Posted by BM on October 17, 2021

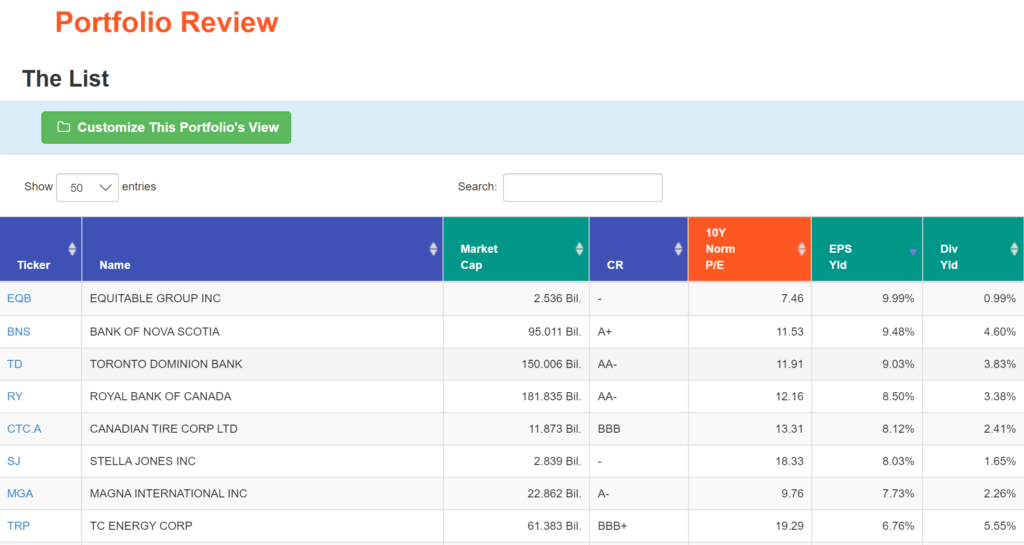

Each month I will walk through our valuation process using a stock on ‘The List’ that meets our minimum screen of 6.5% EPS Yld. This month it is Equitable Group Inc. (EQB-T).

Valuation is the second step in our three-step process. Buying when our quality stocks are sensibly priced will help ensure our future investment returns meet our expectations. We rely heavily on the fundamental analyzer software tool (FASTgraphs) to help us understand the fundamentals of the stocks we invest in and then read the company’s website for investor presentations and recent earnings reports to learn more.

Intro:

Equitable Group Inc. trades on the Toronto Stock Exchange (TSX: EQB and EQB.PR.C) and serves a growing number of Canadians through Equitable Bank, Canada’s Challenger Bank™. Equitable Bank has grown to become the country’s eighth largest independent Schedule I bank with a clear mandate to drive real change in Canadian banking to enrich people’s lives. Founded over 50 years ago, Equitable Bank provides diversified personal and commercial banking and through its EQ Bank platform has been named #1 Bank in Canada on the Forbes World’s Best Banks 2021 list. EQ Bank provides state-of-the-art digital banking services, like the Savings Plus Account that reimagines banking by offering an everyday high interest rate, plus the flexibility of a chequing account, as well as a wide range of smart banking solutions for Canadians, like fast international money transfers, US dollar accounts and a suite of registered products.

