MP Market Review – August 26, 2022

Last updated by BM on August 29, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was down slightly with a minus -0.2% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were two earnings reports from companies on ‘The List’.

- One company on ‘The List’ is due to report earnings this week.

- Are you looking to build an income portfolio of your own? When you become a premium subscriber, you get exclusive access to the MP Wealth-Builder Model Portfolio (CDN) and subscriber-only content. Start building real wealth today! Learn More

“The evidence is clear. If you like the idea of lower volatility, shallow losses in bear markets and higher long-term returns, then it would be prudent to increase your allocation to high-quality dividend-paying stocks.”

– Noah Solomon, Financial Post article

Stocks the undisputed champion for scoring long-term returns (Financial Post)

The author compares a wide range of historical returns on several types of investments. He cautions investors not to invest in a stock-only portfolio unless they meet three criteria.

“The 100-per-cent stock portfolio is a double-edged sword. If you can 1) stick with it through stomach-churning bear market losses, 2) have a (very) long-term horizon, and 3) don’t need to sell assets for any reason, then strapping yourself into the roller coaster of a 100-per-cent stock portfolio may indeed be the optimal solution. Conversely, it would be difficult to identify a worse alternative for those who do not meet these criteria.”

Our dividend growth strategy seems well aligned with his criteria.

- We only buy quality, so bear markets don’t bother us as we know our companies will still be there and be profitable coming out of downturns.

- Our time horizon is very long (ten years and more).

- We don’t need to sell to generate income and pay bills. We have growing dividends.

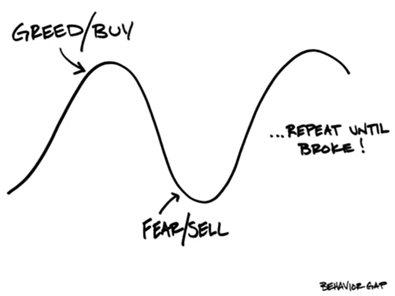

My favourite part of the article, though, is this graphic.

Another quote we like from the article is this one:

“With respect to the emotional fortitude required to stand pat through bear markets, there is considerable evidence that many investors are simply incapable of doing this.”

A time-tested dividend growth strategy focused on income and predictable capital returns over the long term certainly helps us with our ‘emotional fortitude’.

If a DGI strategy interests you, please subscribe to our Magic Pants DGI Premium Membership, and you can learn how to build a robust dividend growth portfolio of your own.

Performance of ‘The List’

Last week, ‘The List’ was down slightly with a minus -0.2% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were TFI International (TFII-N), up +5.19%; TC Energy Corp. (TRP-T), up +2.32%; and Brookfield Infrastructure Partners (BIP-N), up +1.32%.

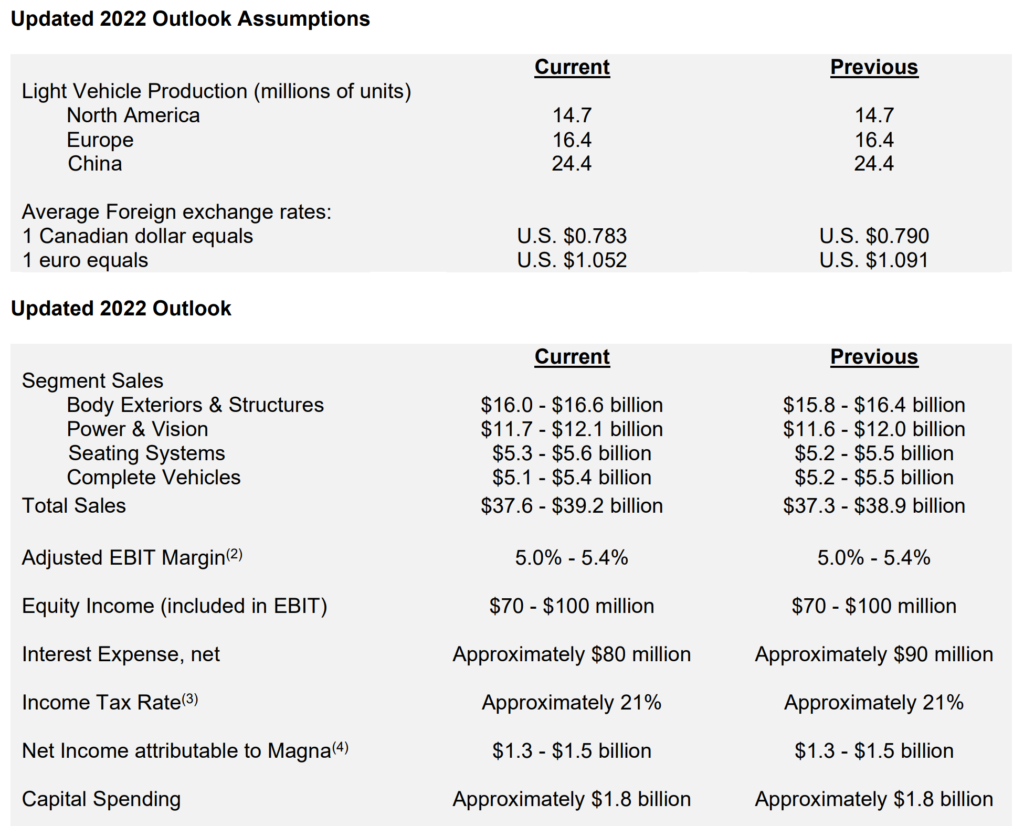

Magna (MGA-N) was the worst performer last week, down -5.12%.

Recent News

Rule of 20 says market bottom much lower (Globe & Mail)

“The investing rule of 20 states that when a new U.S. bull market starts, the trailing price to earnings (PE) ratio of the S&P 500 added to the inflation rate will result in a number less than 20. Unfortunately, right now the trailing PE ratio is 20.2 and the inflation rate is 8.5.”

Following this rule, inflation would need to go to zero, the S&P 500 would have to fall 40 percent more, or earnings would have to be reported 50 percent above expectations. All three scenarios look improbable in the short term.

There is also mention of CAPE being abnormally high, one of the valuation metrics we use to arrive at a sensible price for our quality dividend growers.

The bear market rally is unravelling. Here’s why it may be two years until stocks truly bottom. (Globe & Mail)

A few months ago, since the markets in the United States entered a bear market, we have been commenting on ‘bear market bounces,’ and the data from past bear markets have backed us up. This article looks at the data and arrives at a similar conclusion. The bear market is likely to continue for at least a year. Based on the behaviour of the market last Friday and particularly the comments from Federal Reserve Chair Jerome Powell, we are in for some more pain in the short term.

There was some excellent advice later on in the article.

“Play the long game by being patient and nimble – since intermittent rallies will come and go – and focus mostly on capital preservation.”

Purchasing individual, quality, dividend growers at sensible prices helps us preserve our capital.

One company on ‘The List’ is due to report earnings this week. ATD-T is another of the handful of companies on ‘The List’ that follows an off-cycle reporting schedule.

Alimentation Couche-Tard Inc. (ATD-T) will release its first-quarter 2023 results on Wednesday, August 31, 2022, before markets open.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Royal Bank (RY-T) and TD Bank (TD-T) follow an off-cycle reporting schedule. Their year ends on October 31 each year. Last week, both companies reported their Q3 Fiscal 2022 earnings.

