MP Market Review – March 28, 2024

Last updated by BM on April 1, 2024

Summary

This is a weekly installment of our MP Market Review series, which provides updates on the financial markets and Canadian dividend growth companies we monitor on ‘The List’.

- Find out how to beat the Taxman and put more money in your pocket.

- Last week, dividend growth stayed the same and has increased by +7.4% YTD, highlighting the dependable growth in our income.

- The YTD price return of ‘The List’ was up from the previous week with a return of +4.3% (capital).

- Last week, there were no dividend announcements from companies on ‘The List’.

- Last week, there were no earnings reports from companies on ‘The List’.

- One company on ‘The List’ is due to report earnings this week.

DGI Clipboard

“It’s not enough to be smart about investing; you also need to be smart about taxes.”

– Joel Greenblatt

Beating the Taxman: How Dividend Growth Investing (DGI) Saves You Money

Understanding the Tax Advantages of Dividend Growth Investing

As savvy investors, our goal is to achieve our investment objectives and maximize our post-tax returns. One effective strategy is investing in dividend-paying companies that offer capital gains and tax benefits.

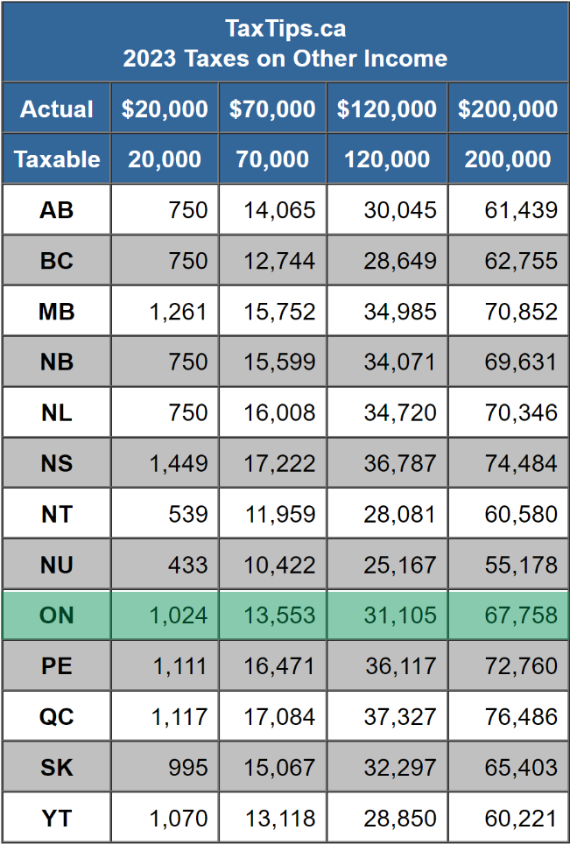

In Canada, dividends from these companies are taxed more favourably thanks to the dividend tax credits available at both federal and provincial levels. These credits prevent double taxation since the dividends are paid from the company’s after-tax profits. As a result, these credits often surpass the tax benefits associated with other investment returns.

How Dividends are Taxed

When a company pays you a dividend, it distributes after-tax profits, meaning shareholders like you shouldn’t be taxed again on this income. To address this, the government uses a specific formula to calculate taxes on eligible dividends, effectively avoiding double taxation. This process involves grossing up your eligible dividend income by 1.38 to align with the correct tax bracket, followed by applying for the dividend tax credits, significantly reducing the amount of tax owed.

