Last updated by BM on July 8, 2024

Summary

This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Timely Ten: Patience is paying off as half ‘The List’ signals undervaluation in this week’s newsletter.

- Last week, dividend growth of ‘The List’ stayed the course and has increased by +8.8% YTD (income).

- Last week, the price of ‘The List’ was up with a return of +4.6% YTD (capital).

- Last week, there were no dividend announcements from companies on ‘The List’.

- Last week, there were no earnings reports from companies on ‘The List’.

- This week, no companies on ‘The List’ are due to report earnings.

DGI Clipboard

“Current yield, using its own historic yield as a guide, is, in my view, a fine valuation measure.”

– Tom Connolly

Timely Ten: Patience is paying off as half ‘The List’ signals undervaluation

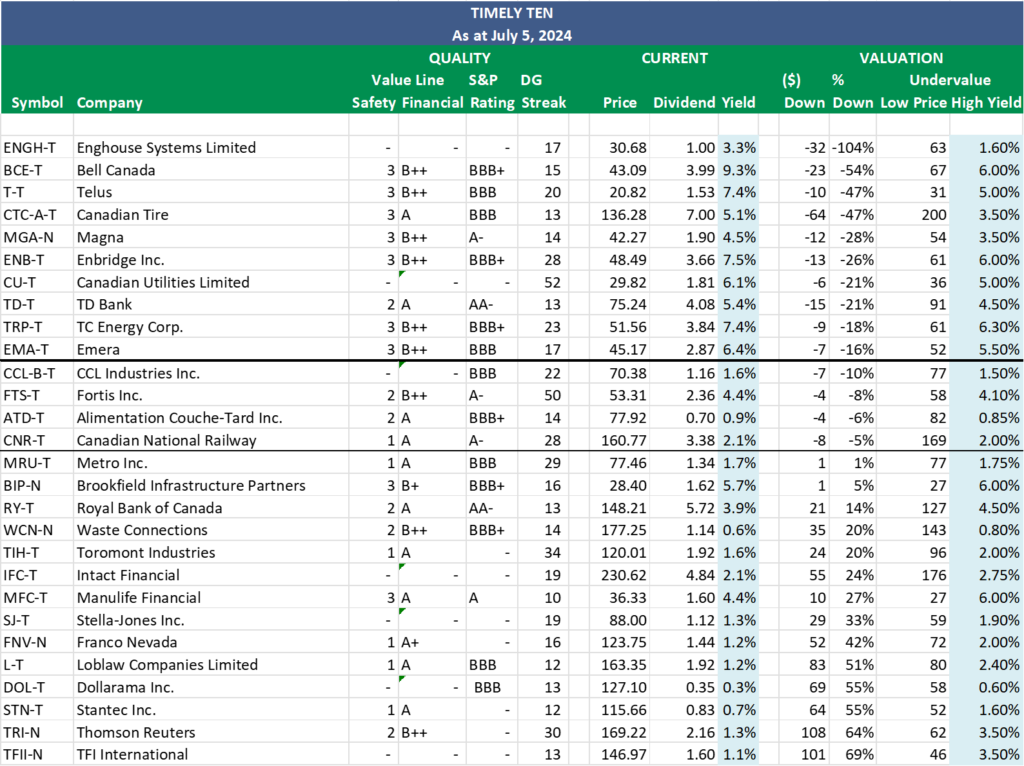

It’s been a few months since we last reviewed our ‘Timely Ten’ dividend growth stocks. For those new to the blog, these are the ten most undervalued stocks on ‘The List,’ determined by one of our key valuation metrics, dividend yield theory.

This latest update of the ‘Timely Ten’ reveals a fascinating trend: a significant number of companies from ‘The List’ are signalling undervaluation. Fourteen stocks meet the criteria based on dividend yield theory—representing half of the companies on ‘The List.’ Even more encouraging, some of our highest-quality companies are now meeting our threshold, making our investment decisions even more straightforward.

Here’s a recap on how we select our ‘Timely Ten’:

Step three in our process involves monitoring our quality dividend growers regularly, which can become quite challenging depending on the number of companies we track. Fortunately, we rely on ‘The List’ instead of the vast array of stocks in the index, which streamlines our task. Nevertheless, we continually seek methods to enhance our efficiency. Through dividend yield theory, we’ve discovered an approach that has proven remarkably effective in aiding us with our efforts over the years.

Dividend yield theory is a simple and intuitive approach to valuing dividend growth stocks. It suggests that the dividend yield of quality dividend growth stocks tends to revert to the mean over time, assuming that the underlying business model remains stable. In practical terms, if a stock pays a dividend yield above its ten-year average annual yield, its price will likely increase to return the yield to its historical average. Knowing that price and yield go in opposite directions, this theory helps us find stocks poised for a positive price correction.

We have pre-screened our candidates using the criteria we initially laid out in building ‘The List’. This helps us considerably narrow the universe of investable stocks.

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Next, we rank ‘The List’ by how significantly each stock is priced below its fair value (Low Price), as calculated using dividend yield theory. To determine fair value, divide the current dividend by what you consider to be the stock’s historically high yield.

All companies above the thin black line have a current price below fair value (sensibly priced). The stocks above the thick black line make up our ‘Timely Ten’.

Always prioritize the ‘quality’ of a company over a ‘sensible price’ when making investment decisions. For more details on stock selection and our quality indicators, refer to our free sample Business Plan.

