Last updated by BM on March 4, 2024

Summary

This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Last week, ‘The List’ was down from the previous week with a YTD price return of +3.8% (capital). Dividends were up and have increased by +6.8% YTD, highlighting the dependable growth in our income.

- Last week, there were two dividend announcements from companies on ‘The List’.

- Last week, there were six earnings reports from companies on ‘The List’.

- One company on ‘The List’ are due to report earnings this week.

DGI Scorecard

The List (2024)

The Magic Pants 2024 list includes 28 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies on ‘The List’ are added or removed annually on Jan. 1. Prices and dividends are updated weekly.

While ‘The List’ is not a standalone portfolio, it functions admirably as an initial guide for those seeking to broaden their investment portfolio and attain superior returns in the Canadian stock market. Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our Canadian dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

For those interested in something more, please upgrade to a paid subscriber; you get the enhanced weekly newsletter, access to premium content, full privileges on the new Substack website magicpants.substack.com and DGI alerts whenever we make stock transactions in our model portfolio.

Performance of ‘The List’

Last week, ‘The List’ was down from the previous week with a YTD price return of +3.8% (capital). Dividends were up and have increased by +6.8% YTD, highlighting the dependable growth in our income.

The best performers last week on ‘The List’ were Enghouse Systems Limited (ENGH-T), up +2.08%; CCL Industries Inc. (CCL-B-T), up +1.15%; and Canadian Utilities Limited (CU-T), up +0.68%.

Stella-Jones Inc. (SJ-T) was the worst performer last week, down -7.52%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $84.02 | 9.5% | $0.70 | 17.4% | 14 |

| BCE-T | Bell Canada | 8.0% | $50.15 | -7.4% | $3.99 | 3.1% | 15 |

| BIP-N | Brookfield Infrastructure Partners | 4.4% | $29.02 | -5.4% | $1.62 | 5.9% | 15 |

| CCL-B-T | CCL Industries Inc. | 1.7% | $69.73 | 20.6% | $1.16 | 9.4% | 22 |

| CNR-T | Canadian National Railway | 1.9% | $176.69 | 5.9% | $3.38 | 7.0% | 28 |

| CTC-A-T | Canadian Tire | 5.1% | $138.23 | -0.3% | $7.00 | 1.4% | 13 |

| CU-T | Canadian Utilities Limited | 5.8% | $30.99 | -3.5% | $1.79 | 0.0% | 52 |

| DOL-T | Dollarama Inc. | 0.3% | $104.26 | 9.7% | $0.28 | 5.8% | 13 |

| EMA-T | Emera | 6.0% | $47.90 | -5.7% | $2.87 | 3.0% | 17 |

| ENB-T | Enbridge Inc. | 7.8% | $47.19 | -2.5% | $3.66 | 3.1% | 28 |

| ENGH-T | Enghouse Systems Limited | 2.5% | $35.85 | 5.5% | $0.88 | 4.1% | 17 |

| FNV-N | Franco Nevada | 1.3% | $106.99 | -2.9% | $1.44 | 5.9% | 16 |

| FTS-T | Fortis Inc. | 4.5% | $52.28 | -4.7% | $2.36 | 3.3% | 50 |

| IFC-T | Intact Financial | 2.1% | $227.52 | 11.9% | $4.84 | 10.0% | 19 |

| L-T | Loblaw Companies Limited | 1.2% | $145.13 | 12.9% | $1.78 | 2.4% | 12 |

| MFC-T | Manulife Financial | 4.9% | $32.38 | 12.1% | $1.60 | 9.6% | 10 |

| MGA-N | Magna | 3.4% | $54.05 | -2.6% | $1.84 | 0.0% | 14 |

| MRU-T | Metro Inc. | 1.8% | $73.45 | 7.2% | $1.34 | 10.7% | 29 |

| RY-T | Royal Bank of Canada | 4.2% | $131.94 | -0.8% | $5.52 | 3.4% | 13 |

| SJ-T | Stella-Jones Inc. | 1.5% | $72.82 | -4.9% | $1.12 | 21.7% | 19 |

| STN-T | Stantec Inc. | 0.7% | $110.78 | 5.8% | $0.83 | 7.8% | 12 |

| T-T | Telus | 6.3% | $23.83 | 0.5% | $1.50 | 5.2% | 20 |

| TD-T | TD Bank | 5.0% | $81.31 | -4.0% | $4.08 | 6.3% | 13 |

| TFII-N | TFI International | 1.1% | $148.37 | 13.1% | $1.60 | 10.3% | 13 |

| TIH-T | Toromont Industries | 1.5% | $125.30 | 11.1% | $1.92 | 11.6% | 34 |

| TRI-N | Thomson Reuters | 1.4% | $159.29 | 11.1% | $2.16 | 10.2% | 30 |

| TRP-T | TC Energy Corp. | 7.1% | $53.92 | 3.1% | $3.84 | 3.2% | 23 |

| WCN-N | Waste Connections | 0.7% | $165.40 | 11.6% | $1.14 | 8.6% | 14 |

| Averages | 3.3% | 3.8% | 6.8% | 21 |

Note: Stocks ending in “-N” declare earnings and dividends in US dollars. To achieve currency consistency between dividends and share price for these stocks, we have shown dividends in US dollars and share price in US dollars (these stocks are listed on a US exchange). The dividends for their Canadian counterparts (-T) would be converted into CDN dollars and would fluctuate with the exchange rate.