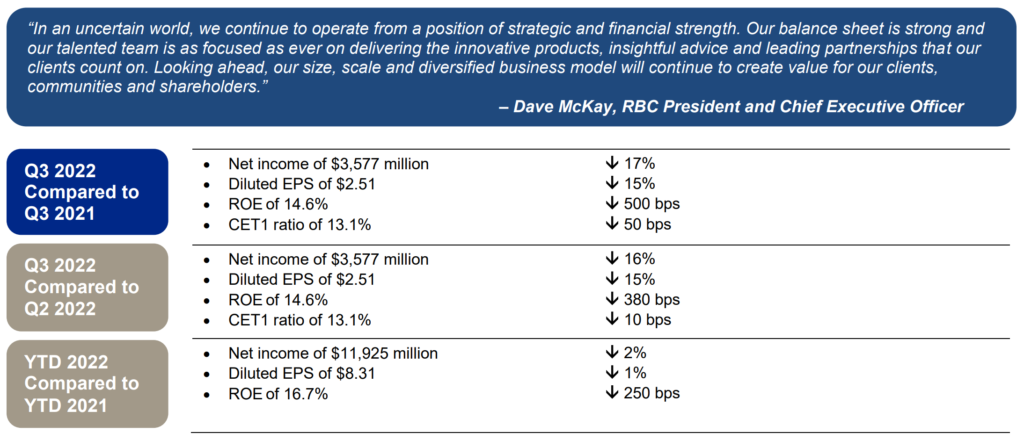

Royal Bank (RY-T)

Highlights:

Outlook:

“Despite the complicated macroeconomic backdrop, we are operating from a position of strength across our capital, liquidity and allowance coverage ratios. I am confident our competitive advantages will drive premium growth going forward. Our premium return on equity was a source of strong internal capital generation and double-digit growth in book value per share. Our priorities in deploying our capital have not changed. We remain focused on building on our momentum and driving accretive, organic growth. Which I will speak to a little later. As part of our commitment to delivering long-term value for our shareholders, we bought back over 10 million shares while paying $1.8 billion of dividends this quarter. We remain well-positioned to execute on key strategic priorities via acquisitions should they meet our strategic and financial requirements. And we are looking forward to working with our new colleagues following the anticipated close of Brewin Dolphin acquisition later this year. Finally, we are comfortable with operating at a higher capital ratio at this point in the cycle. We believe this is the prudent thing to do given the uncertain environment. Our liquidity coverage ratio provides a $66 billion buffer over the regulatory minimum. And we expect to continue to fund the majority of our organic loan growth in our personal and commercial banking businesses through our large client deposit base.”

See the full Earnings Release here

Toronto Dominion Bank (TD-T)

“Continued business momentum, increased customer activity and the benefits of our deposit rich franchise contributed to TD’s strong performance in the third quarter,” said Bharat Masrani, Group President and CEO, TD Bank Group. “Investments in talent and innovation, combined with our focus on prudent risk and financial management, strengthened our business and extended our competitive advantage.”

Highlights:

THIRD QUARTER HIGHLIGHTS

- Reported diluted earnings per share were $1.75, compared with $1.92.

- Adjusted diluted earnings per share were $2.09, compared with $1.96.

- Reported net income was $3,214 million, compared with $3,545 million.

- Adjusted net income was $3,813 million, compared with $3,628 million.

YEAR-TO-DATE FINANCIAL HIGHLIGHTS

- Reported diluted earnings per share were $5.85, compared with $5.68.

- Adjusted diluted earnings per share were $6.18, compared with $5.83.

- Reported net income was $10,758 million, compared with $10,517 million.

- Adjusted net income was $11,360 million, compared with $10,783 million.

Outlook:

“We enter the final quarter of fiscal 2022 with growing businesses, a powerful brand and a proven ability to drive consistent execution across the Bank,” added Masrani. “In a complex macroeconomic environment, we are well-positioned to continue investing in our business and create long-term value for our shareholders.”

See the full Earnings Release here

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on August 26, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.0% | $14.15 | -1.4% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $56.97 | 9.3% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.6% | $64.65 | -1.9% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.3% | $43.01 | 5.6% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $64.27 | -5.2% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $160.99 | 3.9% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.6% | $161.24 | -12.0% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.3% | $41.23 | 12.6% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $80.48 | 26.9% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.3% | $61.35 | -2.0% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.1% | $56.80 | 14.7% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.2% | $32.33 | -29.5% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.0% | $126.96 | -6.7% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.6% | $58.83 | -2.7% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.1% | $192.44 | 17.5% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $117.31 | 14.2% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 3.1% | $58.98 | -27.7% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $70.06 | 4.5% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 4.0% | $124.97 | -8.7% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 1.9% | $41.08 | 1.0% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $63.22 | -9.9% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.1% | $86.87 | -12.6% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.0% | $107.33 | -3.1% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.4% | $105.49 | -7.2% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.4% | $65.74 | 10.1% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.4% | $30.10 | 1.1% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $139.64 | 4.2% | $0.92 | 8.9% | 12 |

| Averages | 2.8% | -0.2% | 10.2% | 18 |

MP Market Review – August 19, 2022

Last updated by BM on August 22, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was up again with a +1.2% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were no earnings reports from companies on ‘The List’.

- Two companies on ‘The List’ are due to report Q3 earnings this week.

- Are you looking for a portfolio of ideas like these? Magic Pants DGI Premium Membership Subscribers get exclusive access to the MP Wealth-Builder Model Portfolio (CDN). Learn More

“Investing shouldn’t feel like going into a casino as a customer. It should feel like owning the casino.”

-Rida Morwa, Seeking Alpha Contributor

Second quarter 2022 earnings are now posted. You can see the Analyst estimates and actual results in a table at the bottom of ‘The List’ menu item. During earnings season, we update all twenty-seven companies on ‘The List’. We also include the earnings highlights and updated guidance in our Weekly Reviews during the earnings reporting season to help readers get to know the companies they invest in a little bit better.

This recent earnings season coincided with an upbeat stock market here in Canada. For the most part, earnings were pretty good, especially when compared to estimates. Twenty of the twenty-seven companies we follow beat estimates (74%). There were a few cautionary warnings in some of the reports, so we are not yet in the camp that thinks the bull market is back.

Benjamin Graham once remarked that earnings are the principal factor driving stock prices. We also like to see a favourable earnings report before investing in a company.

Reviewing quarterly earnings reports is part of our due diligence process. Much like the casino, which does its due diligence on every game it offers, we, too, are taking a calculated risk that over time the odds will be substantially in our favour if we stick to our process and do our research properly.

An investment strategy that is time-tested, focused on income, and predictable over the long term allows everyday investors to take control of their future and enjoy building real wealth without the stress of constant trading and unpredictable price fluctuations.

If this strategy interests you, please subscribe to our Magic Pants DGI Premium Membership, and you can build a dividend growth portfolio alongside ours.

Performance of ‘The List’

Last week, ‘The List’ was up with a +1.2% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Loblaws (L-T), up +4.75%; Canadian Tire (CTC-A-T), up +3.78%; and Metro (MRU-T), up +2.45%.

TFI International (TFII-N) was the worst performer last week, down -5.14%.

Recent News

Tuesday’s TSX breakouts: This company has raised its dividend for 18 consecutive years (Globe & Mail)

This is a good article on one of the stocks in ‘The List’, (SJ-T). Lots of analysis and price targets from various analysts.

Stella-Jones (SJ-T) has rebounded nicely from its 2022 lows. We will let you decide after reading the article if you think there is more upside in the short run from today’s price.

P.S. Our consecutive dividend growth streak only shows 17 consecutive years as we only update ‘The List’ once at the end of each fiscal year.

The case for Canada: A BlackRock senior strategist on energy, banks, bonds and why our market rules in 2022 (Globe & Mail)

“The overarching theme is that the period of steady growth, declining inflation and lengthening business cycles is over. We’re bracing for volatility. We think that central banks are going to have to veer between focusing on the politics of inflation and focusing on the economic consequences of controlling inflation. And that means the bull market in stocks and bonds that prevailed for most of the past four decades is unlikely to repeat itself.”

The author likes Canada because it has a lot of commodities and energy names. We like this quote from the article.

“Within stocks, the focus is on earnings quality and resilience.”

Two companies on ‘The List’ are due to report Q3 earnings this week.

Both Royal Bank (RY-T) and TD Bank (TD-T) follow an off-cycle reporting schedule. Their fiscal year ends on October 31 each year. This means that their fiscal Q3 earnings are the first of ‘The List’ to report each quarter.

