Last updated by BM on May 30, 2022

“We don’t promise perfection – we deliver on a probability-weighted process. Our process is based on probabilities, not certainties!” Hedegeye CEO, Keith McCullough

We follow Hedgeye to gain a macro view of the economy and appreciate the insights into their process, much of which could be applied to our dividend growth investing strategy.

We were asked by a subscriber this week why we have been a little tentative in sending out DGI Alerts for buying stocks in our new MP Wealth-Builder Model Portfolio (CDN). The answer has a few parts to it.

First, the drawdown in the financial markets has mostly been more of a global one than a Canadian-specific one. Our markets have held up pretty well thus far. On top of that, most of the price pullbacks on Canadian stocks have been on companies that were overvalued coming into 2022. Many are still above their historical fair value.

Secondly, the angst felt by the subscriber is one of breaking the preconditioned habit of ‘buying the dips’ in the market over the last few years, and it is not an easy one to toss aside. This habit works well in bull markets but not so much in a bear market with rising interest rates.

Thirdly, when it comes to earnings, a stock may look sensibly priced at 15x earnings after a price decrease, but what happens if the earnings come in 20% lower than expected. The revised multiple is now closer to 19x. This could happen if the central banks are not careful when trying to cool off inflation with aggressive interest rate hikes.

Finally, we are just getting into the Q2 earnings season, which should be the most challenging year-over-year (YoY) comparisons we’ve ever seen.

Walmart and Target are recent examples of where an earnings miss combined with a YoY net income miss of 25% and 50%, respectively, can wreak havoc on a company’s stock price. This scenario has the potential to panic a lot of investors and is the reason we are being more cautious right now on our purchases. Always remember that emotions determine the market price in the short run.

In summary, the time to buy may be soon, but not until we have a more straightforward path to earnings and economic data that is reaccelerating or at least a greater margin of safety if there are some short-term challenges. The probability continues to rise that we will see some opportunities shortly to purchase our quality dividend growers at a ‘sensible price’.

Performance of ‘The List’

Last week, ‘The List’ was up a couple of points with a minus -0.8% YTD price return (capital). Dividend growth of ‘The List’ was also up slightly at 10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Canadian Tire (CTC-A-T), up 5.3%; Dollarama (DOL-T), up 4.6%; and Loblaws (L-T), up 4.4%.

Emera (EMA-T) was the worst performer last week, down -1.4%.

Recent News

Bankers buck gloomy trend by forecasting growth amid concerns about economic slowdown

“Top executives at two major Canadian banks predict they can keep adding new loans and increasing profits in the coming quarters, offering an optimistic outlook for the financial sector that is at odds with economists’ increasingly gloomy forecasts of a downturn ahead.”

Dividend raises this past week by most Canadian banks sending the same signals. Banks are remaining optimistic.

How central bankers lost their grip on inflation

“The Bank of Canada, like many central banks overseeing advanced economies, was slow to start raising rates, even as it became clear that high inflation was not going to be a temporary blip.”

A key point in the article is that if employees and businesses feel inflation will remain high they will demand higher wages and set higher prices making inflation a self-fulfilling prophecy.

“There’s no good way to do this,” Prof. Melino said. “It’s going to hurt. You can’t get rid of inflation without pain. And the credibility will come from its willingness to take the blame to get things going again.”

For dividend growth investors, pain translates into opportunity. We can buy more future income by purchasing our quality dividend growers when they are on sale.

There are no companies on ‘The List’ due to report earnings this week.

Dividend Increases

One company on ‘The List’ announced a dividend increase last week.

Royal Bank (RY-T) on Thursday said it increased its 2022 quarterly dividend from $1.20 to $1.28 per share, payable August 24, 2022, to shareholders of record on July 23, 2022.

This represents a dividend increase of 7%, marking the 12th straight year of dividend growth for this quality financial institution.

Earnings Releases

Last week was the beginning of the Q2 2022 earnings season for the Canadian banks. Two of the larger ones, Royal and TD, are on ‘The List’ and reported on Thursday.

Royal Bank (RY-T)

“The resilience of our diversified business model, prudent risk and capital management, and strategic investments in talent and technology continued to define our performance in the second quarter. We remain well-positioned for future growth, and to deliver differentiated long-term value for our clients, employees and shareholders. At a time when geopolitical tensions, inflationary pressures and global supply chain issues are creating an uncertain macroeconomic backdrop, I’m proud of how RBC employees continue to drive positive change in our communities and deliver trusted advice and insights for those we serve. We will continue to leverage our scale and financial strength, and the powerful combination of our people and culture, to play a leading role in shaping a thoughtful transition to net zero and an inclusive post-pandemic future.”

