in light of current and expected activity levels.

The Equipment Group’s parts and service business provides stability supported by a large and diversified installed base of equipment. The on-going integration and alignment of operating processes and systems, best practices and culture, continues across our territory. The long-term outlook for infrastructure projects and other construction activity is positive across most territories although tied somewhat to the general economic climate which is increasingly uncertain. Mining customers and our operations that support them continue to evaluate appropriate activity levels on a daily/weekly basis. Longer term, mine expansion will remain dependent on global economic and financial conditions.

Investment continues in broadening product lines and service offerings, the branch network, rental fleets, and technologies to create efficiency and effectiveness across the organization. Product support technologies, such as remote diagnostics, telematics and digital information models support and expand our strategic platform.

CIMCO’s installed base and product support levels supports current and future operations and growth trends. CIMCO has a wide product offering using natural refrigerants including innovative CO2 solutions, which remains a differentiator in recreational markets. In industrial markets, CIMCO’s proven track record and strong geographical coverage provides growth opportunities. Recreational markets have been limited due to pandemic restrictions, however over the longer term, opportunity exists. Current backlogs are supportive of future activity. Inflationary costs and highly competitive pricing by competition in the market continue to challenge package revenue growth opportunities.

The diversity of the markets served, expanding product offering and services, strong financial position and disciplined operating culture position the Company well for continued positive results in the long term.

See the full Earnings Release here

Loblaws (L-T)

“Loblaw delivered consistent operating and financial results, as customers recognized the value, quality and convenience delivered through our diverse store formats, control brand products, and our PC Optimum loyalty program,” said Galen G. Weston, Chairman and President, Loblaw Companies Limited. “In the quarter we also continued to pursue our strategic growth agenda, with the completion of our acquisition of Lifemark Health Group, bolstering our healthcare services offering and furthering our purpose to help Canadians Live Life Well.”

Highlights:

- Revenue was $12,847 million, an increase of $356 million, or 2.9%.

- Retail segment sales were $12,623 million, an increase of $341 million, or 2.8%.

- Food Retail (Loblaw) same-stores sales increased by 0.9%.

- Drug Retail (Shoppers Drug Mart) same-store sales increased by 5.6%.

- E-commerce sales decreased by 17.5%, lapping elevated online sales due to lockdowns last year.

- Operating income was $742 million, a decrease of $10 million, or 1.3%. Operating income was negatively impacted by $111 million as a result of a charge related to a President’s Choice Bank (“PC Bank”) commodity tax matter.

- Adjusted EBITDA² was $1,499 million, an increase of $128 million, or 9.3%.

- Retail segment adjusted gross profit percentage² was 31.4%, an increase of 50 basis points.

- Net earnings available to common shareholders of the Company were $387 million, an increase of $12 million or 3.2%. Diluted net earnings per common share were $1.16, an increase of $0.07, or 6.4%. Diluted net earnings per common share was negatively impacted by $0.25 per common share as a result of a charge related to a PC Bank commodity tax matter.

- Adjusted net earnings available to common shareholders of the Company² were $566 million, an increase of $102 million, or 22.0%.

- Adjusted diluted net earnings per common share² were $1.69, an increase of $0.34 or 25.2%.

- Repurchased for cancellation, 5.4 million common shares at a cost of $607 million and invested $302 million in capital expenditures. Retail segment free cash flow² was $840 million.

- Acquired Lifemark Health Group (“Lifemark”) on May 10, 2022, adding to the Company’s growing role as a healthcare service provider, with a network of health and wellness solutions, accessible in-person and digitally.

- PC ExpressTM Rapid Delivery announced, to make grocery and convenience items available to customers in an expected express delivery time of 30-minutes-or-less through a collaboration with DoorDash.

Outlook:

Loblaw will continue to execute on retail excellence in its core grocery and pharmacy businesses while advancing its growth initiatives in 2022. In the third year of the pandemic, the Company’s businesses remain well placed to service the everyday needs of Canadians. However, the Company cannot predict the precise impacts of COVID-19, the related industry volatility and inflationary environment on its 2022 financial results.

On a full year basis, the Company continues to expect:

- its Retail business to grow earnings faster than sales;

- to invest approximately $1.4 billion in capital expenditures, net of proceeds from property disposals, reflecting incremental store and distribution network investments; and

- to return capital to shareholders by allocating a significant portion of free cash flow to share repurchases.