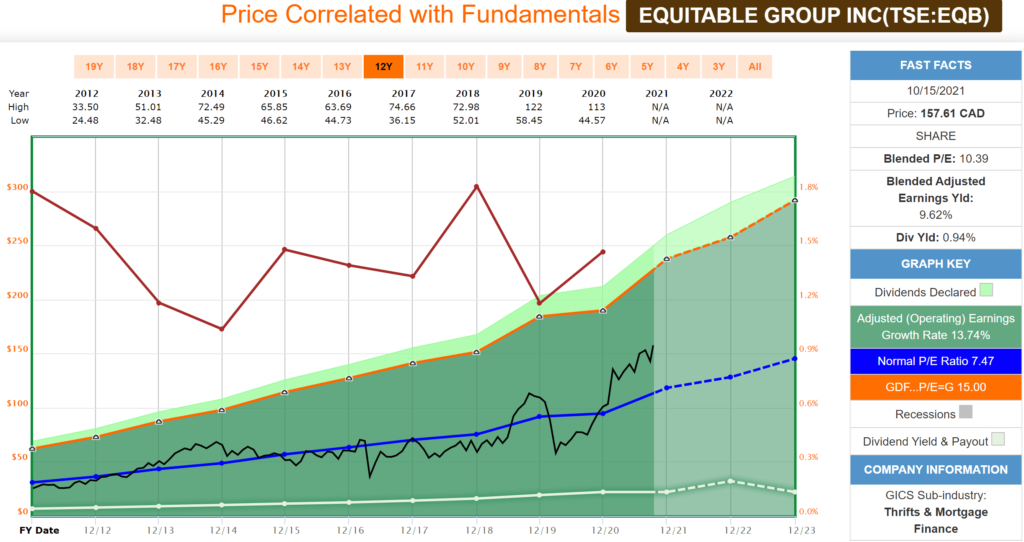

Historical Graph:

Comments:

Equitable Group is another of our good dividend growers that has traded within a narrow valuation corridor. As you can see from the Blue Line on the graph (Average P/E) and the Black Line (Price), there is typically very little variance (except for the large dip in 2020 due to COVID). Investment opportunities occur when the Black Line touches or falls below the Blue Line with this quality dividend grower. The fundamentals show a company whose earnings have grown steadily over the last ten years and are accelerating. The price reflects this with a higher-than-average P/E with a lower dividend yield (Red Line).

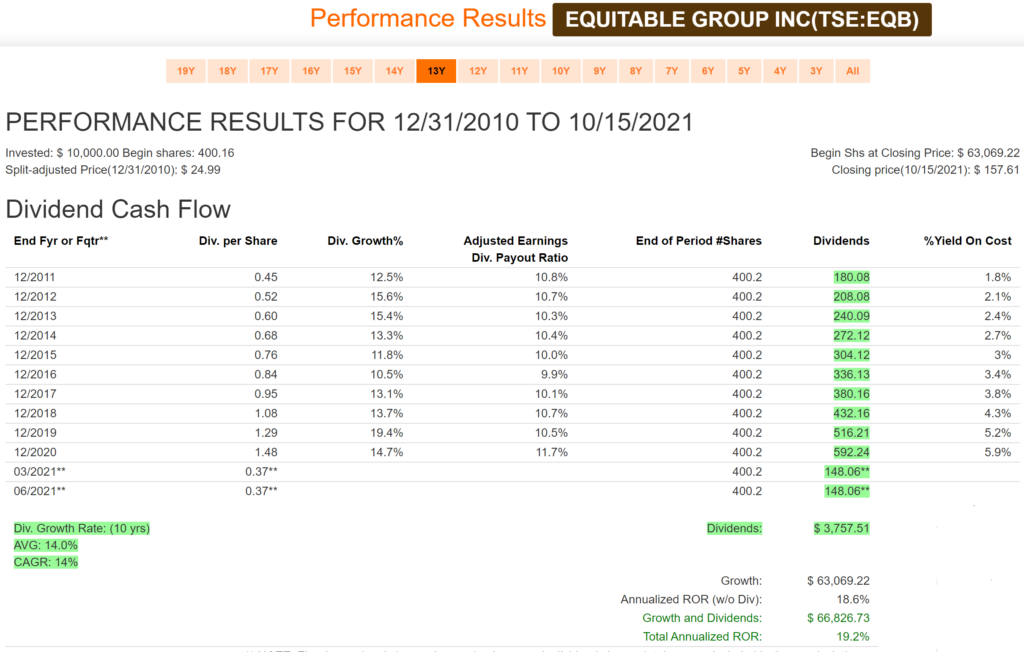

Performance Graph:

Comments:

Equitable Group Inc. has an excellent dividend growth rate (14%/year) over the last decade. A low starting yield takes a bit longer to produce an acceptable income level for retirees, but you can clearly see that EQB is gaining fast. With a starting yield of 1.8% ten years ago, you would now be receiving a return of 5.9% on your original investment from dividends alone.