Royal Bank (RY-T) will release its third-quarter 2022 results on Wednesday, August 24, 2022, before markets open.

TD Bank TD-T) will release its third-quarter 2022 results on Thursday, August 25, 2022, before markets open.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Last week, there were no earnings reports from companies on ‘The List’.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on August 19, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 4.9% | $14.27 | -0.6% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.7% | $59.06 | 13.4% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.5% | $66.04 | 0.2% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.4% | $42.45 | 4.2% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $65.06 | -4.0% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $164.73 | 6.4% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.5% | $168.94 | -7.8% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.3% | $41.18 | 12.5% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $80.35 | 26.7% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.2% | $62.83 | 0.4% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.1% | $56.25 | 13.5% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.2% | $32.81 | -28.5% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.0% | $128.52 | -5.6% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.5% | $60.32 | -0.3% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.0% | $195.54 | 19.4% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.2% | $123.59 | 20.3% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 2.9% | $62.16 | -23.8% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.5% | $72.37 | 8.0% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.8% | $129.05 | -5.7% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.0% | $41.00 | 0.8% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $65.77 | -6.3% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.1% | $87.45 | -12.0% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.1% | $102.03 | -7.9% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.4% | $106.43 | -6.4% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.6% | $64.25 | 7.6% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.3% | $30.74 | 3.3% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.6% | $141.87 | 5.8% | $0.92 | 8.9% | 12 |

| Averages | 2.8% | 1.2% | 10.2% | 18 |

MP Market Review – August 12, 2022

Last updated by BM on August 15, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was up with a +0.6% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were eight earnings reports from companies on ‘The List’.

- No companies on ‘The List’ are due to report earnings this week.

- Are you looking for a portfolio of ideas like these? Magic Pants DGI Premium Membership Subscribers get exclusive access to the MP Wealth-Builder Model Portfolio (CDN). Learn More

“Our approach to saving is all wrong: We need to think about monthly income, not net worth.”

– Robert C. Merton, HBR (2014)

I was speaking with a couple of our young subscribers recently who wanted a quick way to calculate how much capital they would need to invest today to generate a certain amount of income in the future.

Accurately, predicting future income is one of the great things about the dividend growth strategy as it is something that has proven very reliable over the years. Let us show you how.

First, we need to calculate our estimated yield at some point in the future on the capital we will be investing today. We call this future yield our Growth Yield.

Estimating Growth Yield can be calculated by taking the current (or starting) dividend yield and multiplying it by the average annual forward dividend growth rate to the power of the period in question (5 for the next five years, 10 for the next ten years). We will use ten years for our demonstration.

We assume a starting yield of 3% today and dividend growth of 7% each year over the next ten years. These are the same conservative assumptions we make in our Model Portfolio (CDN) Business Plan.

Current Yield * Average Annual Forward Dividend Growth Rate ^ Period = Estimated Growth Yield

3.0 * 1.07 ^ 10 = 5.9%

Next, we need to know how much income we will require a decade from now. Let’s assume $70,000 annually. By taking the desired income and dividing it by our new estimated Growth Yield we get our answer.

$70,000 / 5.9% = $1,186,440

The subscribers would need to invest ~ one million two hundred thousand dollars today in a portfolio of individual dividend growth stocks with an initial average yield of 3% and grow their dividends on average by 7% per year. They should have ~ $70,000 in yearly dividends from their original investment in only ten years.

By changing the formula’s inputs (starting yield, dividend growth and time), you can arrive at your desired income and initial capital requirements.

As a bonus, their capital should also have increased (~10% annually), and their income will continue to grow to protect them from inflation. This exercise does not include any new contributions (cash or reinvested dividends) to their original capital over the decade. The compounding of reinvested dividends is a powerful force for younger investors who may not need the income in the short term and will accelerate the achievement of their investing goals.

An investment strategy that is time-tested, focused on income, and predictable over the long term allows everyday investors to take control of their future and enjoy building real wealth without the stress of constant trading and unpredictable price fluctuations.

If this strategy interests you, please subscribe to our Magic Pants DGI Premium Membership, and you can build a dividend growth portfolio alongside ours.

Performance of ‘The List’

Last week, ‘The List’ was up with a +0.6% YTD price return (capital). Dividend growth of ‘The List’ remains at +10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were Stella-Jones Inc. (SJ-T), up +7.33%; Magna (MGA-N), up +6.59%; and Stantec Inc. (STN-T), up +4.41%.

Canadian Tire (CTC-A-T) was the worst performer last week, down -3.98%.

Recent News

Has Inflation Peaked? Sam and Robert Kovacs (Seeking Alpha Contributors)

One of the narratives sparking the upturn in the stock markets recently is that inflation has peaked and that interest rate hikes may not be as aggressive going forward.

In this article, the authors agree that one component of inflation (gas prices) has indeed reversed course but this may only be temporary. Food and shelter costs are still rising and gas prices could reverse course and head even higher.

The authors advise caution and warn not to be too quick to jump back into the market full throttle just yet.

#Quad4 (Bulls, Beware)

Another service we subscribe to is Hedgeye. Hedgeye proposes an active investing strategy based on four quads. The one we are in now is Quad4 (Growth and Inflation both slowing). Here is what they have to say about our current environment.

“The facts belie that rosy outlook. By our estimation, inflation will remain sticky (even as inflation slows from multi-decade highs). Combine this with the U.S. economy on the precipice of a major multi-quarter slowdown and we have a recipe for serious hardship for most Americans. (For investors, this outlook posits #Quad4 market risk according to our Growth, Inflation, Policy model.)

Financial pressure is already hurting cash-strapped U.S. consumers. Here’s an alarming stat. According to the U.S. Census Bureau, about 15% of U.S. renters (representing 8.4 million Americans) are late on making their monthly rent payments (for the period June 1 to June 13). Millions of these struggling Americans will see their leases run off in the coming months.

Getting back to the Fed.

With sticky inflation, we think the Fed will need to raise rates into an impending #Quad4 slowdown which will exacerbate the existing squeeze on American consumers. In this environment, job cuts broaden as U.S. corporates feel the bite of economic malaise. As we recently detailed in our 154-slide Mid-Quarter Update presentation, we’re already seeing many of these dynamics play out.

In other words, bulls beware.”

No companies on ‘The List’ are due to report earnings this week.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Last week, eight companies on ‘The List’ reported their Q2 Fiscal 2022 earnings. We will begin with Metro’s latest earnings report.

Metro (MRU-T)

Metro, follows an off-cycle reporting schedule. Its fiscal year ends at the end of September. This means that its fiscal Q3 is reported in line with the Q2 Fiscal 2022 earnings of ‘The List’.

“We are pleased with the performance of our food and pharmacy businesses in the third quarter, which was achieved in a challenging operating environment with increasing inflationary pressures as well as ongoing labor shortages that are impacting the supply chain and our operations. I want to thank our teams who strive to deliver the best value possible to customers in these inflationary times with our multiple formats, effective promotional strategies and strong private label offering. Finally, we are on track with our supply chain modernization program as the transition to our fully automated frozen food distribution center in Toronto is now complete and the ramp-up is progressing well”, declared Eric La Flèche, President and Chief Executive Officer.

Highlights:

- Sales of $5,865.5 million, up 2.5%

- Food same-store sales up 1.1%

- Pharmacy same-store sales up 7.2%

- Net earnings of $275.0 million, up 9.0% and adjusted net earnings(1) of $283.8 million, up 8.7%

- Fully diluted net earnings per share of $1.14, up 10.7%, and adjusted fully diluted net earnings per share of $1.18, up 11.3%

Outlook:

“We continue to face higher than normal inflationary pressures and labor shortages, and it is difficult to predict how long this situation will last. If prolonged, this environment could put pressure on margins. In the short term, we expect same-store food sales to grow at a higher rate than in recent quarters as we are now cycling periods last year without significant pandemic restrictions. On the pharmacy side, we expect growth in prescriptions to moderate versus year-to-date levels given the high number of visits to physicians in the fourth quarter last year. We also expect front of store revenues to remain strong, namely driven by over-the-counter product sales.”

