Posted by BM on February 28, 2022

Each month we walk through our valuation process using a stock on ‘The List’ that meets our minimum screen of 6.5% EPS Yield. This month it is Magna International (MG-T).

Valuation is the second step in our three-step process. Buying when our quality stocks are sensibly priced will help ensure our future investment returns meet our expectations. We rely heavily on the fundamental analyzer software tool (FASTgraphs) to help us understand the fundamentals of the stocks we invest in and then read the company’s website for investor presentations and recent earnings reports to learn more.

Intro:

Magna is more than one of the world’s largest suppliers in the automotive space. They are a mobility technology company with a global, entrepreneurial-minded team of over 158,000 employees and an organizational structure designed to innovate like a startup.

With 60+ years of expertise, and a systems approach to design, engineering and manufacturing that touches nearly every aspect of the vehicle, they are positioned to support advancing mobility in a transforming industry. Thier global network includes 343 manufacturing operations and 91 product development, engineering and sales centres spanning 28 countries. Roughly half of Magna’s revenue comes from North America while Europe accounts for approximately 44%

Historical Graph:

Comments:

Magna International has a slightly wider valuation corridor than some of our other dividend growers. As you can see from the Blue Line on the graph (Normal P/E) and the Black Line (Price), there has been quite a swing in valuation recently. A company that traded below a 10 P/E for most of the last decade has now traded at more than a 22 P/E (almost twice its average) as recently as June of 2021.

The fundamentals show a company whose earnings have grown steadily over the last ten years at an annualized rate of ~14.36%. One other thing of note is that with Magna’s transformation into an EV company, Analysts are predicting an uptick in earnings growth out until the end of 2024 at a much higher growth rate (~28%).

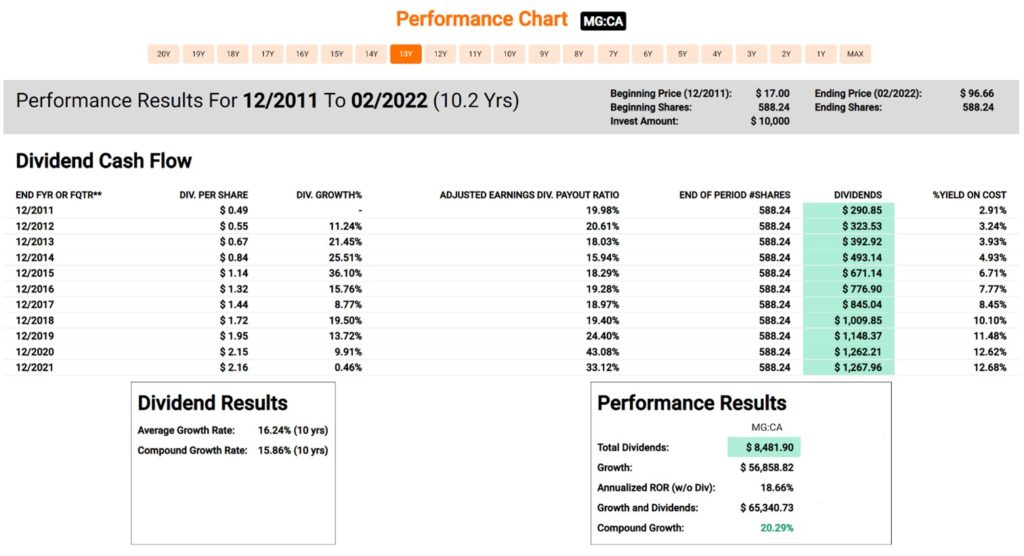

Performance Graph:

Comments:

Magna International has an annualized dividend growth rate of 15.86% over the last ten years. The company also has an annualized Total Return of 20.29% over that time period. MG-T recently announced a dividend increase of ~5.0% for 2022 which is about half of last year’s increase. Magna has been a terrific investment over the last decade both from a capital and income growth perspective.

