Posted by BM on July 7, 2021

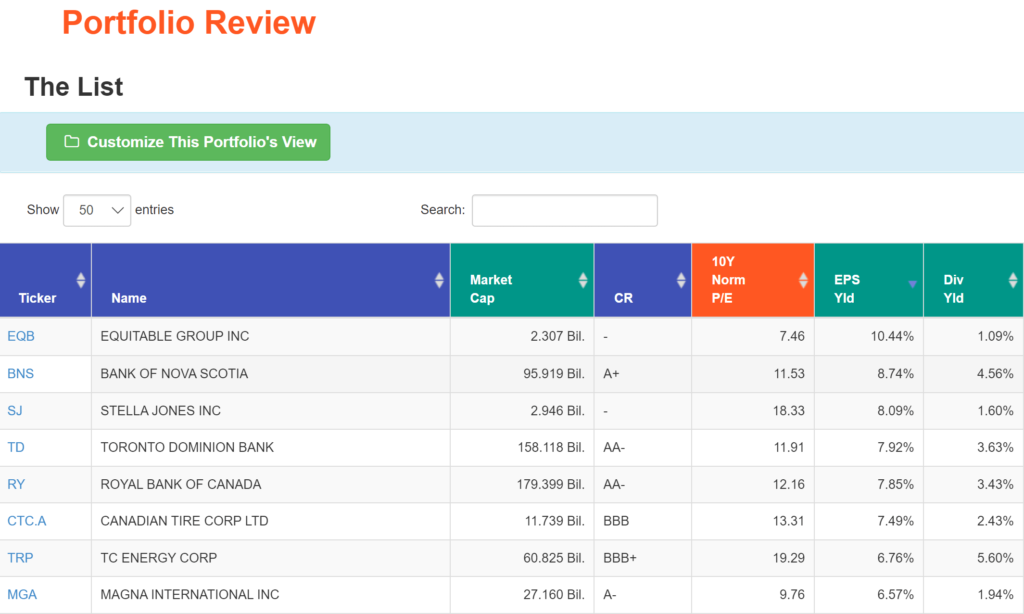

Each month I will walk through our valuation process using a stock on ‘The List’ that meets our minimum screen of 6.5% EPS Yld. This month it is Stella Jones (SJ-T).

Valuation is the second step in our three-step process. Buying when our quality stocks are sensibly priced will help ensure our future investment returns meet our expectations. We rely heavily on the fundamental analyzer software tool (FASTgraphs) to help us understand the fundamentals of the stocks we invest in and then read the company’s website for investor presentations and recent earnings reports to learn more.

Intro:

Stella-Jones Inc. is a Canada-based company that is focused on producing industrial pressure-treated wood products. The Company operates through two segments: pressure-treated wood and logs and lumber. The pressure-treated wood segment includes railway ties, utility poles, residential lumber and industrial products. The logs and lumber segment comprise of the sales of logs harvested in the course of the Company’s procurement process that are determined to be unsuitable for use as utility poles. Also included in this segment is the sale of excess lumber to local home-building markets. Its Operating plants are located in approximately six Canadian provinces and nineteen American states. The Company also operates a distribution network across North America. The Company also provides customized services, such as pre-plating, pre-boring, railway crossing panels, end-plating and bridge timbers to specification.

