Posted by BM on October 25, 2021

In 2016 Michael J. Mauboussin wrote a paper titled ‘Thirty Years: Reflections on the Ten Attributes of Great Investors’. One of those attributes deals with position sizing.

Mauboussin writes, “success in investing has two parts: finding edge and fully taking advantage of it through proper position sizing. Almost all investment firms focus on edge, while position sizing generally gets much less attention.”

He uses the example of card counting in blackjack as means to finding an edge and incorporating a betting strategy that takes advantage of it when the cards are in your favor.

As dividend growth investors we already know what our ‘edge’ is…buying quality individual dividend growth companies when they are sensibly priced and holding for the growing income. Our strategy for taking advantage of our ‘edge’ requires further explanation.

First, we size our positions based on quality. Our portfolios have a high concentration of high quality dividend growth stocks (as much as 80%) and not as much on quantity (think ETF). Studies have proven that once you get by sixteen stocks you have utilized most if not all the benefit that diversification provides. The added benefit to a concentrated portfolio is that we have fewer stocks to monitor (Step 3 in our process) which takes us less time to stay on top of our portfolios.

Secondly, like the card counting strategy mentioned earlier, we add to our position sizes (increase our bets) when our quality companies are sensibly priced and more aggressively when they go on sale. To dividend growth investors, this is the equivalent of having a lot of face cards left in the deck and increases the probability of better long-term returns.

Getting Started

Let’s say you’ve come up with a sensible estimate of fair value for a company on ‘The List’. Its share price is now below your estimate of fair value, so you think there is very probably a margin of safety between the current price and fair value.

You like the quality of the company (based on our quality indicators), and you like the current price, so you decide to invest. But how much of your capital should you invest into this business?

First separate your quality companies into ‘Core’ and ‘non-Core’ categories. In Canada, ‘Core’ companies are the ones that are essential to the economy (Telcos, Utilities, Banks, Railroads, Pipelines). We then ensure that these companies have high safety and financial ratings from third party sources (i.e. Value Line, S&P). These companies will be the foundation of our Canadian dividend growth portfolio.

Next, we choose our ‘non-Core’ companies. These companies are typically low yield/high growth businesses that tend to be a bit smaller in size but have stability in earnings, good management teams, and a history of paying growing dividends.

Our ‘full’ position size for a company will be about 8% in ‘Core’ companies and 2-4% in ‘non-Core’ companies. We typically, only take the top two rated companies in any given sector. This allows us to hold between 15-20 stocks in our portfolio providing ample diversification across industries.

The logic behind our approach is that we now have greater concentration around the safest opportunities (Core) with some exposure to faster growing companies (non-Core). Our goal is that some of these ‘non-Core’ companies will continue to grow and will become ‘Core’ holdings over time.

If our position sizes grow beyond our initial full position size, we have the luxury of either allocating some of that growth to other areas of our portfolio or letting it run. We typically do not let any one position size grow to more than 10% or our portfolio.

Next, we enter our positions incrementally. This helps us avoid the dreaded price drop in the short term which can discourage those new to dividend growth investing and can supercharge our returns if done properly during times of market volatility. We like to buy in 50-100 basis points at a time when we are entering a position. A basis point is one-one hundredth of one percent so it can take a few trades to get to the position size we want. If the price dops 5% and nothing has fundamentally changed with the company, we will buy more. We usually only buy into a declining stock price three times in a short period of time. If the stock price reverses, we can buy more on the upswing if it remains sensibly priced provided, we have not exceeded our full position size.