Based on its year to date operating and financial performance and momentum exiting the second quarter, the Company expects full year adjusted net earnings per common share growth in the mid-to-high teens.

See the full Earnings Release here

Canadian Utilities Limited (CU-T)

“Canadian Utilities achieved adjusted earnings of $136 million or $0.51 per share in the second quarter of this year. This is $21 million or $0.08 per share higher than the second quarter of last year. The $21 million year-over-year increase in the second quarter earnings was primarily driven by strong operating metrics, and CPI indexing in our international natural gas distribution business in Australia.

Cost efficiencies, rate-based growth and the timing of expenditures in Alberta utilities, along with a strong performance from our Alberta Hub asset also contributed to this great year-over-year earnings growth.

Highlights: (Conference Call Transcript)

Going back to our Australia natural gas business, not only did we see growth in key operating metrics such as gross new connections, the business also benefited from upward pressure in Australian CPI and the regulatory CPI indexing mechanism.

Similar to the trends that we saw in the latter part of 2021, this upward trend in CPI serves to amplify the business’ strong operating performance and drives additional earnings. Currently, in-country forecasts now suggest that CPI could grow as much as 6% or potentially even higher for the full year. This will be a key trend to monitor throughout the remainder of 2022.

Moving on to our Canadian utilities, the strong performance that we saw from our businesses in the first quarter of this year continued into the second quarter. Our distribution utilities continued to deliver exceptional performance in their final year of the current performance-based regulation cycle, or PBR. The efficiencies unlocked in this PBR cycle will provide ratepayers with long-lasting benefits. I’ve touched on the mechanisms of PBR in prior calls, but as we move closer to the end of 2022 and the completion of our current PBR2 term, it’s worth briefly touching on our expectations for the Alberta distribution utilities in 2023.

Moving on to Luma Energy, we continue to see great earnings contributions from this investment, and numerous tangible signs that our work is improving the lives of people in Puerto Rico, bringing them closer to having a reliable and modern electricity system. Over the last year of Luma’s operations, Luma connected over 25,000 customers in net metering. That equates to 2,100 net metering installations per month, an equivalent tie-in of 130 megawatts of renewables to the Puerto Rico electricity system. The team has also executed numerous initiatives aimed at improving system reliability and reducing outage frequency, which has declined 30% since Luma assumed operations.

Moving on to capital, I just want to briefly touch on the capital investments we made in the second quarter of this year. The second quarter saw us invest $297 million in our business with $244 million of this being invested in our core utilities. This ongoing utility investment ensures the continued generation of stable earnings and reliable cash flows, while also driving rate-based growth.

Outlook:

“Overall, Canadian Utilities delivered another great quarter of earnings growth for our shareholders, with many of the key drivers of this earnings growth likely to persist through the remainder of this year.”

See the full Earnings Release here

TC Energy (TRP-T)

TC Energy’s President and Chief Executive Officer, François Poirier commented, “Through the first six months of 2022, we have delivered strong results reflecting the high utilization we continue to see across our entire system. Demand for clean, responsibly sourced natural gas remains high in North America, with energy security also driving incremental growth in the global LNG market.” Poirier continued, “I am pleased to report we have reached a significant milestone with the Coastal GasLink Limited Partnership (Coastal GasLink LP), signing revised agreements with LNG Canada that will allow the safe and timely execution of our largest LNG-linked project. The 670-kilometre Coastal GasLink project is approximately 70 per cent complete, with mechanical in-service expected by the end of 2023. Together with LNG Canada, this project will provide the first direct path for Canadian natural gas to reach global LNG markets. By leveraging our competitive strengths, we continue to develop solutions to move, generate and store the energy North America relies on in a secure and increasingly sustainable way.”