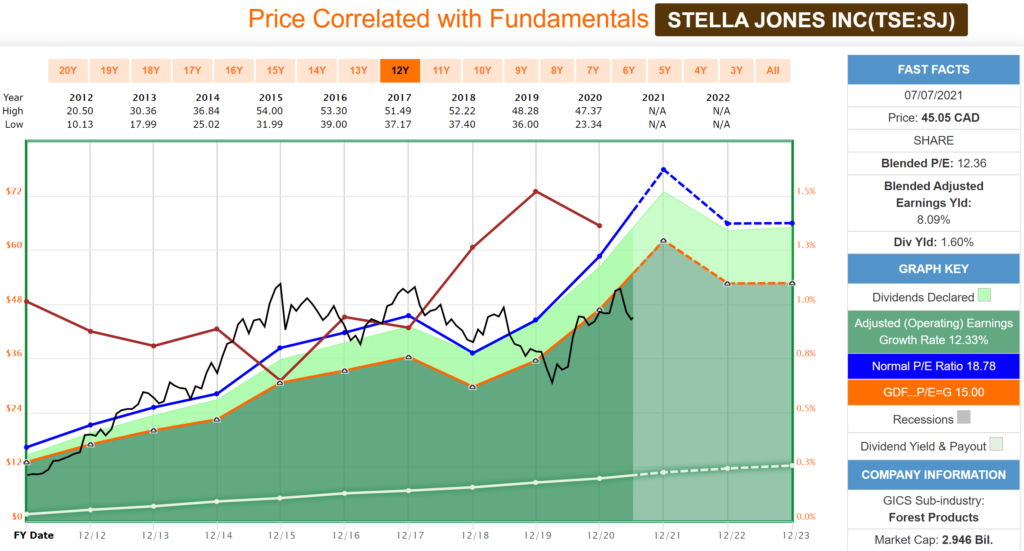

Historical Graph:

Comments:

Stella Jones typically trades in a ‘valuation corridor’ between a 15 and 20 P/E. Investment opportunities when the price (Black Line) is under the 15 P/E line (Orange Line), where it is now, are rare. The Red Line is the dividend yield and we can see that Stella Jones is currently offering one of its highest starting yields in a decade. The low payout ratio signified by the White Line is quite low as well which gives us some comfort knowing our dividend is safe from any short-term market pressures.

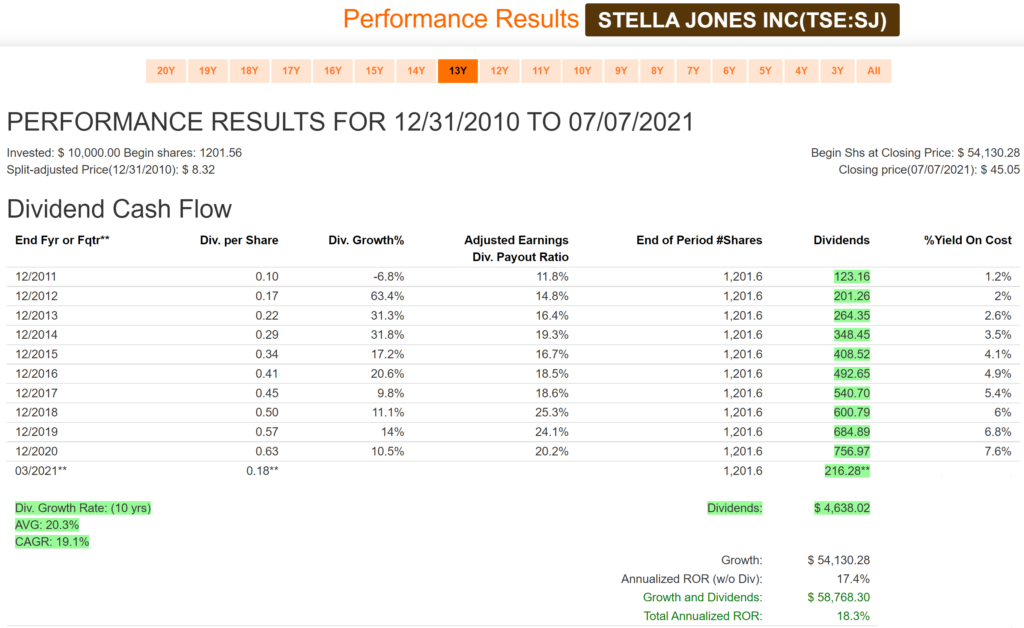

Performance Graph:

Comments:

Stella Jones has an excellent dividend growth record averaging over 20% per year over the last ten years. Although the starting yield is low you can see how quickly your yield on cost can grow and provide you with growing income. The annualized rate of return (ROR) of 18.3% is excellent as well and seems to align nicely with dividend growth. Another example of ‘as the dividend grows so does the price’.