EQB is also one of the stocks we like as dividend growth investors that aligns dividend growth closely with price growth (~16% CAGR of capital over the past decade).

Note: The dividend rate was unchanged from 2020 reflecting regulatory guidance from OSFI to all federally regulated banks. The Bank intends to resume its previously announced dividend increases once regulatory restrictions are lifted.

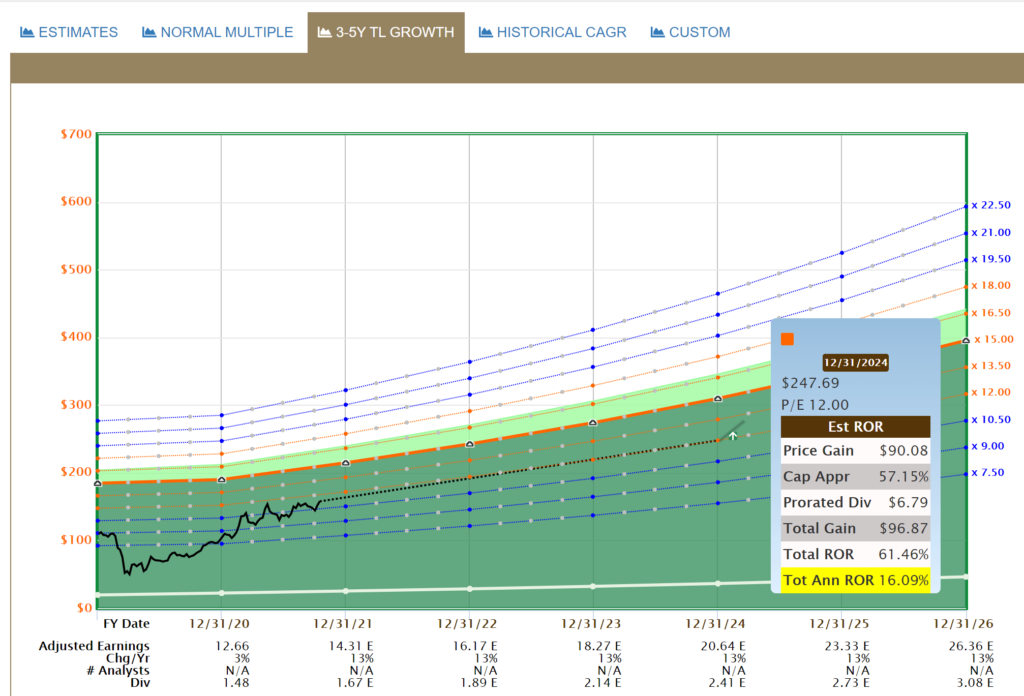

Estimated Earnings:

Comments:

We are going to use a different way of forecasting for EQB than we have used for some of the other stocks we have analyzed. The reason is that EQB has been accelerating its earnings growth over the last few years and the historical P/E is becoming less relevant. In this example we use the ‘3-5Y TL Growth’ or Trend Line Growth. With a historical 13% earnings growth rate over this period we can see that the stock should be valued at a higher multiple (P/E).

EQB’s ‘Blended P/E’ is 11.29. Blended P/E is based upon a weighted average of the most recent actual value and the closest forecast value. It appears that EQB will demand a higher multiple going forward from the market which makes the price today a sensible entry point using this forecasting methodology.

