Posted by BM on August 15, 2021

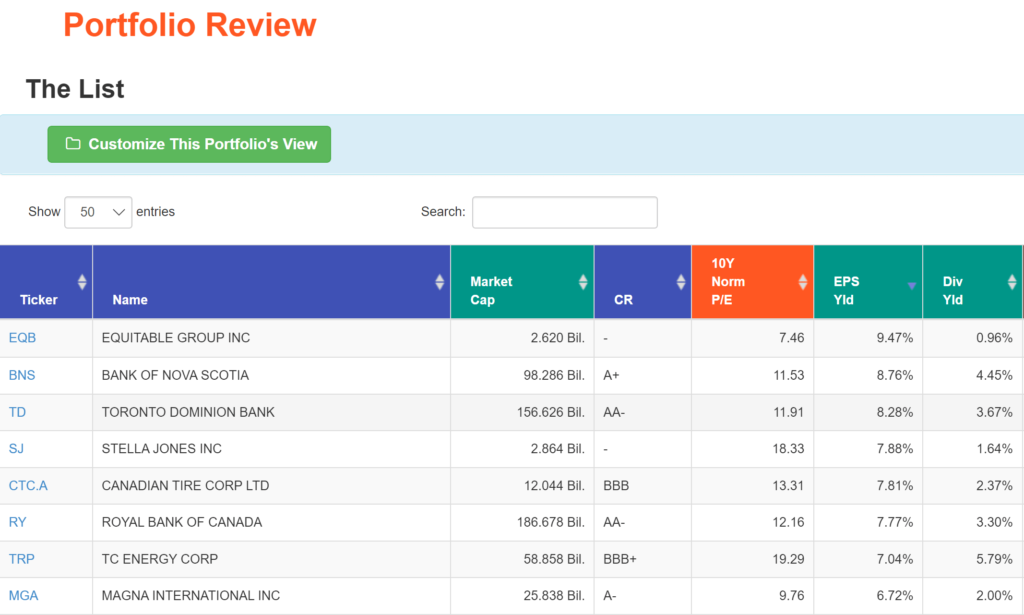

Each month I will walk through our valuation process using a stock on ‘The List’ that meets our minimum screen of 6.5% EPS Yld. This month it is Toronto Dominion Bank (TD-T).

Valuation is the second step in our three-step process. Buying when our quality stocks are sensibly priced will help ensure our future investment returns meet our expectations. We rely heavily on the fundamental analyzer software tool (FASTgraphs) to help us understand the fundamentals of the stocks we invest in and then read the company’s website for investor presentations and recent earnings reports to learn more.

Intro:

The Toronto-Dominion Bank (the Bank) operates as a bank in North America. The Company’s segments include Canadian Retail, U.S. Retail, Wholesale Banking and corporate. Canadian Retail segment serves customers in the Canadian personal and commercial banking, wealth, and insurance businesses. Personal Banking provides financial products and advice through its network of automated teller machines (ATM), telephone, digital and mobile banking. U.S. Retail comprises the Bank’s personal and business banking operations under the brand TD Bank and wealth management in the United States. Wholesale Banking offers a range of capital markets and corporate and investment banking services, including underwriting and distribution of new debt and equity issues, providing advice on strategic acquisitions and divestitures, and meeting the daily trading, funding, and investment needs of its clients.

TD is Canada’s second largest bank by market cap. Right behind Royal Bank.

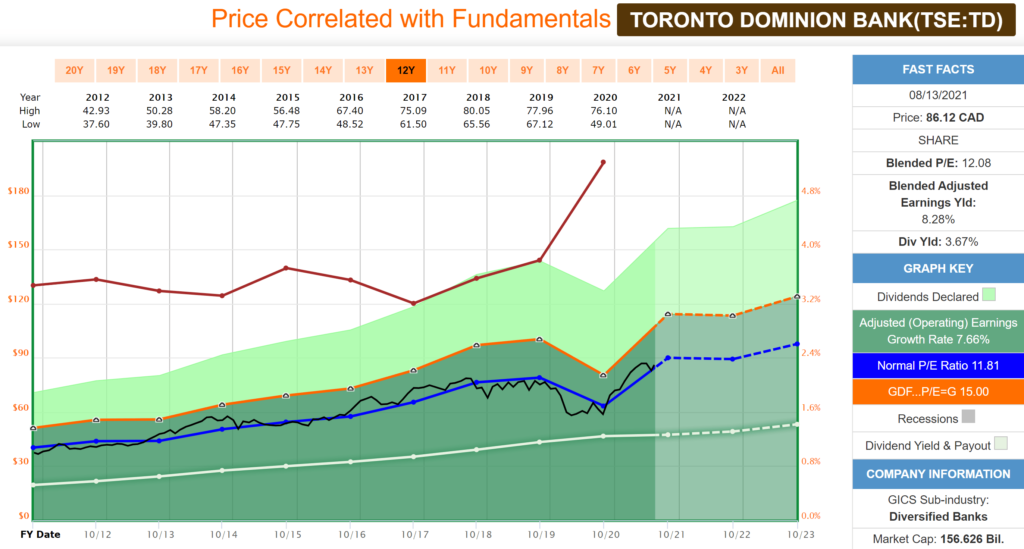

Historical Graph:

Comments:

Toronto Dominion tracks its average P/E very closely. As you can see from the Blue Line on the graph (Average P/E) and the Black Line (Price), there is typically very little variance. Investment opportunities occur when the Black Line falls below the Blue Line with this quality dividend grower. It’s dividend yield (~3.7%) and payout ratio (~40%) are both close to their averages over time, which gives us some comfort with the safety of the dividend at the current price.