See the full Earnings Release here

Emera (EMA-T)

“Our portfolio of high-quality regulated assets continues to deliver solid performance and predictable earnings growth, driven by strong results from our Florida utilities, “ said Scott Balfour, President and CEO of Emera Inc. “Our strategy continues to deliver for both customers and shareholders, with our focus on a clean energy transition that ensures grid reliability and minimizes the cost impacts to customers.”

Highlights:

- Quarterly adjusted EPS increased $0.05 or 9% to $0.59 compared to $0.54 in Q2 2021. Quarterly reported net loss per common share increased $0.18 to $(0.25) in Q2 2022 compared to a net loss per common share of $(0.07) in Q2 2021 due to higher mark-to-market (“MTM”) losses.

- Year-to-date, adjusted EPS increased $0.02 or 1% to $1.51 compared to $1.49 in Q2 2021. Year-to-date reported EPS increased by $0.11 to $1.12 from $1.01 in 2021 due to lower MTM losses.

- Contributions from regulated utilities increased adjusted EPS 18% for the quarter and 12% year-to-date primarily driven by new rates and favourable weather at Tampa Electric and continued growth at both Tampa Electric and People’s Gas (“PGS”) year-to-date. These increases were partially offset by higher corporate costs, lower contributions from Emera Energy and a higher share count.

- On track to fully execute on 2022 capital plan with almost $1.1B of capital investment in cleaner and reliable energy in the first half of 2022.

Capital Program Update:

- On track to deliver $2.9 billion in capital investment in 2022, a 19% increase over the $2.4 billion capital investment in 2021

- Emera’s capital program continues to drive forecasted rate base growth of approximately 7% to 8% through 2024

- 2023‐2025 capital plan will be rolled out in Q3 2022

See the full Earnings Release here

Stella-Jones (SJ-T)

“Stella-Jones recorded solid results in the second quarter, above market performance, delivering sequentially higher margins and generating significant cash,” said Éric Vachon, President and CEO of Stella-Jones. “We are particularly pleased with the performance of our infrastructure-related businesses, which speaks highly to the wide reach of our expanded network and to our procurement and logistics capabilities to continue to meet strong demand. While inflationary pressures impacted costs of all product categories, we continued to successfully implement contractual price adjustments and generate healthy margins, underscoring the strength of our business model.”

Highlights:

- Sales increased to $907 million, despite the normalization of residential lumber sales

- 10% organic growth for infrastructure-related businesses

- EBITDA of $154 million, or a healthy margin of 17.0%

- Net income of $94 million, or $1.51 per share

- Strong cash flow generation of $228 million

Outlook:

Stella-Jones’ sales are primarily to critical infrastructure-related businesses. While all product categories can be impacted by short-term fluctuations, the business is mostly based on replacement and maintenance-driven requirements, which are rooted in long-term planning. Corresponding to this longer-term horizon and to better reflect the expected sales run-rate for residential lumber and reduce the impact of commodity price volatility, the Company shifted its guidance to a three-year outlook in early 2022. Below are key highlights of the 2022-2024 outlook with a more comprehensive version, including management assumptions, available in the Company’s MD&A. Management remains confident in the achievement of its three-year strategic guidance.

Key Highlights:

- Compound annual sales growth rate in the mid-single digit range from 2019 pre-pandemic levels to 2024;

- EBITDA margin of approximately 15% for the 2022-2024 period;

- Capital investment of $90 to $100 million to support the growing demand of its infrastructure-related customer base, in addition to the $50 to $60 million of annual capital expenditures;

- Residential lumber sales expected to stabilize between 20-25% of total sales while infrastructure-related businesses expected to grow and represent 75-80% of total sales by 2024;

- Anticipated returns to shareholders between $500 and $600 million during three-year outlook period;

- Leverage ratio of 2.0x-2.5x between 2022-2024, but may temporarily exceed range to pursue acquisitions.

See the full Earnings Release here

Stantec (STN-T)

“We are very pleased that our operational performance continues to drive record earnings,” said Gord Johnston, President and CEO. “Our backlog has never been higher and the opportunity pipeline remains robust. Significant US Federal funding is moving forward, although it has taken longer than expected, and this will further add to future growth prospects that will accelerate in 2023.”

Highlights:

- Stantec achieved adjusted diluted EPS of $0.83 in Q2 2022, a $0.21 per share or 33.9% increase from $0.62 in Q2 2021, reflecting strong net revenue growth, solid execution of its strategic growth initiatives, and focused project execution.

- Net revenue increased 22.9% or $208.4 million to $1.1 billion compared to Q2 2021, driven by 9.4% organic growth and 12.4% acquisition growth. Consistent with the first quarter of this year, every one of the regional and business operating units delivered organic growth, most notably in Global and in Water and Environmental Services where organic growth was in the double-digits.

- Project margin increased $119.4 million or 24.7% to $602.7 million as a result of net revenue growth and solid project execution. As a percentage of net revenue, Stantec delivered a 54.0% project margin, an 80 basis point increase from Q2 2021.

- Adjusted EBITDA1 increased $40.1 million or 27.4% to $186.7 million and achieved a margin of 16.7% compared to 16.1% in the prior period, resulting from strong performance across the business.

- Net income decreased 4.0%, or $2.5 million, to $60.7 million, and diluted EPS decreased 3.5%, or $0.02, to $0.55. Acquisition-related expenses (namely integration, depreciation and amortization, and interest expenses), coupled with a net unrealized fair value loss associated with Stantec’s equity investments held for self-insured liabilities, more than offset increased project margin and lower income tax expense.

- Adjusted net income1 grew 33.0%, or $23.0 million, to $92.6 million, achieving 8.3% of net revenue compared to 7% in Q2 2021, and adjusted diluted EPS increased 33.9% to $0.83 from $0.62 in Q2 2021.

- Contract backlog stands at $5.8 billion at June 30, 2022, a new record reflecting 13.0% organic growth from December 31, 2021. Like net revenue, organic backlog growth was achieved across all Stantec’s regional and business operating units. US operations led with 14.8% organic backlog growth. Global’s backlog exceeded $1 billion, a high-water mark, reflecting 13.4% organic growth. Infrastructure, Buildings, and Energy & Resources achieved double-digit organic backlog growth. Contract backlog represents approximately 14 months of work—an increase of one month from December 31, 2021.

- Operating cash flows amounted to an outflow of $4.4 million compared to an inflow of $78.2 million in the prior period reflecting the expected disruptions from the Cardno integration, particularly the financial system migration. Cash outflow was also driven by the increased investment in net working capital to support organic revenue growth and an increase in days sales outstanding (DSO).

- Days sales outstanding was 79 days, remaining within Stantec’s expectations, and represents an increase of 4 days from 75 days at December 31, 2021.

- Net debt to adjusted EBITDA (on a trailing twelve-month basis) at June 30, 2022 was 2.0x, remaining within Stantec’s internal target range of 1.0x to 2.0x.

- In Q2 2022, Stantec repurchased 625,019 common shares at a cost of $36.7 million under its normal course issuer bid.

- On April 1, 2022, Stantec acquired Barton Willmore, the UK’s leading planning and design consultancy firm. This acquisition added approximately 300 team members across the UK providing services for both public and private clients across all development sectors, which strategically complements Stantec’s existing business in Infrastructure.

Outlook:

“The inflationary environment does not seem to be slowing the pace of project opportunities in any meaningful way,” continued Mr. Johnston. “As we engage with our clients, the imperative for tackling the challenges of aging and overloaded infrastructure, climate change, and production capacity constraints is outweighing the effects of inflation. This gives us confidence in our continued ability to meet our financial targets.”