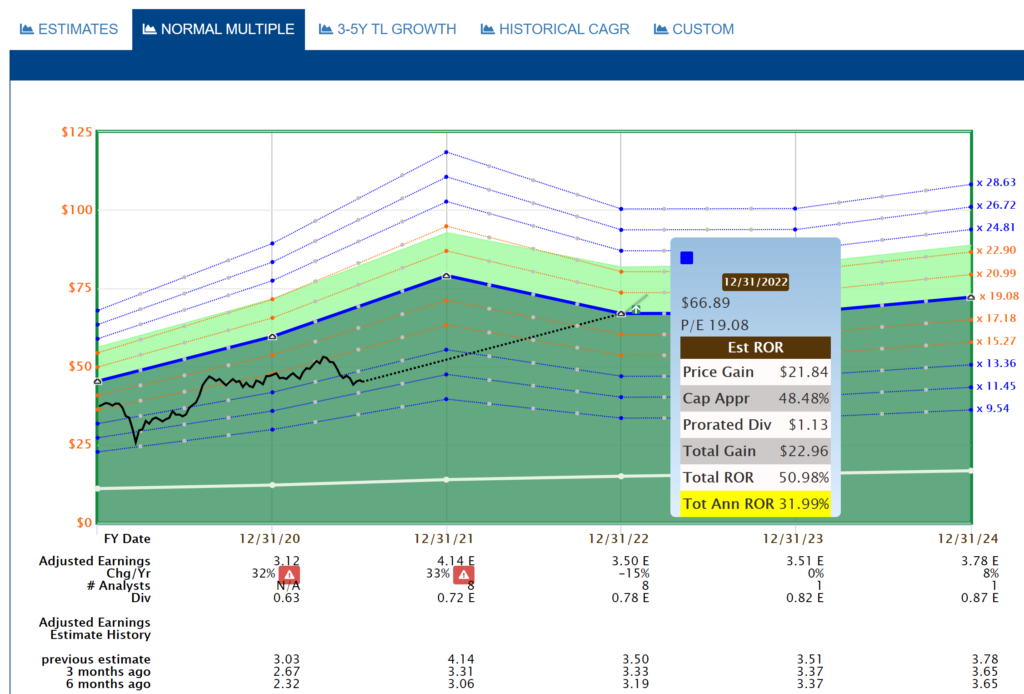

Estimated Earnings:

Comments:

There are eight analysts covering Stella Jones and the earnings estimates are being revised upwards from both three months and six months ago. This is a positive sign. When we project out to the end of 2022 you can see analysts are expecting an annual return of 31.99% on a purchase at today’s price.