Highlights:

- Consistent with our 2021 Annual Report outlook, 2022 comparable EBITDA is expected to be modestly higher than 2021, while 2022 comparable earnings per common share are expected to be consistent with 2021

- Second quarter 2022 results were underpinned by solid utilization and reliability across our assets. The continued need for energy security has placed renewed focus on the long-term role our infrastructure will play in responsibly fulfilling North America’s energy demands:

- Continued to deliver around a quarter of volumes destined for export from U.S. LNG facilities through our U.S. Natural Gas Pipelines and advanced 3.3 Bcf/d of additional projects during the first six months of the year

- Total NGTL System deliveries averaged 12.8 Bcf/d, up nine per cent compared to second quarter 2021

- S. Natural Gas Pipelines flows averaged 25.4 Bcf/d, up over three per cent compared to second quarter 2021

- Bruce Power planned outages were completed ahead of schedule with results further augmented by the approximately $10/MWh increase in the contract power price that went into effect on April 1, 2022 related to the ongoing MCR program, asset management work and annual adjustments

- During the quarter, the Keystone Pipeline System safely delivered nearly 610,000 Bbl/d as we placed approximately 30 per cent of the 2019 Open Season contracts into service effective April 1, 2022 with additional volumes anticipated through year end

- Second quarter 2022 financial results:

- Net income attributable to common shares of $0.9 billion or $0.90 per common share compared to a net income of $1.0 billion or $1.00 per common share in 2021. Comparable earnings1 of $1.0 billion or $1.00 per common share compared to $1.0 billion or $1.06 per common share in 2021

- Segmented earnings of $1.7 billion compared to segmented earnings of $1.6 billion in 2021 and comparable EBITDA1 of $2.4 billion compared to $2.2 billion in 2021

- Net cash provided by operations of $0.9 billion compared to 2021 results of $1.7 billion and comparable funds generated from operations1 was $1.6 billion compared to $1.8 billion in 2021

- Declared a quarterly dividend of $0.90 per common share for the quarter ending September 30, 2022

- Reinstated issuance of common shares from treasury at a two per cent discount under our Dividend Reinvestment Plan (DRP) commencing with the dividends declared on July 27, 2022 to prudently fund our growth program that includes increased project costs on the NGTL System and following our commitment to make an equity contribution of $1.9 billion to Coastal GasLink LP. We expect the DRP will be activated for a period of four quarters based on historical participation

- Continued to advance our $28 billion secured capital program, with $1.5 billion invested in second quarter 2022

- Reached revised project agreements with LNG Canada on the Coastal GasLink project which is now approximately 70 per cent complete

- To date in 2022, finalized contracts for approximately 580 MW and 240 MW from wind energy and solar projects, respectively, that will largely be used to provide renewable power to portions of the Keystone Pipeline System. We expect to finalize additional contracts in 2022.

Outlook:

“Our overall comparable EBITDA and comparable earnings per common share outlook for 2022 remains consistent with the 2021 Annual Report. 2022 comparable EBITDA is expected to be modestly higher than 2021 and 2022 comparable earnings per common share outlook is expected to be consistent with 2021. Please refer to the 2021 Annual Report for additional details. We continue to monitor the impact of changes in energy markets, our construction projects and regulatory proceedings as well as COVID-19 for any potential effect on our 2022 comparable EBITDA and comparable earnings per share.

Our total capital expenditures for 2022 are now expected to be approximately $8.5 billion. The increase from what was outlined in the 2021 Annual Report is primarily due to the partner equity contributions of approximately $1.3 billion we expect to make in 2022 to Coastal GasLink LP in accordance with revised agreements impacting Coastal GasLink LP. “

See the full Earnings Release here

Fortis (FTS-T)

“We are pleased to report another strong quarter, with financial results reflecting the underlying growth of our utilities as they continue to execute capital investments consistent with our 2022 capital plan. Affordability remains a key focus for our companies as we invest in safe and reliable electric and natural gas delivery infrastructure, and we are committed to ensuring the essential services we provide remain affordable for our customers,” said David Hutchens, President and Chief Executive Officer, Fortis.

Highlights:

- Second quarter net earnings of $284 million, or $0.59 per common share

- Adjusted net earnings2 of $0.57 per common share, up from $0.55 in the second quarter of 2021

- 2022 Sustainability Report released today highlighting the Corporation’s progress on key sustainability initiatives

- Capital expenditures2 of $1.9 billion in the first half of 2022; $4.0 billion annual capital plan on track

- MISO board has approved first tranche of projects associated with LRTP; ITC’s estimated range of LRTP investments increased to between US$1.4 billion and US$1.8 billion

- Tucson Electric Power filed general rate application seeking new rates in 2023 supporting reliable service and cleaner energy

Outlook:

The Corporation’s long-term outlook remains unchanged. Fortis continues to enhance shareholder value through the execution of its capital plan, the balance and strength of its diversified portfolio of utility businesses, and growth opportunities within and proximate to its service territories. While energy price volatility, global supply chain constraints and rising inflation are issues of potential concern that continue to evolve, including from the effects of the COVID-19 pandemic, war in Eastern Europe, economic sanctions and geopolitical tensions, the Corporation does not currently expect there to be a material impact on its operations or financial results in 2022.