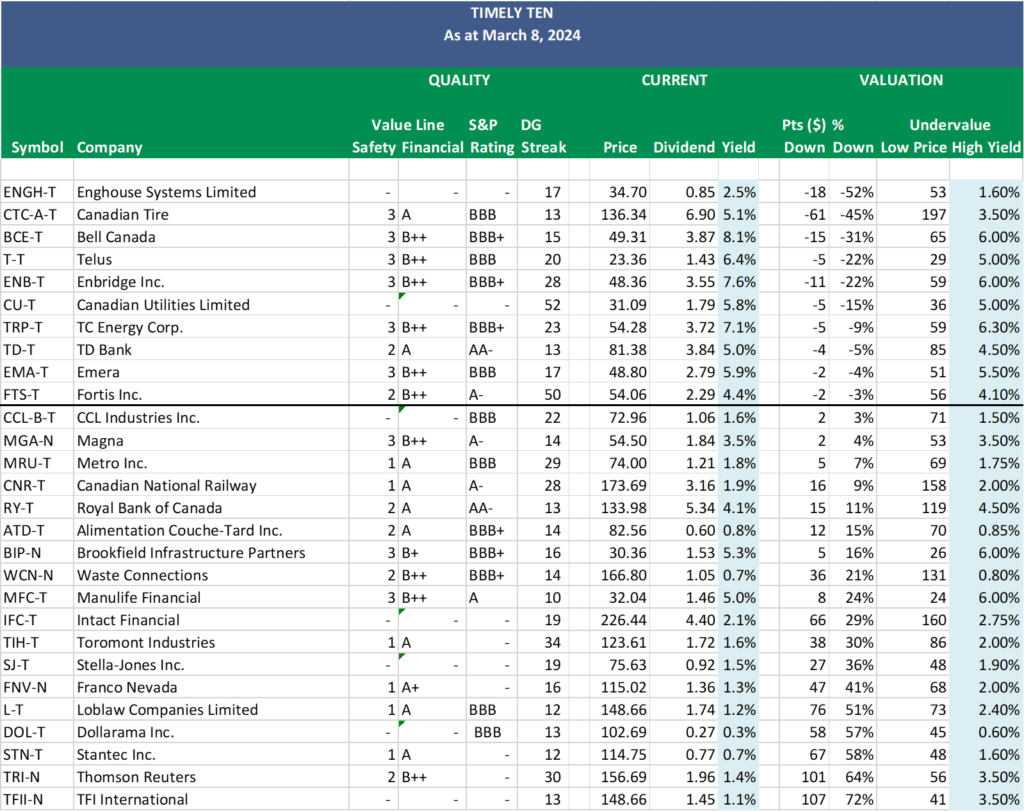

The two charts below show the taxes paid (highlighted in green) on four actual before-tax incomes, demonstrating how much more money you can keep in your pocket when investing in dividend-paying companies compared to other forms of income.

Source: Taxtips.ca

Visualizing the Savings

The accompanying charts illustrate the tax differences on four hypothetical incomes, highlighting the substantial savings when earning from dividend-paying companies compared to other income types like salaries or bonds. For instance, earning $70,000 from eligible Canadian dividends could save you nearly $10,000 in taxes compared to the same amount from other income sources.

Resources for Calculating Your Tax Benefits

For those looking to calculate specific tax scenarios, websites like EY’s Personal Tax Calculator and TaxTips.ca provide valuable tools and comparisons:

- EY Personal Tax Calculator: https://www.eytaxcalculators.com/en/2024-personal-tax-calculator.html

- TaxTips.ca Tax Comparisons: https://www.taxtips.ca/dtc/taxcomparisons/tax-comparison-investments-2023.htm

Long-Term Benefits of DGI

Another advantage of dividend growth investing is the potential to defer taxes on increasing capital through unrealized capital gains while simultaneously earning inflation-protected income. By holding onto high-quality dividend growers for an extended period, you can potentially fund your retirement with tax-efficient dividend income instead of depleting your capital and incurring capital gains taxes.

Conclusion

The tax savings from dividend growth investing are substantial, allowing you to reinvest more or enjoy a financially secure retirement. Smart tax planning is crucial for maximizing investment returns, proving once again that a strategic approach to investing and taxes is essential for long-term success.

DGI Scorecard

The List (2024)

The Magic Pants 2024 list includes 28 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

- Dividend growth streak: 10 years or more.

- Market cap: Minimum one billion dollars.

- Diversification: Limit of five companies per sector, preferably two per industry.

- Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from ‘The List’ annually on January 1. Prices and dividends are updated weekly.

While ‘The List’ is not a standalone portfolio, it functions admirably as an initial guide for those seeking to broaden their investment portfolio and attain superior returns in the Canadian stock market. Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our Canadian dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

For those interested in something more, please upgrade to a paid subscriber; you get the enhanced weekly newsletter, access to premium content, full privileges on the new Substack website magicpants.substack.com and DGI alerts whenever we make stock transactions in our model portfolio.

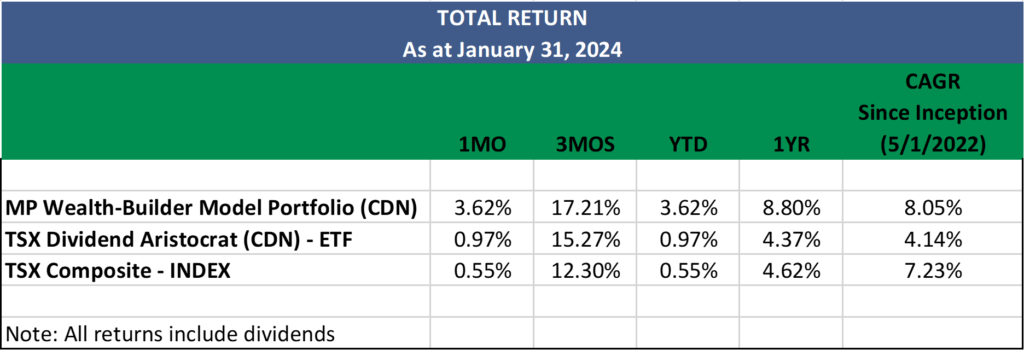

Performance of ‘The List’

Last week, dividend growth stayed the same and has increased by +7.4% YTD, highlighting the dependable growth in our income.