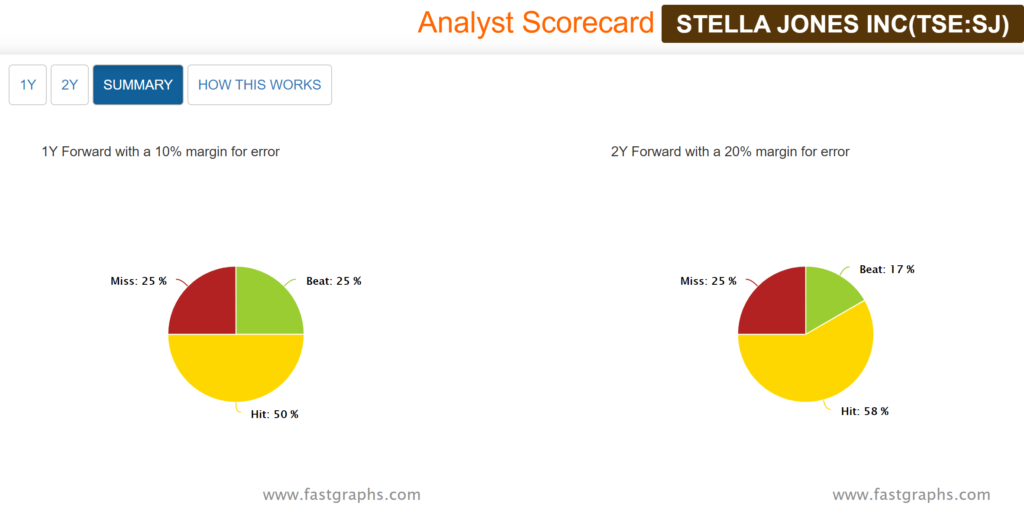

Analyst Scorecard:

Comments:

Analyst estimates over the years are quite accurate based on one and two-year earnings projections. Analysts projections have either hit or beat 75% of the time on one and two-year estimates.

Recent Earnings Report-Q1 2021:

Montreal, Quebec – May 3, 2021 – Stella-Jones Inc. (TSX: SJ) (“Stella-Jones” or the “Company”) today announced financial results for its first quarter ended March 31, 2021.

- Sales increased 23% to a first quarter record of $623 million

- EBITDA rose 57% to $99 million, or a margin of 15.9%

- Net income doubled to reach $56 million or $0.85 per share

- Solid financial position with a net debt-to-EBITDA ratio of 2.2x

- Annual 2021 EBITDA guidance raised to $450 to $480 million

- Entered into a new senior unsecured credit agreement of up to US$350 million, subsequent to quarter-end

“We had an exceptionally robust start to the year, continuing our momentum of growth. Our first quarter performance was fueled by record pricing and volume gains in the residential lumber product category, solid utility poles results, and strong railway ties demand tempered by pricing pressures in certain markets. EBITDA grew by 57% to an all-time first quarter high of $99 million and net income doubled to $56 million compared to the same period last year,” stated Éric Vachon, President and CEO of Stella-Jones.

“In anticipation of continued strong market conditions for residential lumber and solid demand in the other core product categories, we leveraged our healthy balance sheet this quarter to increase working capital and invest in our network. In April, we increased our available liquidity with a new senior unsecured credit facility, further enhancing our financial flexibility. Together with our resilient business model and solid competitive position, we are well positioned to take advantage of the momentum in demand, create opportunities to grow our core businesses and deliver EBITDA in the mid-to-high $400 million range in 2021,” concluded Mr. Vachon.

Updated Outlook

The Company’s financial outlook provided in the MD&A for the year ended December 31, 2020 is updated to reflect the strong quarterly performance, largely attributable to the unprecedented rise in the market price of lumber, and the expectation that the higher levels of pricing for lumber will continue to favorably impact the profitability of the residential lumber product category during the seasonal peak demand period.

Stella-Jones is now targeting to deliver EBITDA in the range of $450 to $480 million in 2021, up from the previously disclosed guidance of $385 to $410 million. This updated guidance anticipates a reduction of approximately $90 million in sales from the depreciation of the value of the U.S. dollar relative to the Canadian dollar to C$1.27 per U.S. dollar.

Excluding the impact of the currency conversion, the Company is projecting 2021 sales growth of 15% to low 20% range compared to 2020. The projected 2021 sales for utility poles, railways ties and industrial products remain unchanged. Utility poles sales are expected to increase in the mid to high-single digit range compared to 2020, due to sustained healthy replacement demand, including an increase in value-added fire-resistant wrapped pole sales, while railway ties and industrial product sales are projected to be relatively comparable to those generated in 2020. For residential lumber, sales are now forecasted to increase in the range of 45% to 65% compared to 2020, driven by the current trend of higher pricing, which is projected to continue during the seasonal peak demand period for this product category.

Summary:

There is a lot to like about Stella Jones right now from a valuation standpoint. Definitely a company dividend growth investors should be paying close attention to given its recent price weakness.