Franco-Nevada (FNV-N)

“We are proud to report record quarterly and half-year results on many financial metrics,” stated Paul Brink, CEO. “The low-risk nature of our business is most pronounced in today’s inflationary environment. Our top-line precious metal stream and royalty interests helped generate our highest margins since starting streaming. Our Energy assets performed well and are the driver behind our record revenues. We are pleased to add exposure to the construction-ready Tocantinzinho gold project and to have received good organic growth news from several of our assets during the quarter, in particular the further expansion of the Detour Lake mine. Franco-Nevada is debt-free and is growing its cash balances.”

Highlights:

- GEOs sold consistent year over year

- On track to achieving guidance

- Portfolio performing well

- Benefit of recovery in energy prices

- 85.5% margin in Q2 2022

Portfolio Additions:

- Financing Package with G Mining Ventures on the Tocantinzinho Gold Project: As previously announced on July 18, 2022, we acquired, through our wholly-owned subsidiary, Franco-Nevada (Barbados) Corporation (“FNBC”), a gold stream with reference to production from the Tocantinzinho project, owned by G Mining Ventures Corp. (“G Mining Ventures”) and located in Pará State, Brazil (the “Stream”). FNBC will provide a deposit of $250 million. Additionally, through one of our wholly-owned subsidiaries, we agreed to provide G Mining Ventures with a $75.0 million secured term loan (the “Term Loan”). We also subscribed for $27.5 million of G Mining Ventures’ common shares (“G Mining Common Shares”).

- Acquisition of Caserones Royalty in Chile: On April 14, 2022, we acquired, through a wholly-owned subsidiary, an effective 0.4582% NSR on JX Nippon Mining & Metals Group’s producing Caserones copper-molybdenum mine located in the Atacama Region of northern Chile for an aggregate purchase price of $37.4 million. Franco-Nevada is entitled to royalty payments in respect of the period commencing January 1, 2022. The last quarterly distribution attributable to Franco-Nevada was $1.2 million.

Outlook:

See the full Earnings Release here

CCL Industries (CCL-B-T)

Geoffrey T. Martin, President and Chief Executive Officer, commented, “I am pleased to report record quarterly results despite an unsettled geopolitical backdrop, China-centric Covid lockdowns, persistent inflation and supply chain challenges. The Company posted strong 10.9% organic sales growth, although significantly selling price driven to offset inflation, while adjusted basic earnings per Class B share improved 5.6% to $0.94, including $0.02 of negative impact from foreign currency translation.”

Highlights:

- Per Class B share: $0.94 adjusted basic earnings up 5.6%; $0.91 basic earnings up 5.8%; currency translation negative $0.02 per share

- Sales increased 14.9% on 10.9% organic and 4.8% acquisition growth partially offset by 0.8% negative currency translation

- CCL, Avery and Innovia posted organic sales growth of 10.9%, 13.8% and 19.5%, respectively

- Operating income improved 5.2%, with a 15.3% operating margin down 140 bps

Outlook:

- Final price pass through initiatives implemented to benefit core CCL Label businesses for H222, orders picture still solid

- CCL Design outlook dependent on chip availability recovery and consumer demand holding up, recent acquisitions additive

- Comps at CCL Secure ease significantly for H222

- Avery volume should continue to improve, augmented by recent acquisitions

- Checkpoint RFID growth at ALS might struggle to offset softer MAS picture in broad retail

- Innovia sales likely to decline on lower resins at today’s purchase prices, must balance freight & energy inflation to match H221 profitability

- China operations back to near normal but demand soft

See the full Earnings Release here

Canadian Tire (CTC-A-T)

“Our strong comparable sales growth clearly demonstrated that customer demand for CTC’s unique multi-category product assortment remained healthy in the second quarter,” said Greg Hicks, President and CEO, Canadian Tire Corporation.

Highlights:

- Retail sales were $5,363.8 million, up 9.9%, compared to the second quarter of 2021; consolidated comparable sales (excluding Petroleum) increased 5.0%

- Revenue increased $485.5 million to $4,404.0 million, up 12.4%; Revenue (excluding Petroleum) increased 5.9% over the same period last year

- Consolidated income before income taxes (IBT) was $238.1 million, down 33.4% compared to the second quarter of 2021; and $284.3 million, down 22.0%, on a normalized basis

- Normalized diluted EPS was $3.11, compared to $3.72 in the prior year. Q2 Diluted EPS was $2.43 per share, compared to $3.64 in the prior year

- Retail Return on Invested Capital (ROIC) calculated on a trailing twelve-month basis, remained strong at 13.5% at the end of the second quarter, compared to 14.1% at the end of the second quarter of 2021

Outlook:

“Our results reflect our continued ability to effectively navigate a challenging and dynamic environment. Our retail team’s outstanding focus on inventory and margin management have enabled us to continue to execute well and stay focused on the delivery of our Better Connected strategy,” continued Hicks. “Also, receivables and new account acquisitions at Canadian Tire Bank remained strong, in line with our expectations to drive long-term growth,” said Hicks

See the full Earnings Release here

Algonquin Power and Utilities (AQN-N)

“We are pleased to report solid second quarter results and continued growth across our regulated and renewables businesses,” said Arun Banskota, President and Chief Executive Officer of AQN. “We remain committed to the execution of our capital plan, which we believe supports growth in earnings and cash flows and delivery of long-term value to our shareholders.”

Highlights:

- Revenue of $624.3 million, an increase of 18% compared to the second quarter of 2021

- Adjusted EBITDA1 of $289.3 million, an increase of 18% compared to the second quarter of 2021;

- Adjusted Net Earnings1 of $109.7 million, an increase of 19.6% compared to the second quarter of 2021; and

- Adjusted Net Earnings1 per share of $0.16, an increase of 7% compared to the second quarter of 2021.

Corporate Highlights

- Pending Acquisition of Kentucky Power Company and AEP Kentucky Transmission Company, Inc. – On May 4, 2022, the Kentucky Public Service Commission (“KPSC”) issued an order, including an approval of the pending acquisition of Kentucky Power Company and AEP Kentucky Transmission Company, Inc. (the “Kentucky Power Transaction”) by Liberty Utilities Co. (“Liberty Utilities”), an indirect, wholly-owned subsidiary of AQN, subject to certain conditions set forth in the order, including those agreed to by Liberty Utilities in the course of the docket. On May 3, 2022, the KPSC issued an order that required certain changes to the proposed operating and ownership agreements (collectively, the “Mitchell Agreements”) relating to the Mitchell coal generating facility (in which Kentucky Power owns a 50% interest, representing 780 MW). On July 1, 2022, the Public Service Commission of West Virginia (“WVPSC”) issued an order on the Mitchell Agreements that is inconsistent with the KPSC’s order on the Mitchell Agreements. The closing of the Kentucky Power Transaction is subject to the satisfaction of certain conditions precedent, which include those relating to the approval of the Mitchell Agreements by the KPSC, WVPSC and U.S. Federal Energy Regulatory Commission. Liberty Utilities and AEP are in discussions to reach a resolution regarding the conditions precedent in respect of the Mitchell Agreements (the “Mitchell Agreements Condition”), which if successful, could allow the Kentucky Power Transaction to close in the second half of 2022.

- Completion of the Blue Hill Wind Facility – On April 14, 2022, the Renewable Energy Group achieved commercial operations (“COD”) at its 175 MW Blue Hill Wind Facility, located in southwest Saskatchewan. The energy generated from the facility is being sold through a long-term power purchase agreement with SaskPower. Bringing low-cost renewable generation capacity to communities is one of the ways the Company is delivering on its commitment to sustainability.

- Completion of Sandhill Renewable Natural Gas Acquisition – On August 5, 2022, the Renewable Energy Group completed its acquisition of Sandhill Advanced Biofuels, LLC (“Sandhill”). Sandhill is a developer of renewable natural gas (“RNG”) anaerobic digestion projects located on dairy farms with a portfolio of four projects in the state of Wisconsin. Two of the projects recently achieved COD, while the other two projects are in late-stage development. Once fully constructed, the portfolio is expected to produce RNG at a rate of approximately 500 million British thermal units (“MMBTUs”) per day. The acquisition represents the Company’s first investment in the non-regulated RNG space.