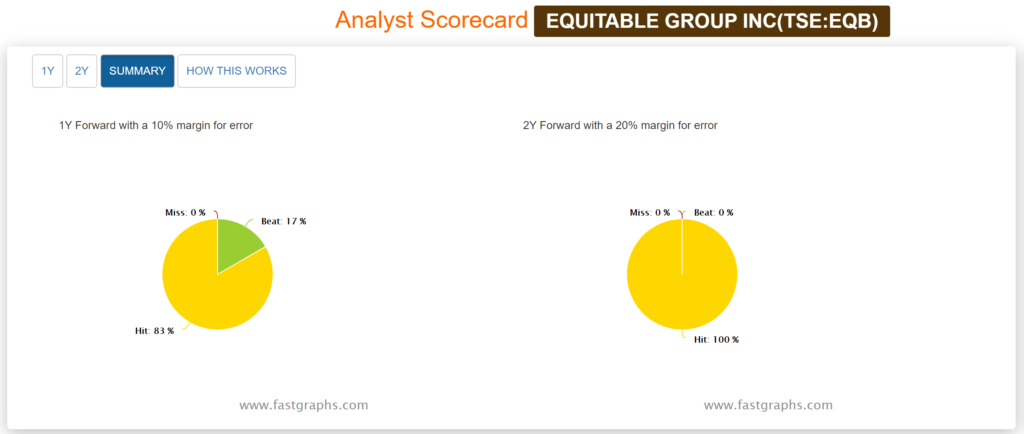

Analyst Scorecard:

Comments:

Analyst estimates over the years are quite accurate based on one and two-year earnings projections. Analysts projections have hit or beat 100% of the time on one and two year estimates.

Recent Earnings Report-Q2 2021:

Q2 Net Earnings $70.8 million, +$18.3 million or +35% from 2020

- Q2 diluted EPS $4.05, +33% from Q2 2020

ROE 16.5% with $100 million in Excess Capital

- Q2 ROE towards high end of 15-17% target, and 1.8% better than 14.7% in Q2 2020

- CET1 14.4% vs. mid-point target of 13.5%, or excess capital of nearly $6 per share

- Efficiency remaining in target range of 39-41% at 40.9% in Q2 and 39.6% YTD

Book Value Surpasses $100 per share

- Book value +20% y/y to $101.94 per share and +$4.08 or +4% from Q1 2021

Customers and Digital – Growing & Deepening

- Now serving nearly 300,000 Canadians, with EQ Bank digital customers +79% y/y to 222,000 and deposits +99% y/y to over $6.5 billion

- Digital transactions +101% y/y, average products per customer +44%, customer lifetime value more than 10 times higher than account acquisition costs

Conventional Lending Driving Asset Growth

- Loans under management +9% y/y to $35.4 billion

- Single family alternative loan originations +200% y/y to $1.8 billion, reverse mortgage originations +318% y/y to $45 million, and Commercial loan originations +16% y/y to $0.7 billion

“Earlier this year, we significantly upgraded our growth forecast and in so doing, challenged ourselves to do more for customers, partners, and shareholders. Through Q2, Equitable delivered to this guidance. On the strength of great execution by our team and meaningful innovations in our challenger bank services, each area of the Bank registered growth. EQ Bank deposits grew 99% over 2020 to a record $6.5 billion, an indication that digital services like our new US Dollar Account are driving the kind of change that enriches the lives of our customers. This past quarter was also an excellent illustration of how we’re positioning to drive future earnings, with double-digit loan origination growth reflecting strong contributions from alternative single family, reverse mortgages, Cash Surrender Value lines of credit and conventional commercial loans where Equitable stands out for responsive service, effective underwriting, and risk management. For shareholders, Q2 featured record earnings, high ROE, and an industry best efficiency ratio, even as we purposely drive higher investment to seed future growth. With the tailwinds of an improving economy and the positive impact of service expansions, Equitable is in a great position to realize its objectives this year and beyond, on behalf of almost 300,000 customers, our valued shareholders, and business partners,” said Andrew Moor, President and Chief Executive Officer.

Summary:

Equitable Group Inc. (EQB) checks a lot of the boxes that dividend growth investors look for in a quality candidate; above average dividend and price growth over the last decade, low payout ratio with estimated double-digit growth ahead. Throw in a 2:1 stock split recently announced (Oct. 5) and you have a compelling case for an investment.

The only caveat is that EQB is not covered by any of the third-party services we subscribe to, so it is hard to get a complete read on the ‘quality’ of this business. The market cap (~2.7B) is a little lower than we would like to see for a core position.

Retirees may not find today’s starting yield appealing but investors with a longer-term horizon may want to consider adding a smaller position to their low yield/high growth category.