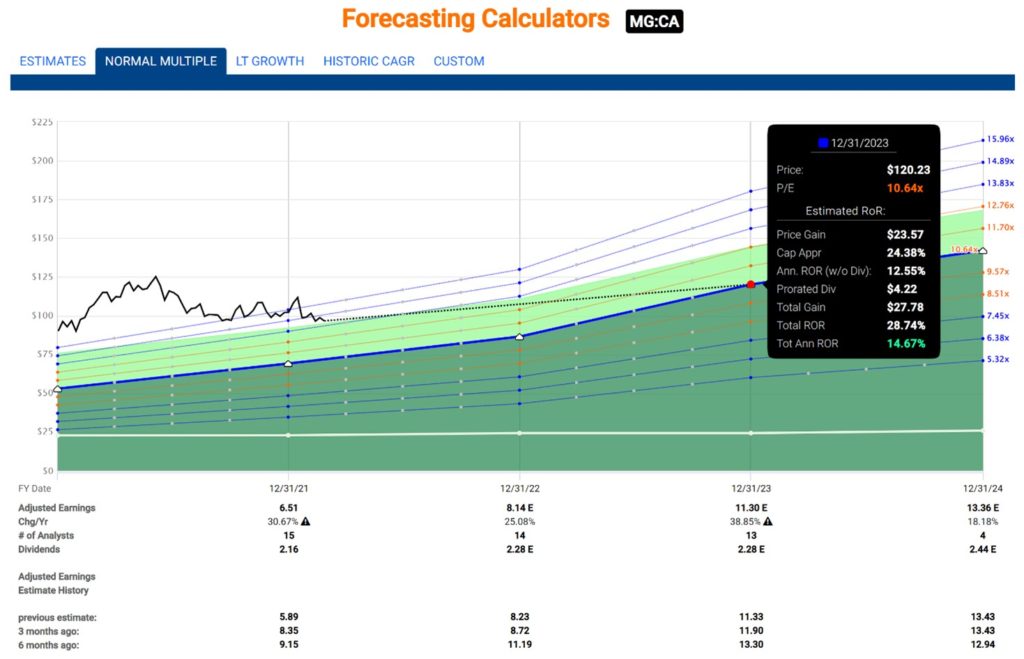

Estimated Earnings:

Comments:

Using the “Normal Multiple’ estimating tool from FASTgraphs, we see a blended P/E average over the last five years of 10.64. Based on Analysts’ forecasts two years out, you can expect an annualized return based on today’s price of 14.67% should MG-T trade at its five-year average blended P/E.

Blended P/E is based upon a weighted average of the most recent actual value and the closest forecast value.

Of importance is that Analysts have been revising their estimates downwards recently. Both the six and three months ago projections for 2022 and 2023 have been dropping. It means that Analysts are more bearish on Magna in the short term.

Analyst Scorecard:

Comments:

Analyst estimates over the years are fairly accurate based on one and two-year earnings projections. Analysts’ projections have hit or beat ~70% of the time on one-year estimates and ~76% on two-year estimates.

Recent Earnings Report-Q4 2021:

“Although 2021 presented its share of challenges, we delivered above-market sales growth and generated solid free cash flow, as we worked closely with our customers and suppliers to minimize the impacts on vehicle production. Despite significant input cost headwinds, we expect improved operating results in 2022 as the industry recovers and production schedules normalize. In addition, we remain confident in our ability to capitalize on the opportunities in front of us, especially in the areas of electrification, autonomy and new mobility.”

– Swamy Kotagiri, Magna’s Chief Executive Officer

Highlights

Fourth Quarter 2021 Highlights

- Sales of $9.1 billion decreased 14%, compared to a 17% decrease in global light vehicle production

- Diluted earnings per share and adjusted diluted earnings per share of $1.54 and $1.30, respectively, compared to $2.45 and $2.83 last year

- Returned $378 million to shareholders through share repurchases and dividends

- Raised quarterly cash dividend by 5% to $0.45 per share

Full Year 2021 Highlights

- Sales of $36.2 billion increased 11%, compared to global vehicle production which increased 4%

- Diluted earnings per share and adjusted diluted earnings per share of $5.00 and $5.13, respectively, compared to $2.52 and $3.95 last year

- Returned over $1 billion to shareholders through share repurchases and dividends

Summary:

Input cost increases due to inflation and the semi-conductor crisis have and will continue to affect Magna’s fundamentals in the short run. A belief in the ability of central banks to manage inflation through interest rate hikes and an improvement in the chip shortage situation in the coming year, will be required to see Magna’s fundamentals improve in 2022. Looking further ahead, the company is well positioned to take advantage of growth opportunities as the auto industry undergoes significant transformation.

When we have purchased Magna shares in the past (MP Wealth-Builder CDN Portfolio), it was always when the P/E was below 8. Although those days may be behind us now, we would like to see a further pullback in the share price or at the very least a clear indication that some of the operational headwinds they experienced in 2021 are now behind them. Like most investors right now, we are waiting for a better entry point.