The Corporation’s $20 billion five-year capital plan is expected to increase midyear rate base from $31.1 billion in 2021 to $41.6 billion by 2026, translating into a five-year compound annual growth rate of approximately 6%. Above and beyond the five-year capital plan, Fortis continues to pursue additional energy infrastructure opportunities.

Additional opportunities to expand and extend growth include: further expansion of the electric transmission grid in the United States to facilitate the interconnection of cleaner energy including infrastructure investments associated with MISO’s LRTP; natural gas resiliency investments in pipelines and liquefied natural gas infrastructure in British Columbia; and the acceleration of cleaner energy infrastructure investments across our jurisdictions.

Fortis expects long-term growth in rate base will support earnings and dividend growth. Fortis is targeting average annual dividend growth of approximately 6% through 2025.

See the full Earnings Release here

TFI International (TFII-N)

“TFI International produced exceptionally strong results despite volatile macro conditions, with strong across-the-board performance and robust free cash flow that demonstrates the strength of our operating principles, a wealth of internal levers to drive efficiencies, and the growing diversity of our end markets,” said Alain Bédard, Chairman, President and Chief Executive Officer. “Our adjusted net income grew 76% over the year-ago quarter and our free cash flow expanded another 16% above already strong levels. In addition to double-digit top line growth generated by LTL, TL and Logistics, our operating ratios were remarkably strong, including 69% for Canadian LTL, underscoring the untapped potential across much of our network. Strategically, in addition to several attractive bolt-on acquisitions, we sold an underutilized terminal in Southern California acquired from UPS with no need to leaseback capacity. We also continued to repurchase shares given the attractive value we see in our own stock, and this week received Board approval to further expand our buyback authorization. As always, our balance sheet remains a pillar of our strength as we continue to seek attractive growth opportunities while returning capital to shareholders whenever possible in our drive to create long-term value.”

Highlights:

- Second quarter operating income of $391.0 million decreased 17% from $470.9 million the same quarter last year due primarily to a bargain purchase gain of $283.6 million recognized in the prior year period. Adjusting for this prior-year bargain purchase gain, operating income increased 109%, benefitting from a continuing rebound in economic activity and transportation demand following pandemic-related weakness, as well as contributions from acquisitions, gains on sale of property and equipment and assets held for sale, cost reductions enacted in response to the pandemic, strong execution across the organization, and an asset-light approach.

- Net income of $276.8 million decreased 33% compared to $411.8 million in Q2 2021. Diluted earnings per share (diluted “EPS”) of $3.00 decreased 31%, compared to $4.32 in Q2 2021. Both declines are due to the aforementioned bargain purchase gain recognized in the prior year period.

- Adjusted net income , a non-IFRS measure, of $241.1 million increased 76% compared to $137.2 million in Q2 2021.

- Adjusted diluted EPS , a non-IFRS measure, of $2.61 increased 81% compared to $1.44 in Q2 2021.

- Net cash from operating activities of $247.8 million compares to $298.7 million in Q2 2021, primarily due to higher working capital needs related to fuel surcharges as fuel expenditures require expedited repayment.

- Free cash flow , a non-IFRS measure, of $309.6 million increased 16% from 267.9 million in Q2 2021.

- The Company’s reportable segments performed as follows: o Package and Courier operating income increased 25% to $36.8 million;

- Less-Than-Truckload operating income decreased 47% to $187.3 million due to the prior-year period recognition of a $271.6 million bargain purchase gain and a gain of $54.6 million on sale of real estate recognized through gain on assets held for sale;

- Truckload operating income increased 103% to $127.4 million; and

- Logistics operating income decreased 11% to $42.4 million due to the prior-year period recognition of a $12.0 million bargain purchase gain.

- During the second quarter TFI International repurchased and cancelled 2,629,441 shares for $211.7 million and on July 28, 2022 the Board of Directors of TFI authorized an increase to the NCIB program to a maximum of 8,798,283 shares, an increase of 1,798,283 over the previously authorized amount. The Company is awaiting approval of the amendment from the TSX.

- On June 15, 2022, the Board of Directors of TFI declared a quarterly dividend of $0.27 per share, compared to the $0.23 per share dividend declared in Q2 2021, a 17% increase.