- Moody’s assigns Baa2 rating – On August 5, 2022, Moody’s Investors Service (“Moody’s”) assigned an inaugural Baa2 long term issuer rating to Liberty Utilities with a stable outlook. Liberty Utilities is also rated by S&P Global Ratings and Fitch Ratings.

Outlook:

- Expected Capital Deployment in 2022 of Over $4.3 billion

- Majority of expected 2022 capital deployment related to Liberty NY Water acquisition (completed) and Kentucky Power Acquisition (pending)

- Capital plan remains on track, over $1.2 billion has been invested YTD as of end Q2 2022:

- 609 million deployed for closing of Liberty NY Water

- Over $200 million of capital invested into organic investments in Q2 2022

- Committed to maintaining investment-grade capital structure

- Moody’s Investors Service assigned an inaugural Baa2 long term issuer rating to Liberty Utilities Co. with outlook stable

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on August 12, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 4.9% | $14.49 | 1.0% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.7% | $59.49 | 14.2% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.6% | $64.47 | -2.2% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.5% | $41.50 | 1.9% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $63.58 | -6.2% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $163.73 | 5.7% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.6% | $162.78 | -11.1% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.4% | $40.52 | 10.7% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $79.25 | 25.0% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.3% | $61.50 | -1.7% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.2% | $55.55 | 12.1% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.2% | $32.90 | -28.3% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.0% | $133.34 | -2.0% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.6% | $60.27 | -0.3% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.1% | $192.11 | 17.3% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $117.99 | 14.9% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 2.8% | $65.30 | -20.0% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $70.64 | 5.4% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.9% | $128.03 | -6.4% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.0% | $40.54 | -0.3% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $64.90 | -7.5% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.1% | $86.45 | -13.0% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.0% | $107.56 | -2.9% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.4% | $107.06 | -5.8% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.5% | $65.32 | 9.4% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.4% | $30.11 | 1.2% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.6% | $141.56 | 5.6% | $0.92 | 8.9% | 12 |

| Averages | 2.8% | 0.6% | 10.2% | 18 |

MP Market Review – August 5, 2022

Last updated by BM on August 8, 2022

Summary

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was down a few basis points with a minus -1.3% YTD price return (capital). Dividend growth of ‘The List’ remains at 10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were four earnings reports from companies on ‘The List’.

- Eight companies on ‘The List’ are due to report earnings this week.

- Are you looking for a portfolio of ideas like these? Magic Pants DGI Premium Membership Subscribers get exclusive access to the MP Wealth-Builder Model Portfolio (CDN). Learn More

“Markets are designed to suck the most amount of people in at the most inopportune time.”

– Keith McCullough, Hedgeye CEO

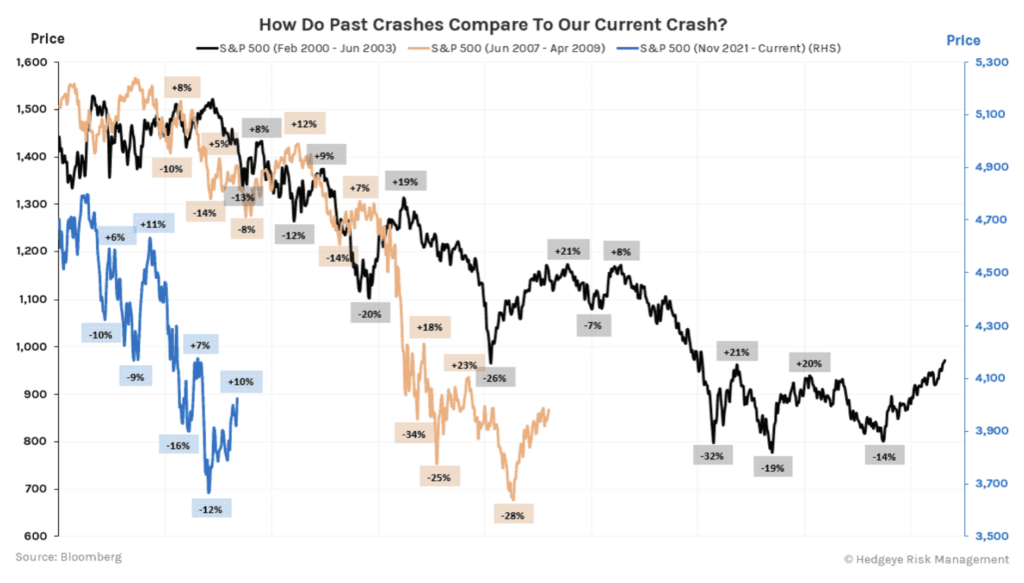

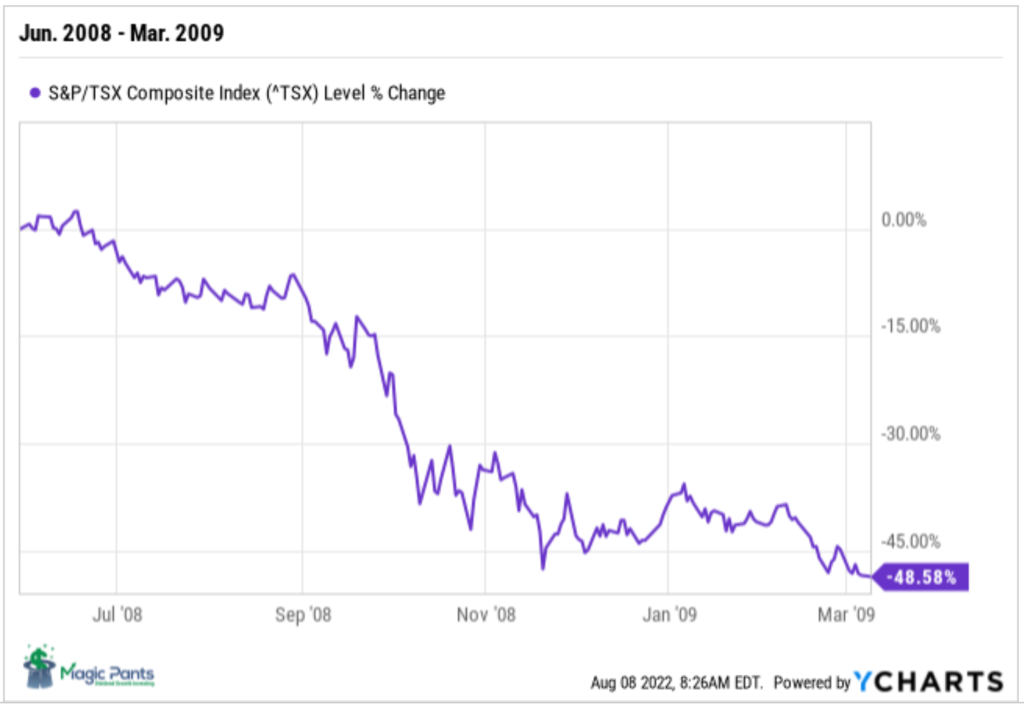

We read an interesting article from Hedgeye (macro investing subscription) over the weekend comparing the last two bear markets in the United States to today’s market. The premise of the article was the last two bear markets saw much larger bear market rallies than we saw in July and the markets continued lower. The average move up in the US 2000-2003 bear market was +15% and the average move down was -18%. In the 2008-2009 bear market the average move up was +12% and the average move down was -19%.

We decided to look at the Canadian markets during these bear markets to see how they behaved. Here are the two charts:

Similar to the markets south of the border, the last two bear markets in Canada had several bounces before the Canadian market found its bottom.

In terms of duration, the current crash has only lasted 16% as long as 2000 and 40% as long as 2008. The message we get from this is that the current bear market has a high probability of lasting much longer.