If you’re a new investor without any positions in the ‘Timely Ten’, now is the time to start your research and get to work.

DGI Scorecard

The List (2024)

The Magic Pants 2024 list includes 28 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from ‘The List’ annually on January 1. Prices and dividends are updated weekly.

While ‘The List’ is not a standalone portfolio, it functions admirably as an initial guide for those seeking to broaden their investment portfolio and attain superior returns in the Canadian stock market. Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our Canadian dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

For those interested in something more, please upgrade to a paid subscriber; you get the enhanced weekly newsletter, access to premium content, full privileges on the new Substack website magicpants.substack.com and DGI alerts whenever we make stock transactions in our model portfolio.

Performance of ‘The List’

Last week, dividend growth of ‘The List’ stayed the course and has now increased by +8.8% YTD (income).

Last week, the price return of ‘The List’ was up with a return of +4.6% YTD (capital).

Even though prices may fluctuate, the dependable growth in our income does not. Stay the course. You will be happy you did.

Last week’s best performers on ‘The List’ were Franco Nevada (FNV-N), up +4.41%; Brookfield Infrastructure Partners (BIP-N), up +3.50%; and Loblaw Companies Limited (L-T), up +2.93%.

Bell Canada (BCE-T) was the worst performer last week, down -2.75%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $77.92 | 1.5% | $0.70 | 17.4% | 14 |

| BCE-T | Bell Canada | 9.3% | $43.09 | -20.5% | $3.99 | 3.1% | 15 |

| BIP-N | Brookfield Infrastructure Partners | 5.7% | $28.40 | -7.5% | $1.62 | 5.9% | 16 |

| CCL-B-T | CCL Industries Inc. | 1.6% | $70.38 | 21.7% | $1.16 | 9.4% | 22 |

| CNR-T | Canadian National Railway | 2.1% | $160.77 | -3.7% | $3.38 | 7.0% | 28 |

| CTC-A-T | Canadian Tire | 5.1% | $136.28 | -1.7% | $7.00 | 1.4% | 13 |

| CU-T | Canadian Utilities Limited | 6.1% | $29.82 | -7.2% | $1.81 | 0.9% | 52 |

| DOL-T | Dollarama Inc. | 0.3% | $127.10 | 33.8% | $0.35 | 29.5% | 13 |

| EMA-T | Emera | 6.4% | $45.17 | -11.1% | $2.87 | 3.0% | 17 |

| ENB-T | Enbridge Inc. | 7.5% | $48.49 | 0.2% | $3.66 | 3.1% | 28 |

| ENGH-T | Enghouse Systems Limited | 3.3% | $30.68 | -9.7% | $1.00 | 18.3% | 17 |

| FNV-N | Franco Nevada | 1.2% | $123.75 | 12.4% | $1.44 | 5.9% | 16 |

| FTS-T | Fortis Inc. | 4.4% | $53.31 | -2.8% | $2.36 | 3.3% | 50 |

| IFC-T | Intact Financial | 2.1% | $230.62 | 13.4% | $4.84 | 10.0% | 19 |

| L-T | Loblaw Companies Limited | 1.2% | $163.35 | 27.1% | $1.92 | 10.0% | 12 |

| MFC-T | Manulife Financial | 4.4% | $36.33 | 25.8% | $1.60 | 9.6% | 10 |

| MGA-N | Magna | 4.5% | $42.27 | -23.8% | $1.90 | 3.3% | 14 |

| MRU-T | Metro Inc. | 1.7% | $77.46 | 13.1% | $1.34 | 10.7% | 29 |

| RY-T | Royal Bank of Canada | 3.9% | $148.21 | 11.4% | $5.72 | 7.1% | 13 |

| SJ-T | Stella-Jones Inc. | 1.3% | $88.00 | 14.9% | $1.12 | 21.7% | 19 |

| STN-T | Stantec Inc. | 0.7% | $115.66 | 10.5% | $0.83 | 7.8% | 12 |

| T-T | Telus | 7.4% | $20.82 | -12.2% | $1.53 | 7.1% | 20 |

| TD-T | TD Bank | 5.4% | $75.24 | -11.2% | $4.08 | 6.3% | 13 |

| TFII-N | TFI International | 1.1% | $146.97 | 12.0% | $1.60 | 10.3% | 13 |

| TIH-T | Toromont Industries | 1.6% | $120.01 | 6.4% | $1.92 | 11.6% | 34 |

| TRI-N | Thomson Reuters | 1.3% | $169.22 | 18.1% | $2.16 | 10.2% | 30 |

| TRP-T | TC Energy Corp. | 7.4% | $51.56 | -1.4% | $3.84 | 3.2% | 23 |

| WCN-N | Waste Connections | 0.6% | $177.25 | 19.6% | $1.14 | 8.6% | 14 |

| Averages | 3.5% | 4.6% | 8.8% | 21 |

Note: Stocks ending in “-N” declare earnings and dividends in US dollars. To achieve currency consistency between dividends and share price for these stocks, we have shown dividends in US dollars and share price in US dollars (these stocks are listed on a US exchange). The dividends for their Canadian counterparts (-T) would be converted into CDN dollars and would fluctuate with the exchange rate.

Check us out on magicpants.substack.com for more info in this week’s issue….