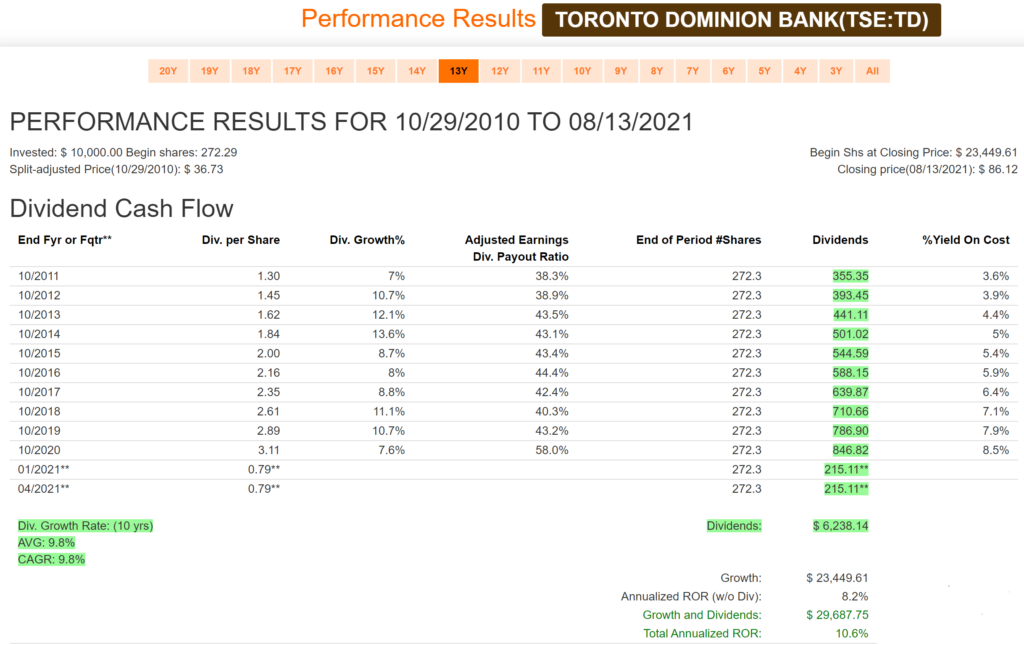

Performance Graph:

Comments:

Toronto Dominion has the best dividend growth rate (9.8%/year) of all the big banks in Canada over the last decade. An above average starting yield with a good dividend growth rate means it doesn’t take long for your income to compound and grow. Cash flow is all important in what we do.

It is relevant to note that the dividend was frozen in 2020 by regulators and TD has yet to announce an increase in 2021.

Note:

Regulators in many regions imposed limits or bans on dividends near the onset of the Covid-19 pandemic, anticipating that the sudden drop in economic activity could lead to cascading loan defaults that would diminish banks’ capital. Canadian lenders, like their U.S. peers, took large provisions for potential losses in the early days of the crisis, but have now returned to higher profit levels.

The Office of the Superintendent of Financial Institutions is expected to lift those restrictions in the second half, which would result in significant dividend hikes at most Big Six banks, according to an analysis by Bloomberg Intelligence.