Although many of our good dividend growers faired much better during past bear markets we are still vigilant about getting ‘sucked in’ too soon given today’s macro conditions.

Performance of ‘The List’

Last week, ‘The List’ was down a few basis points with a minus -1.3% YTD price return (capital). Dividend growth of ‘The List’ remains at 10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were TFI International (TFII-N), up 6.31%; Waste Connections (WCN-N), up 3.72%; and Canadian Tire (CTC-A-T), up 3.05%.

TC Energy Corp. (TRP-T) was the worst performer last week, down -6.91%.

Recent News

What’s wrong with my dividend ETF? (Globe & Mail)

“Long-term investors should be aware that energy stocks will one day be dead weight for dividend stocks. Low oil prices would be a twofold problem – lower share prices and falling dividend payments.”

The author speaks about the differences in an ETF’s weighting as a major determinant of the funds’ returns. When we reviewed the top dividend ETFs in Canada, we found a similar issue. The Canadian ETFs were heavily weighted in energy and financial companies (over 50%) which can cause quite a fluctuation in performance year to year.

‘The List’ and our model portfolio are purposely built so that no one sector will have an adverse effect on long-term returns. Compare our historical performance (on the subscribe page) to other dividend funds to see for yourself.

Acquisition of LifeWorks approved by Lifeworks shareholders (Telus website)

“Following LifeWorks’ shareholder approval, we remain highly confident in receiving the appropriate regulatory approvals and, in turn, closing this transaction on or about the fourth quarter of 2022, and look forward to welcoming LifeWorks’ employees and customers into our TELUS Health family,” said Darren Entwistle, President and CEO.”

It will be interesting to watch Telus’ transition over the next few years!

Eight companies on ‘The List’ are due to report earnings this week.

Metro (MRU-T) will release its third-quarter 2022 results on Wednesday, August 10, 2022, before markets open.

Emera (EMA-T) will release its second-quarter 2022 results on Wednesday, August 10, 2022, before markets open.

Stella-Jones (SJ-T) will release its second-quarter 2022 results on Wednesday, August 10, 2022, before markets open.

Stantec (STN-T) will release its second-quarter 2022 results on Wednesday, August 10, 2022, after markets close

Franco-Nevada (FNV-N) will release its second-quarter 2022 results on Wednesday, August 10, 2022, after markets close

CCL Industries (CCL-B-T) will release its second-quarter 2022 results on Wednesday, August 10, 2022, after markets close

Canadian Tire Corp. (CTC-A-T) will release its second-quarter 2022 results on Thursday, August 11, 2022, before markets open.

Algonquin Power & Utilities (AQN-N) will release its second-quarter 2022 results on Thursday, August 11, 2022, after markets close

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Last week, four companies on ‘The List’, reported their Q2 Fiscal 2022 earnings. Let’s get started with Waste Connections.

Waste Connections (WCN-N)

“Accelerating solid waste pricing and E&P waste activity drove a top-to-bottom beat in the period. Solid waste pricing growth of 8.8% enabled us to overcome increased inflationary pressures during the period and deliver adjusted EBITDA(b) margin in line with our outlook for Q2 and flat on a year over year basis excluding the margin dilutive impact from acquisitions completed since the year ago period,” said Worthing F. Jackman, President and Chief Executive Officer.

Highlights:

- Accelerating solid waste pricing growth and E&P waste activity drive better than expected Q2 results

- Revenue of $1.816 billion, up 18.4%

- Net income of $224.1 million, and adjusted EBITDA of $566.8 million, up 16.9%

- Adjusted EBITDA margin of 31.2% of revenue, in line with outlook and flat year over year, excluding acquisitions

- Net income of $0.87 per share, and adjusted net income of $1.00 per share, up 23.5%

- Year to date net cash provided by operating activities of $973.7 million and adjusted free cash flow(b) of $638.4 million, or 18.4% of revenue

- Year to date signed or closed acquisitions with approximately $470 million of total annualized revenue

- Increases full year 2022 outlook to revenue of approximately $7.125 billion, net income of approximately $837.5 million, adjusted EBITDA of approximately $2.190 billion, net cash provided by operating activities of approximately $1.974 billion and adjusted free cash flow of approximately $1.160 billion

Outlook:

Waste Connections also updated its outlook for 2022, which assumes no change in the current economic environment or underlying economic trends.

- Revenue is estimated to be approximately $7.125 billion, as compared to our original revenue outlook of approximately $6.875 billion.

- Net income is estimated to be approximately $837.5 million, and adjusted EBITDA is estimated to be approximately $2.190 billion, or about 30.7% of revenue, as compared to our original adjusted EBITDA outlook of $2.145 billion or 31.2% of revenue.

- Capital expenditures are estimated to be approximately $850 million, in line with our original outlook.

- Net cash provided by operating activities is estimated to be approximately $1.974 billion, and adjusted free cash flow of approximately $1.160 billion, or about 16.3% of revenue, as compared to our original adjusted free cash flow outlook of $1.150 billion or 16.7% of revenue.

See the full Earnings Release here

Brookfield Infrastructure Partners (BIP-N)

“We generated record financial results during the second quarter, with strong cash flows from our base business given the essential nature of our investments and the highly regulated or contracted revenue frameworks they operate under,” said Sam Pollock, Chief Executive Officer of Brookfield Infrastructure. “It was a very successful quarter as we continued to execute on our asset rotation strategy. In the past several weeks, we committed $1.9 billion across two marquee European companies and agreed to sell four mature assets for total proceeds of nearly $900 million. We will once again exceed our annual investment deployment target and thus our financial results should remain strong and well ahead of last year.”

Highlights:

- FFO of $513 million in the second quarter represents an increase of 30% over the prior year on a total basis

- FFO per unit increased by 20% reflecting the shares issued in conjunction with the Inter Pipeline privatization and an equity offering completed in November

- Organic growth was 10% reflecting the high inflationary environment and earnings associated with ~$1 billion of capital commissioned over the last 12 months

- Significant contribution from our asset rotation program and the privatization of Inter Pipeline in the second half of 2021

- Distribution of $0.36 per unit represents an increase of 6% compared to the prior year

- Payout ratio for the quarter of 69% falls within our long-term 60-70% target range

- Net income benefited from the contribution associated with recent acquisitions, organic growth across our base business, as well as a mark-to-market gain on our foreign currency hedging program

- Excluding the impact of disposition gains in the current and prior year, net income increased $200 million relative to last year

- Total assets decreased compared to December 31, 2021 due to the impact of foreign exchange more than offsetting organic growth and the acquisition of two Australian utilities

Strategic Initiatives:

- Closed the acquisition of Intellihub, the leading provider of electricity smart meters in Australia and New Zealand, for ~$215 million (BIP’s share) on April 1, 2022

- Announced two take private transactions:

- Acquisition of Uniti Group Ltd. through a 50/50 joint venture partnership; net to BIP equity of ~$200 million, closing expected in early August

- Acquisition of HomeServe Plc, a residential infrastructure business in the U.K. and U.S.; net to BIP equity of ~$1.3 billion, closing expected in Q4

- Announced an agreement to acquire a 51% interest, alongside another institutional investor, in a marquee portfolio of ~36,000 telecom towers in Germany and Austria; total transaction size is €17.5 billion (net to BIP equity – ~$600 million)

Outlook:

The macroeconomic outlook has continued to evolve as central banks are making a concerted effort to tackle high inflation by way of substantial interest rate hikes. Consequently, these actions have increased the probability of recessionary conditions in many markets in which we operate. While an economic slowdown will generally have negative consequences for many companies, the highly contracted and regulated nature of the revenue frameworks at our assets should cushion the effects on Brookfield Infrastructure. Nonetheless we will continue to operate our businesses prudently, by monitoring inflationary cost pressures within our business and maintaining high levels of liquidity.