- On May 16, 2022, the Company sold one property in southern California for $83.0 million, from its U.S. LTL operations, generating a gain on disposal of $54.0 million. The property was utilized at less than 50% and did not require a long term sale and leaseback arrangement as operations will be moved to other facilities in the region.

- During the quarter, TFI International acquired South Shore Transportation, Cedar Creek Express, and Premium Ventures, and subsequent to quarter end completed the acquisition of Transport St-Amour and HO-RO Trucking Company

Outlook:

North American economic growth has recently slowed due to a variety of factors including rising interest rates, higher inflation including elevated energy prices, labor shortages, continued global supply chain challenges, higher commodity prices and slower growth in major international markets. TFI International’s diversity across industrial and consumer end markets and across many modes of transportation helped the company generate record results during the second quarter. Nonetheless, macro uncertainty persists and an increasing number of economists see the possibility of economic recession over the coming year.

TFI International has successfully navigated recent macro challenges and management remains vigilant in its monitoring for new potential risks, including additional COVID-19 variants and the potential economic disruption they could cause, risks related to energy prices, supply chain disruption, driver availability and higher wages. Factors such as these may cause additional rounds of declining freight volumes and higher costs, adversely affect TFI’s operating companies and the markets they serve. Additional uncertainties include but are not limited to geopolitical risk such as the ongoing war in Ukraine, policy changes surrounding international trade, environmental mandates and changes to the tax code in any jurisdictions in which TFI International operates.

Management believes the Company is well positioned for continued solid operational and financial performance in 2022 due to its strong financial foundation and cash flow generation, its lean cost structure, and a longstanding focus on profitability, efficiency, network density, customer service, optimizing pricing, driver retention, and the rationalization of assets to avoid internal overcapacity. TFI continues to have material synergy opportunities related to 2021’s acquisition of UPS Freight (now TForce Freight), the integration of which continues as planned, and the Company also has meaningful opportunities to enhance performance within its operations. In addition, the Company’s diverse industrial exposure through specialized TL and LTL should continue to benefit from increased domestic manufacturing as a result of reduced imports due to global supply chain issues. TFI is also well positioned to benefit over the long term from the ongoing expansion of e-commerce, which provides both growth and margin expansion opportunities for its P&C and Logistics business segments.

TFI International’s favorable positioning, which was significantly enhanced by last year’s acquisition of UPS Freight, should enable continued solid results over the remainder of this year assuming no significant degradation in economic conditions. Longer term, regardless of the operating environment, management’s goal is to build shareholder value through consistent adherence to its operating principles, including customer focus, an asset-light approach, and continual efforts to enhance efficiencies. In addition, TFI International values free cash flow generation and strong liquidity with a conservative balance sheet that features a high portion of attractive fixed-rate spreads and limited near-term debt maturities. This strong financial footing allows the Company to prudently invest in the business and pursue select, accretive acquisitions while returning excess capital to shareholders.

See the full Earnings Release here

Enbridge (ENB-T)

“Rising global energy shortages and high commodity prices are highlighting the importance of secure, affordable, and reliable energy supply. Energy markets are at a pivotal point, requiring renewed investment in both conventional and lowcarbon energy supply to meet growing energy demand, while achieving society’s emissions reductions goals. North America is ideally positioned to play a critical role in meeting future energy demand with its massive, low-cost and sustainable resources.

The current energy outlook validates our dual-pronged strategy to expand our existing conventional pipeline and export businesses, while ramping up investment in low-carbon opportunities to drive future growth platforms. As we execute our strategy, we’re committed to maintaining our low-risk business model which provides predictable and resilient cash flows in all market cycles.

In the second quarter, we continued to progress well on our strategic priorities.”