Source: Bloomberg

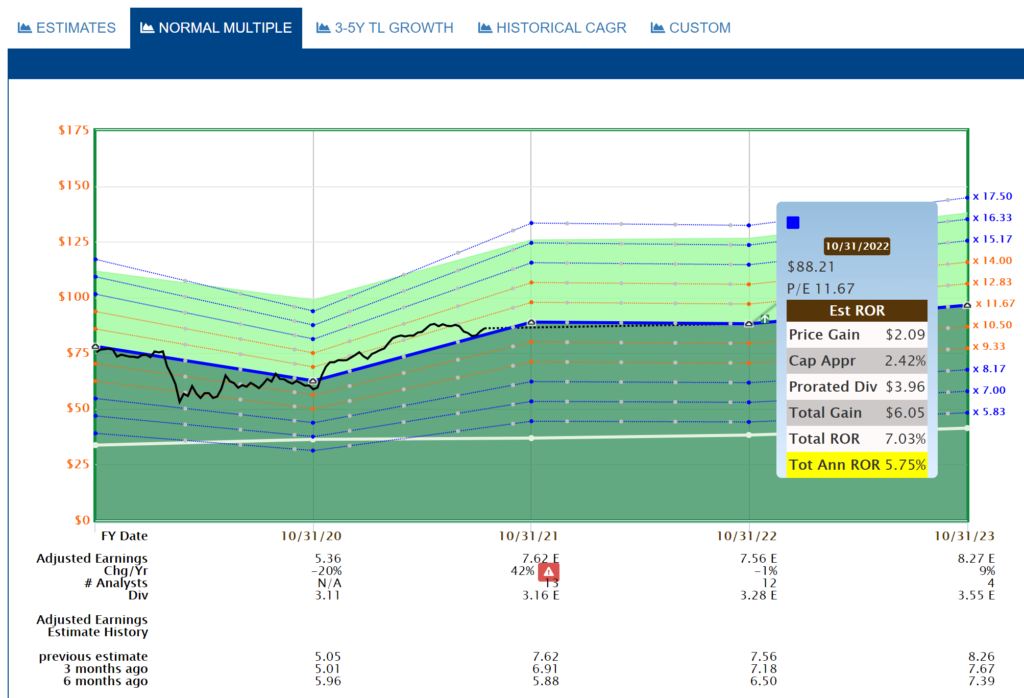

Estimated Earnings:

Comments:

There are ~ twelve analysts covering Toronto Dominion in 2021/2022. Earnings in 2021 are expected to be up significantly over 2020 so this is a bit of an anomaly (Red Triangle). With most of the good news factored in already, analysts don’t see a lot of price appreciation out until the end of 2022.

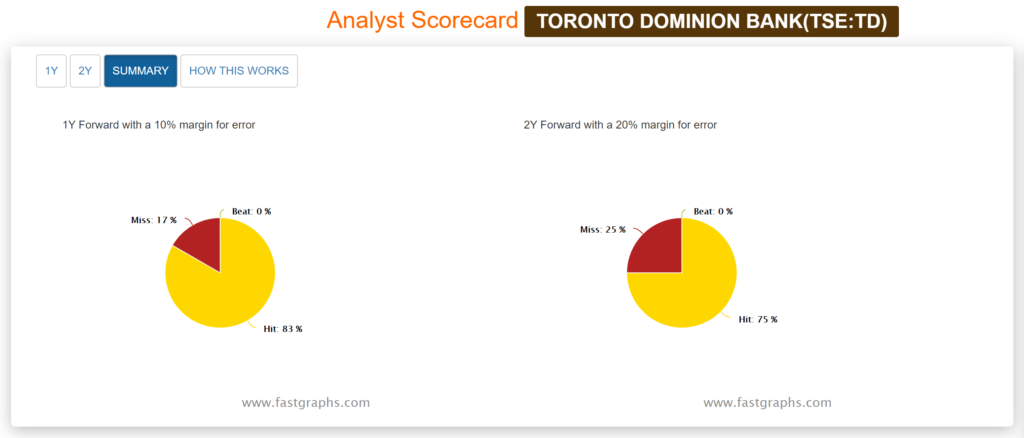

Analyst Scorecard:

Comments:

Analyst estimates over the years are quite accurate based on one and two-year earnings projections. Analysts projections have hit 83% of the time on one year estimates and 75% accuracy on two-year estimates.

Recent Earnings Report-Q2 2021:

Second Quarter Financial Highlights, compared with the second quarter last year:

Reported diluted earnings per share were $1.99, compared with $0.80.

Adjusted diluted earnings per share were $2.04, compared with $0.85.

Reported net income was $3,695 million, compared with $1,515 million.

Adjusted net income was $3,775 million, compared with $1,599 million.

Year-To-Date Financial Highlights, six months ended April 30, 2021, compared with the corresponding period last year:

Reported diluted earnings per share were $3.76, compared with $2.42.

Adjusted diluted earnings per share were $3.86, compared with $2.51.

Reported net income was $6,972 million, compared with $4,504 million.

Adjusted net income was $7,155 million, compared with $4,671 million.

“TD reported strong results in the second quarter, reflecting the underlying strength of our diversified businesses, improving economic conditions and our prudent approach to managing risk,” said Bharat Masrani, Group President and CEO, TD Bank Group. “We continued to invest in our people, capabilities and technology to position our business for growth as economies re-open and consumer and business activity recovers.”

“TD is strong and well-capitalized, and we continue to adapt and grow through this time of disruption. Our performance demonstrates the strength of our proven business model, brought to life through the efforts and resilience of our 90,000 colleagues across the globe who live our purpose and demonstrate a deep commitment to the Bank, those we serve, and the communities where we live and work,” concluded Masrani.

Summary:

The banks have been on fire in the last year with the sector up over 50% from their 2020 lows. Valuation is a bit ‘frothy’ compared to historical norms which limits short term upside on price appreciation. With that said, TD is one of the highest quality (Value Line Financial Rating of ‘A’) dividend growers in Canada with a stellar record of consecutive dividend payments.

“Valuations control long-term returns. The higher the price you pay today for each dollar you expect to receive in the future, the lower the long-term return you should expect from your investment.”

-John Hussman

Toronto Dominion reports it’s Q3 results on August 26, 2021 which will give us a better idea of when dividend increases will resume.