The YTD price return of ‘The List’ was up from the previous week with a return of +4.3% (capital).

Last week’s best performers on ‘The List’ were Brookfield Infrastructure Partners (BIP-N), up +6.12%; Franco Nevada. (FNV-N), up +4.18%; and Manulife Financial (MFC-T), up +3.58%.

Stantec Inc. (STN-T) was the worst performer last week, down -3.86%.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| ATD-T | Alimentation Couche-Tard Inc. | 0.9% | $77.31 | 0.7% | $0.70 | 17.4% | 14 |

| BCE-T | Bell Canada | 8.7% | $46.03 | -15.0% | $3.99 | 3.1% | 15 |

| BIP-N | Brookfield Infrastructure Partners | 5.2% | $31.21 | 1.7% | $1.62 | 5.9% | 16 |

| CCL-B-T | CCL Industries Inc. | 1.7% | $69.23 | 19.7% | $1.16 | 9.4% | 22 |

| CNR-T | Canadian National Railway | 1.9% | $178.37 | 6.9% | $3.38 | 7.0% | 28 |

| CTC-A-T | Canadian Tire | 5.2% | $135.10 | -2.5% | $7.00 | 1.4% | 13 |

| CU-T | Canadian Utilities Limited | 5.8% | $30.85 | -4.0% | $1.79 | 0.0% | 52 |

| DOL-T | Dollarama Inc. | 0.3% | $103.19 | 8.6% | $0.28 | 5.8% | 13 |

| EMA-T | Emera | 6.0% | $47.67 | -6.1% | $2.87 | 3.0% | 17 |

| ENB-T | Enbridge Inc. | 7.5% | $48.95 | 1.1% | $3.66 | 3.1% | 28 |

| ENGH-T | Enghouse Systems Limited | 3.3% | $30.53 | -10.1% | $1.00 | 18.3% | 17 |

| FNV-N | Franco Nevada | 1.2% | $119.16 | 8.2% | $1.44 | 5.9% | 16 |

| FTS-T | Fortis Inc. | 4.4% | $53.52 | -2.4% | $2.36 | 3.3% | 50 |

| IFC-T | Intact Financial | 2.2% | $220.04 | 8.2% | $4.84 | 10.0% | 19 |

| L-T | Loblaw Companies Limited | 1.2% | $150.10 | 16.8% | $1.78 | 2.4% | 12 |

| MFC-T | Manulife Financial | 4.7% | $33.83 | 17.1% | $1.60 | 9.6% | 10 |

| MGA-N | Magna | 3.5% | $54.48 | -1.8% | $1.90 | 3.3% | 14 |

| MRU-T | Metro Inc. | 1.8% | $72.72 | 6.1% | $1.34 | 10.7% | 29 |

| RY-T | Royal Bank of Canada | 4.0% | $136.62 | 2.7% | $5.52 | 3.4% | 13 |

| SJ-T | Stella-Jones Inc. | 1.4% | $79.00 | 3.1% | $1.12 | 21.7% | 19 |

| STN-T | Stantec Inc. | 0.7% | $112.46 | 7.5% | $0.83 | 7.8% | 12 |

| T-T | Telus | 6.9% | $21.67 | -8.6% | $1.50 | 5.2% | 20 |

| TD-T | TD Bank | 5.0% | $81.75 | -3.5% | $4.08 | 6.3% | 13 |

| TFII-N | TFI International | 1.0% | $159.46 | 21.5% | $1.60 | 10.3% | 13 |

| TIH-T | Toromont Industries | 1.5% | $130.35 | 15.6% | $1.92 | 11.6% | 34 |

| TRI-N | Thomson Reuters | 1.4% | $155.83 | 8.7% | $2.16 | 10.2% | 30 |

| TRP-T | TC Energy Corp. | 7.1% | $54.44 | 4.1% | $3.84 | 3.2% | 23 |

| WCN-N | Waste Connections | 0.7% | $172.01 | 16.1% | $1.14 | 8.6% | 14 |

| Averages | 3.4% | 4.3% | 7.4% | 21 |

Note: Stocks ending in “-N” declare earnings and dividends in US dollars. To achieve currency consistency between dividends and share price for these stocks, we have shown dividends in US dollars and share price in US dollars (these stocks are listed on a US exchange). The dividends for their Canadian counterparts (-T) would be converted into CDN dollars and would fluctuate with the exchange rate.

Check us out on magicpants.substack.com for more info in this week’s issue….