– Dave McKay, RBC President and Chief Executive Officer

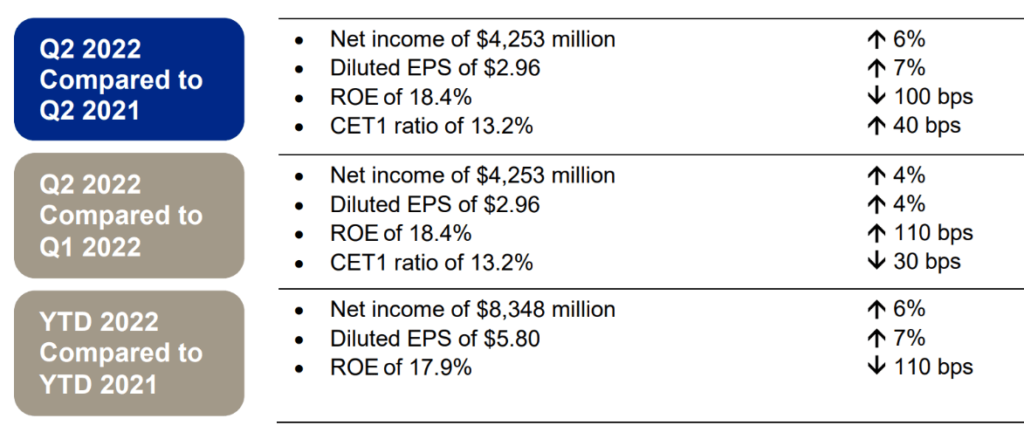

Highlights:

Outlook:

“Inflation has surged higher and unemployment rates have continued to fall, prompting central banks in Canada, the U.S. and the United Kingdom (U.K.) to increase interest rates and to reduce asset holdings. The conflict between Russia and Ukraine has exacerbated global supply chain challenges and pushed key commodity prices higher, intensifying inflationary pressures. The economic impact from the COVID-19 pandemic has eased in most regions with recoveries in travel and hospitality sectors contributing to near-term growth momentum. However, the COVID-19 pandemic continues to impact goods manufacturing and supply, including economic disruptions in China resulting from stringent efforts to control virus spread. Low unemployment and strong demand for workers are driving wages higher. Central banks are expected to continue raising interest rates at the most aggressive pace in decades, which is expected to slow GDP growth later this year and into calendar 2023.”

Provisions for Credit Losses (PCL) have been reduced at Royal Bank since last quarter and were an important component in RY-T showing an increase in Net Income in Q2. This accounting transaction reflects the reduced uncertainty relating to the COVID-19 pandemic. Overall RY-T seems to be in pretty good shape for now. A nice 7% bump to the dividend keeps us happy as well.

Toronto Dominion Bank (TD-T)

“TD’s second quarter performance reflects the strength of our diversified business model and customer-centric approach,” said Bharat Masrani, Group President and CEO, TD Bank Group. “We have delivered strong revenue growth across our businesses and we enter the second half of the year well-positioned to support households and businesses as they navigate an evolving economic environment. TD will continue to invest in our people, technology, and innovation to exceed our customers’ rapidly changing expectations and help shape the future of banking.”

Highlights:

SECOND QUARTER FINANCIAL HIGHLIGHTS, compared with the second quarter last year:

- Reported diluted earnings per share were $2.07, compared with $1.99.

- Adjusted diluted earnings per share were $2.02, compared with $2.04.

- Reported net income was $3,811 million, compared with $3,695 million.

- Adjusted net income was $3,714 million, compared with $3,775 million.

YEAR-TO-DATE FINANCIAL HIGHLIGHTS, six months ended April 30, 2022, compared with the corresponding period last year:

- Reported diluted earnings per share were $4.09, compared with $3.76.

- Adjusted diluted earnings per share were $4.09, compared with $3.86.

- Reported net income was $7,544 million, compared with $6,972 million.

- Adjusted net income was $7,547 million, compared with $7,155 million.

With Toronto Dominion, it was interesting to note that the year-over-year comparison between Q2 in 2021 versus Q2 in 2022 was lower in all segments of the business. If we interpret the numbers correctly, the slowdown in the economy from TD-T’s perspective has already begun.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Rather, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on May 27, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 4.8% | $14.51 | 1.1% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $57.03 | 9.5% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.3% | $68.82 | 4.4% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.6% | $60.29 | -1.3% | $2.16 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.6% | $60.48 | -10.8% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 2.0% | $145.11 | -6.3% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.4% | $170.37 | -7.0% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.5% | $39.86 | 8.9% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $71.41 | 12.6% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.2% | $63.32 | 1.2% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 5.9% | $58.78 | 18.7% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.1% | $33.89 | -26.1% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 0.9% | $142.57 | 4.8% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.4% | $63.79 | 5.5% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.2% | $180.22 | 10.1% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $116.07 | 13.0% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 2.8% | $63.96 | -21.6% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $69.87 | 4.2% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.8% | $130.95 | -4.3% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.2% | $35.68 | -12.3% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.2% | $57.55 | -18.0% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 3.7% | $95.99 | -3.4% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.3% | $81.36 | -26.5% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.4% | $110.52 | -2.8% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 4.9% | $73.13 | 22.4% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.2% | $31.49 | 5.8% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $128.49 | -4.2% | $0.92 | 8.9% | 12 |

| Averages | 2.7% | -0.8% | 10.2% | 18 |