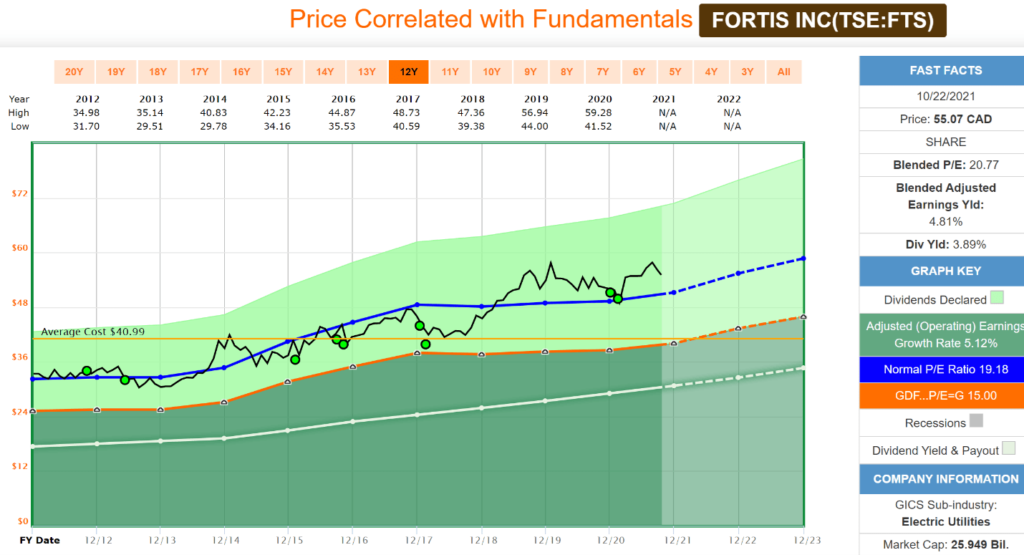

I will illustrate how we built a position size using a company from our Canadian Dividend Growth Portfolio, Fortis Inc. (FTS.TO). Both our buying strategies (sensibly priced and on sale) were part of our strategy when building this position. The green dots on the graphic are when we bought a position.

Our historical graph shows that Fortis’ valuation corridor tends to follow its P/E ratio (Blue Line) very closely. The price (Black Line) has periods when it is above the P/E ratio (overpriced) and ones where it is below (on sale). We bought Fortis nine times over the last nine years. On four occasions we initiated a position when the price was at or near the average P/E (sensibly priced) where on five other occasions we initiated a position when the price was well below the average P/E. This is how we win!

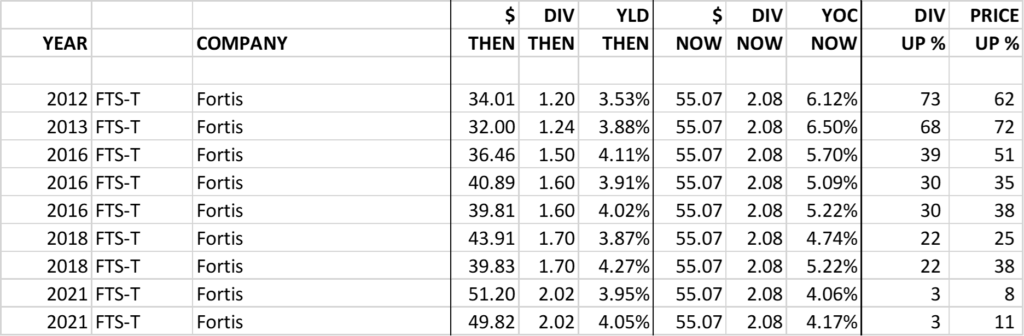

The chart below is what we use to quickly monitor how our positions are performing. Dividend growth (DIV UP %) and price growth (PRICE UP %) quickly tell us how our purchases have performed. We like Fortis’ pattern as it seems to align dividend growth with price growth over time when it is purchased at a sensible price. The ‘on sale’ purchases (2016-2018) tend to have higher price appreciation compared to their dividend growth which makes sense given they were a bargain at the time and the price has now recovered.

Summary

We never know if our good dividend growers will go on sale and if they do, how long will it last. Being out-of-the-market for long periods of time will affect your returns so don’t be too cautious with your buying strategy. Entering positions incrementally along the way when our quality companies are sensibly priced and fully taking advantage of a sale when it presents itself increases the probability of above average long-term returns and the best way to use our ‘edge’.