Posted by BM on February 25, 2022

“Corporations which pay rising dividends are wealth creating machines.” Tom Connolly

A big shout out to one of my mentors, Tom Connolly from Kingston, ON. Thank you, Tom, for introducing me to dividend growth investing (DGI).

Two- and one-half Olympics ago we started the Magic Pants Wealth-Builder (CDN) Portfolio. Most of our research on dividend growth investing was backward looking (historical returns) but the evidence was so overwhelming we decided to take the plunge. Our first DGI stocks were a grocer, utility, pipeline, royalty company and telco. As the saying goes….” the rest is history.”

Here were the total returns generated (dividends included) and the corresponding benchmarks for comparison:

| MP Wealth-Builder CDN | TSX Dividend Aristocrat CDN Index | TSX Composite Index | |

|---|---|---|---|

| Year | Total Return | Total Return | Total Return |

| 2012 | 29.13% | 9.33% | 7.19% |

| 2013 | 15.75% | 14.41% | 12.99% |

| 2014 | 25.08% | 13.87% | 10.55% |

| 2015 | -6.63% | 10.75% | 8.32% |

| 2016 | 20.21% | 21.95% | 21.08% |

| 2017 | 11.15% | 5.89% | 9.09% |

| 2018 | -4.19% | 8.28% | 8.89% |

| 2019 | 20.59% | 26.29% | 22.88% |

| 2020 | 7.54% | -2.28% | 5.60% |

| 2021 | 28.10% | 25.91% | 25.09% |

| 10YR Compounded Gain: | 146.73% | 96.34% | 97.26% |

| Annualized Returns | |||

| 1YR | 28.10% | 25.91% | 25.09% |

| 3YR | 18.86% | 15.80% | 17.52% |

| 5YR | 13.27% | 8.56% | 10.04% |

| 10YR | 12.95% | 8.86% | 9.14% |

Source: Magic Pants Dividend Growth Investing Inc. & S&P Global

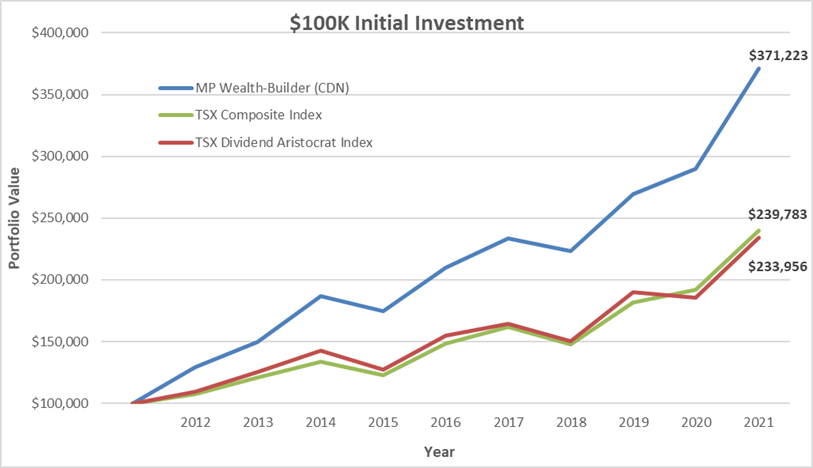

A ~13% compounded annual growth rate is over 40% better than the indexes. Compared against the top ETFs and dividend funds in Canada will render similar outperformance.

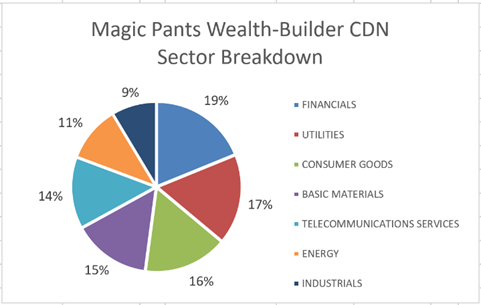

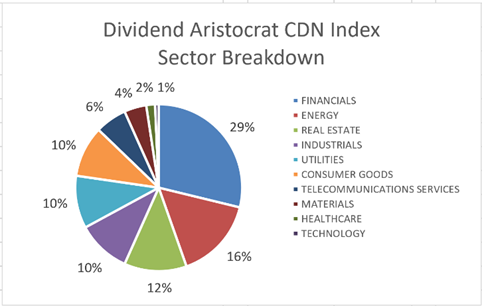

The reason for our outperformance is clear; ETFs and Funds charge management fees; are less concentrated, contain lower quality companies; have higher turnover due to short-term thinking; are less diversified (40-50% in only two sectors); and do not generate the same amount of income our growing dividend portfolio provides. It is no wonder they were unable to keep pace.

To highlight our outperformance, we looked at 100K invested in all three portfolios starting in 2012 and here is what we found:

The question then becomes, how did we do it?

“We buy quality individual dividend growth stocks when they are sensibly priced and hold for the growing income.”

I know it sounds simple, but it works. It has worked for decades for others and is the reason we started dividend growth investing in the first place.

Lessons Learned:

Although we are proud of our performance, we did learn a lot over the last ten years. Yes, we made some mistakes but thankfully we stuck to our process. We are a lot wiser and less emotional when it comes to our process now. We are excited about what the future holds.

Lesson #1

Only buy ‘quality’ companies. Early on we purchased a few companies that had respectable dividend growth records but were not sufficiently capitalized and when there was turbulence in the market, they suffered more than our high-quality companies did and were slow to recover. In the end we exited our positions at a loss and chalked one up to experience.

Lesson #2

Do not buy cyclical companies. Cyclicals can do very well when they are in favor but can turn quickly when the cycle trends the other way. Case in point are the pure ‘Energy’ companies in Canada. You need to incorporate ‘market timing’ into your process and hold on for the ride if you want to add cyclicals to your dividend growth portfolio. For most investors the emotional rollercoaster is too much.

Lesson #3

Rarely sell your good dividend growers. Early on we sold some companies too early when they appeared overvalued. They continued to go higher, and we were unable to participate. If you must sell due to perceived overvaluation, sell some, and take your position size down but don’t exit totally. That way if they continue higher, you still have some skin in the game.

Lesson #4

Have a position sizing strategy. First separate your quality companies into ‘Core’ and ‘non-Core’ categories. In Canada, ‘Core’ companies are the ones that are essential to the economy (Telcos, Utilities, Banks, Railroads, Pipelines). Determine based on your own comfort level what percentage of your investable capital you are going to allocate to each individual company in each category.

Lesson #5

Supercharge your returns by having the confidence in a market sell-off to purchase the quality companies on your list. We had a few opportunities over the last ten years to either initiate or add to our core positions at a steep discount. We ended up being too conservative when the opportunities presented themselves and our returns were not as good as they could have been. Have a chat with yourself prior to a sell-off on what your strategy would be and try and eliminate the emotion for when the time comes. Trust the process.

In summary, it was a good decade for many types of investing methodologies, and we realize that most returns were higher than historical norms. With that said, we still outperformed the market by a wide margin with DGI.

Do you have a repeatable investing process? We prefer dividend growth investing because it less active than other forms, does well in both bull and bear market cycles and no matter what, we always have our growing income to fall back on. If you are still unsure, give it a try with a percentage of your portfolio and track your performance against other strategies you believe in. If you are like us, you will like what you see.

For those of you who need a little more help, you can always subscribe to the blog and build your portfolio alongside ours.