Highlights:

- Second quarter GAAP earnings of $0.5 billion or $0.22 per common share, compared with GAAP earnings of $1.4 billion or $0.69 per common share in 2021

- Adjusted earnings of $1.4 billion or $0.67 per common share , compared with $1.4 billion or $0.67 per common share in 2021

- Adjusted earnings before interest, income taxes and depreciation and amortization (EBITDA) of $3.7 billion, compared with $3.3 billion in 2021

- Cash provided by operating activities of $2.5 billion, compared with $2.5 billion in 2021

- Distributable cash flow (DCF) of $2.7 billion or $1.36 per common share , compared with $2.5 billion or $1.24 per common share in 2021

- Reaffirmed 2022 full year guidance range for EBITDA of $15.0 billion to $15.6 billion and DCF per share of $5.20 to $5.50

- Executing the Company’s diversified secured capital program with approximately $4 billion on track to enter service in 2022, providing visible EBITDA growth in the years ahead

- Reached a settlement in principle with participants on Texas Eastern ensuring the system continues to earn an appropriate return on invested capital

- Sanctioned two projects totaling US$0.4 billion to deliver 1.5 billion cubic feet per day (bcf/d) of natural gas to Venture Global’s Plaquemines LNG facility

- Secured estimated $1.2 billion expansion of B.C. Pipeline’s T-North section to serve growing regional demand and west coast LNG exports

- Launched a binding open season for a $2.5+ billion expansion of B.C. Pipeline’s T-South section adding approximately 300 million cubic feet per day of new capacity

- Announced an investment in the 2.1 million tonnes per annum (mtpa) Woodfibre LNG facility, representing a 30% interest, further advancing Enbridge’s LNG export strategy

- Concluded three successful open seasons for capacity on the Alliance Pipeline highlighting the unique value of its liquids-rich transportation capability

- Issued 21st Sustainability Report, demonstrating the Company’s ongoing progress towards the goals set in November 2020

- The Company remains committed to its equity self-funding model and is on track to achieve Debt to EBITDA of 4.7x or lower by year end, providing significant financial flexibility

Outlook:

The Company reaffirms its 2022 financial guidance announced at its December Investor Day, which included adjusted EBITDA between $15.0 and $15.6 billion and DCF per share between $5.20 to $5.50. Results for the first half of 2022 are in line with expectations and the Company anticipates that its businesses will continue to experience strong utilization and good operating results through the balance of the year with normal course seasonality. Forward financial guidance reflects a provision in recognition of the uncertainty of future Mainline tolls associated with the ongoing commercial framework discussions with shippers.

Strong operational performance is expected to be offset by challenging market conditions which continue to impact Energy Services, along with higher financing costs, due to rising interest rates, relative to 2022 financial guidance.

See the full Earnings Release here

Magna (MGA-N)

“Our second quarter results were largely in line with our expectations, excluding the impairment of our investment in Russia. While we anticipate ongoing industry disruption through at least the remainder of 2022, we expect light vehicle production and our earnings to increase in the second half of the year, compared to the first half. We continue to focus on our go-forward strategy and investing for the future.” – Swamy Kotagiri, Magna’s Chief Executive Officer

Highlights:

- Sales of $9.4 billion increased 4%, compared to global light vehicle production increase of 2%

- Diluted loss per share of $0.54 includes $1.24 of non-cash impairment charges related to our investment in Russia

- Adjusted diluted earnings per share decreased 41%

- Increased sales outlook

Outlook:

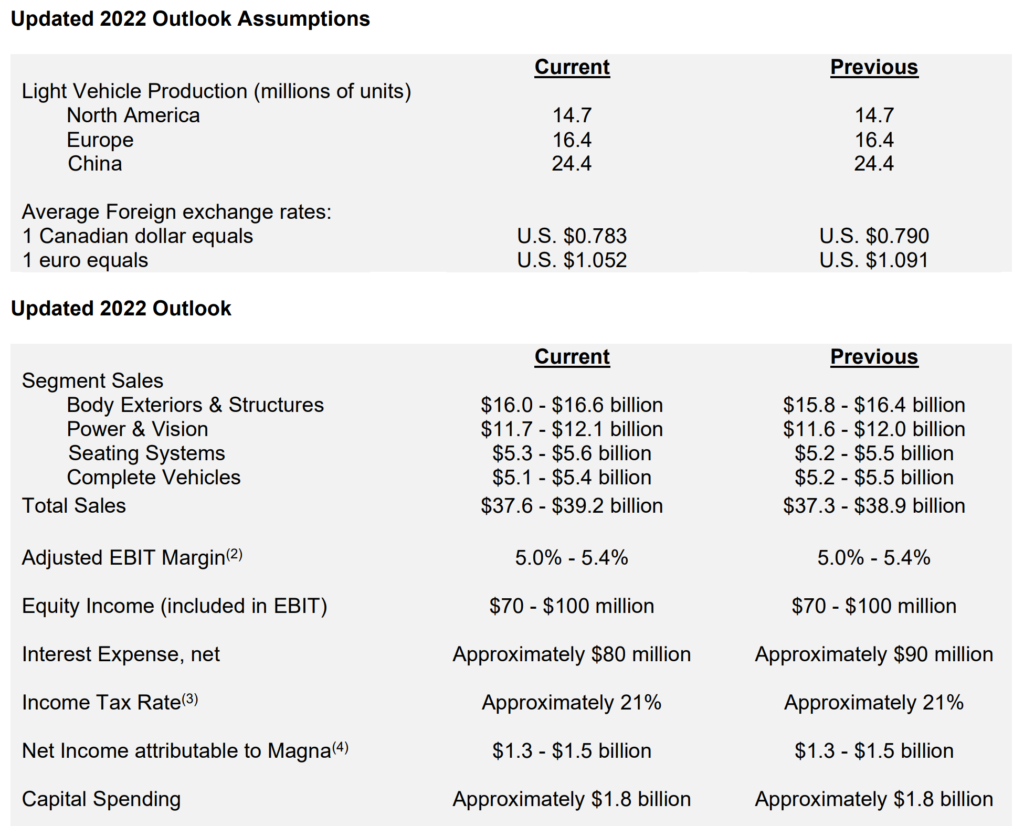

We first disclose a full-year Outlook annually in February, with quarterly updates. The following Outlook is an update to our previous Outlook in April 2022.

See the full Earnings Release here

Intact Financial (IFC-T)

“We delivered strong results in Q2-2022 with contribution from all segments. In the one year since the close of the RSA acquisition, we have achieved $175M in run-rate synergies and greatly strengthened our Canadian and specialty lines platforms. We remain optimistic about the growth opportunities across our business and particularly in specialty lines. We expect that our disciplined underwriting and deep claims expertise will continue to be assets in navigating inflation pressures, climate change and evolving driving patterns.”

Highlights:

- Net operating income per share was $3.14 with meaningful accretion from RSA and strong investment and underwriting results

- Operating DPW grew 36% in the quarter, driven by the RSA acquisition and 4% organic growth, led by commercial lines

- Operating combined ratio of 90.7% was strong across all geographies, but higher than last year mainly due to catastrophe losses

- EPS of $6.64 in the quarter reflecting strong operating results, significant gains on investments and the sale of Codan Denmark

- OROE of 15.4% and ROE of 18.5% reflecting robust operating and non-operating performance

- Total capital margin remains strong at $2.5 billion despite a volatile macroeconomic environment

- After one year, NOIPS accretion from the RSA acquisition was well above expectations at 15%, and integration remains on track

Outlook:

- Over the next twelve months, we expect firm-to-hard insurance market conditions to continue in most lines of business, supported by high pre-pandemic combined ratios, inflation, and climate change.

- In Canada, we expect firm market conditions to continue in personal property. Personal auto premium growth is expected to progress towards the mid-single-digit range to reflect inflation and evolving driving patterns.

- In commercial lines, in both the US and Canada, hard market conditions are expected to continue.

- In the UK&I, hard market conditions are expected to continue across commercial lines. In personal lines, near term industry growth levels are uncertain as companies navigate pricing reforms and inflation.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on July 29, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.0% | $13.99 | -2.5% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $57.21 | 9.8% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.6% | $64.70 | -1.8% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.6% | $39.83 | -2.2% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $64.33 | -5.1% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $162.23 | 4.7% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.6% | $164.51 | -10.2% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.3% | $41.45 | 13.2% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $77.61 | 22.4% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.4% | $60.71 | -3.0% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.0% | $57.51 | 16.1% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.2% | $32.80 | -28.5% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.0% | $127.98 | -6.0% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.5% | $60.49 | 0.0% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.1% | $190.60 | 16.4% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $116.57 | 13.5% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 2.8% | $63.86 | -21.7% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $70.91 | 5.8% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 4.0% | $124.86 | -8.8% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.1% | $38.01 | -6.6% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $63.19 | -10.0% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.3% | $83.18 | -16.3% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.1% | $99.93 | -9.8% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.4% | $107.85 | -5.1% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.2% | $68.27 | 14.3% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.5% | $29.48 | -0.9% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $133.37 | -0.5% | $0.92 | 8.9% | 12 |

| Averages | 2.8% | -0.8% | 10.2% | 18 |