DGI Clipboard

“The big money is not in the buying and selling. But in the waiting.”

– Charlie Munger

Dividends: The Silent Wealth Builders

One of the significant challenges I’ve faced while introducing subscribers to dividend growth investing (DGI) is steering them away from the fixation on short-term results to focus on long-term wealth creation.

During the weekend, I distributed the quarterly review of our Magic Pants Wealth-Builder Model Portfolio (CDN) to our paid subscribers. This portfolio aligns with the business plan we introduced to these subscribers in May 2022, outlining our approach to creating and managing a dividend growth portfolio.

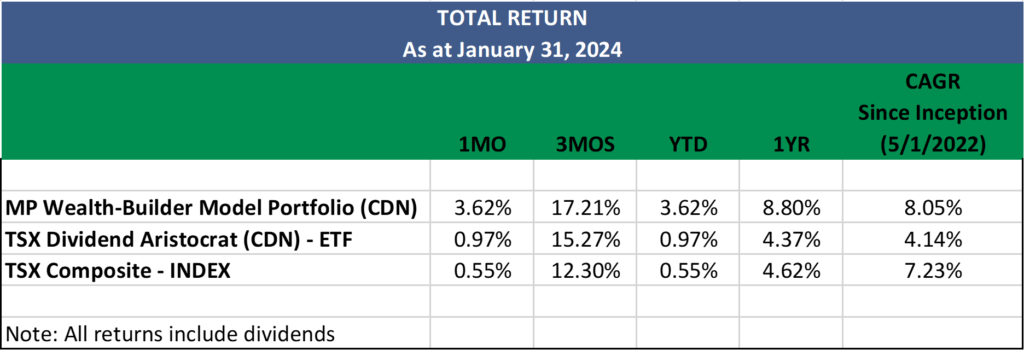

Below are a couple of charts and excerpts from the review demonstrating the success of our process and how wealth-building works.

Note: Total return is calculated using the ‘Modified Dietz Return,’ which considers the timing of cash inflows and outflows (including dividends). Cash that is yet to be deployed (as per the business plan) is not included in this calculation.

Our overall returns continue to outperform the more ‘passive’ benchmarks. We cautioned our paid subscribers against becoming overly fixated on the ups and downs of individual trades. Instead, we asked them to look deeper into the numbers and begin to see the gradual accumulation of wealth.

During the quarter, every company in our model portfolio announced a dividend increase; there will be more in 2024.

Waste Connections (WCN-T) .255 to .285, up 11.76%, payable on November 28, 2023

Fortis Inc. (FTS-T) .565 to .59, up 4.42%, payable on December 1, 2023

Alimentation Couche-Tard (ATD-T) .14 to .175, up 25.0%, payable on December 21, 2023

Telus (T-T) .3636 to .3761, up 3.4%, payable January 2, 2024

TFI International (TFII-N) .35 to .40, up 14%, payable on January 15, 2024

TD Bank (TD-T) .96 to 1.02, up 6.3%, payable January 31, 2024

Royal Bank of Canada (RY-T) 1.35 to 1.38, up 2.0%, payable February 23, 2024

Metro Inc. (MRU-T) .3025 to .3350, up 10.7%, payable March 05, 2024

Magna (MGA-N) .46 to .475, up 3.3%, payable March 8, 2024

Canadian National Railway (CNR-T) .79 to .845, up 7%, payable March 28, 2024

Franco Nevada (FNV-T) .34 to .36, up 5.88%, payable March 28, 2024

CCL Industries (CCL-B-T) .265 to .29, up 9.4%, payable March 28, 2024

TC Energy Corp. (TRP-T) .93 to .96, up 3.2%, payable April 30, 2024

Toromont Industries (TIH-T) .43 to .48, up 11.6%, payable April 4, 2024

Bell Canada (BCE-T) .9675 to .9975, up 3.1%, payable April 15, 2024

There are two takeaways from this chart. First, regardless of what the stock market is doing, our strategy produces – we are receiving dividends, and our dividends are growing. Our average starting yield of 3.50% grew to 3.76% on our original investments. Projecting this growth forward, we will beat the market from dividend return alone within the decade.

Secondly, as yields build, our companies become more valuable. With average dividend growth already at 10% and average price growth at 3%, the price has some catching up to do. This is where we sit tight, as we know the price growth will eventually track the dividend growth.

Capital growth (prices) driven by income growth (dividends) is the wealth-building we are talking about, and it happens all because of the dividends.

Most people (Advisors included) have still not made the connection between dividends and capital gains. Uncle Charlie was right, the big money is yet to come.

Check us out on magicpants.substack.com for more info in this week’s issue….