From a new investment perspective, we may be entering a period where we can buy for value. Generally, we expect that infrastructure assets will hold their value through recessionary conditions given their resilient nature. However, should liquidity in the market become tighter, certain owners of high-quality assets may become overextended, allowing us to use our liquidity and access to capital to make investments at attractive entry points. Following an active start to the year, we are focused on a number of new investment opportunities that if successful, will begin contributing toward our 2023 capital deployment target.

For the remainder of the year, our priority will be to complete the investments and asset sales that we have secured or are in the process of securing. We will once again exceed our investment deployment target for the year and thus the financial results for the year should remain strong and well ahead of last year.

See the full Earnings Release here

Bell Canada (BCE-T)

“We continue to see momentum in wireless with 110,761 mobile phone net subscriber activations and strong service revenue growth. Our retail Internet net activations were also up 27.9% with 8% residential Internet revenue growth. These excellent results are a testament to the significant and unprecedented investments we’re making in network connectivity, reliability, and our fibre footprint expansion. In addition, our continued investments in customer experience and digital support options are encouraging customers to stay with Bell, as reflected in a third consecutive quarter of improved churn for our wireless, residential Internet and Fibe TV services.”

Highlights:

- Consolidated adjusted EBITDA up 4.6% driven by 3.8% service revenue growth

- Net earnings of $654 million, down 10.9%, with net earnings attributable to common shareholders of $596 million, or $0.66 per common share, down 13.2%; adjusted net earnings1 of $791 million generated adjusted EPS1 of $0.87, up 4.8%

- Wireless operating momentum continues: 110,761 mobile phone net subscriber activations, up 139.5%; best-ever quarterly postpaid churn2 rate of 0.75%; 3.8% higher mobile phone blended ARPU ; and strong service revenue and adjusted EBITDA growth of 7.8% and 8.3% respectively

- Next evolution of 5G underway with the launch of mobile 5G+, delivering Bell’s fastest mobile speeds ever

- Retail Internet net activations up 27.9% to 22,620 with 8% residential Internet revenue growth; on track to deliver approximately 900,000 new fibre locations in 2022

- Broadband leadership underscored with upcoming launches of 8 Gbps symmetrical pure fibre Internet service in select areas of Toronto with data upload speeds 250 times faster than cable, and Wi-Fi 6E technology; and newly launched Fibe TV service powered by Google Android TV

- Media revenue up 8.7% with 5.6% adjusted EBITDA growth; digital revenue up 55%

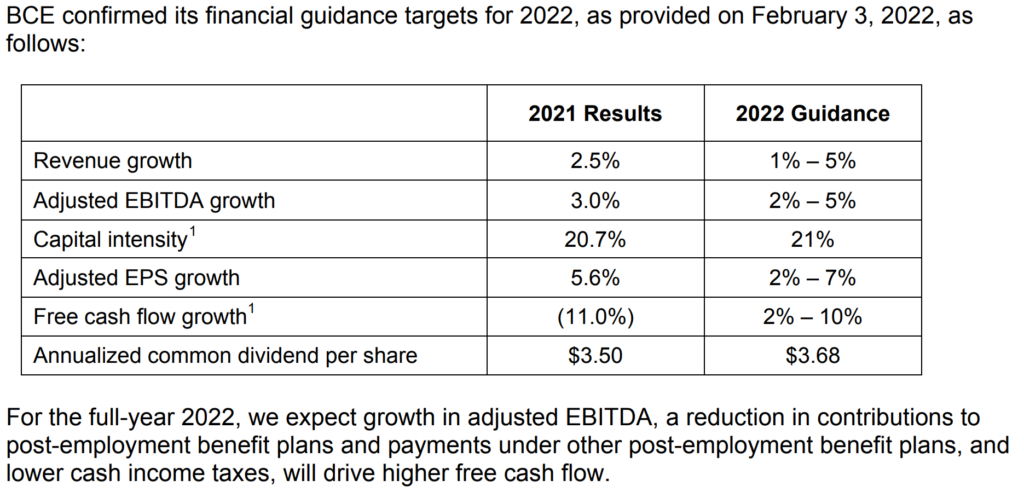

- Reconfirming all 2022 financial guidance targets

Outlook:

See the full Earnings Release here

Telus (T-T)

“In the second quarter, the TELUS team once again demonstrated continued execution excellence, characterized by the consistent combination of industry-leading customer growth, resulting in strong operational and financial results across our business,” said Darren Entwistle, President and CEO. “Our robust performance reflects the potency of our globally leading broadband networks and customer-centric culture, which enabled record second quarter total customer additions of 247,000. This included strong mobile phone net additions of 93,000, our best second quarter result since 2011, and industry-leading total fixed net additions of 62,000, an all-time second quarter record for TELUS. Our leading customer growth is underpinned by our consistent, industry-best client loyalty across our mobile and fixed product lines. Notably, again this quarter, blended mobile phone, PureFibre internet, Optik TV, security and voice churn were all below one per cent. Moreover, our industry-leading postpaid mobile phone churn of 0.64 per cent was unchanged over the prior year period, and represents the seventh quarter out of the last 10 below 0.80 per cent.”

Highlights:

- Industry-leading total Mobile and Fixed customer growth of 247,000, up 24,000 over last year and our strongest second quarter on record, driven by higher year-over-year customer growth across our portfolio of leading Mobile and Fixed services

- Leading customer growth reflects strong demand for our superior bundled offerings over world-leading broadband networks and leading customer loyalty results, including Blended Mobile Phone Churn of 0.81 per cent

- Consolidated Revenue, Adjusted EBITDA, Net Income and Earnings Per Share growth of 7.1 per cent, 8.9 per cent, 45 per cent and 36 per cent, respectively, reflecting consistent execution excellence; Adjusted Net Income and Earnings Per Share of 21 per cent and 23 per cent, respectively

- Continued operating momentum in our high-growth, technology-oriented verticals with robust Revenue growth across TELUS International, TELUS Health and TELUS Agriculture & Consumer Goods

- Shareholders of LifeWorks approve our proposed acquisition; transaction to add significant scale, strengthening TELUS Health’s position as a leading global provider of digital primary and preventative healthcare, mental health and wellness solutions for employers

Outlook:

The assumptions for our 2022 outlook, as described in Section 9 in our 2021 annual MD&A, remain the same, except for the following:

Our revised estimates for 2022 economic growth in Canada, B.C., Alberta, Ontario and Quebec are 3.9%, 4.1%, 5.1%, 3.8% and 3.1%, respectively (compared to 4.3%, 4.2%, 4.4%, 4.5% and 3.7%, respectively, as reported in our 2021 annual MD&A). 11

Our revised estimates for 2022 annual unemployment rates in Canada, B.C., Alberta, Ontario and Quebec are 5.4%, 4.8%, 6.4%, 5.8% and 4.4%, respectively (compared to 6.1%, 5.2%, 7.1%, 6.1% and 5.3%, respectively, as reported in our 2021 annual MD&A).

Our revised estimates for 2022 annual rates of housing starts on an unadjusted basis in Canada, B.C., Alberta, Ontario and Quebec are 240,000 units, 40,000 units, 32,000 units, 87,000 units and 59,000 units, respectively (compared to 224,000 units, 39,000 units, 30,000 units, 83,000 units and 55,000 units, respectively, as reported in our 2021 annual MD&A).

The extent to which the economic growth estimates affect us and the timing of their impact will depend upon the actual experience of specific sectors of the Canadian economy.

Below is a snapshot of ‘The List’ from last Friday’s close. For a sortable version of ‘The List’, please click on The List menu item.

‘The List’ is not meant to be a template for investors to copy exactly. Instead, its purpose is to provide investment ideas and a real-time illustration of dividend growth investing in action. It is not a ‘Buy List’ nor does it reflect the composition or returns of our Magic Pants Wealth-Builder (CDN) Portfolio. It is only a starting point for our analysis and discussion.

The List (2022)

Last updated by BM on August 5, 2022

*Note: The following graph is wide, you can scroll to the right on your device to see more of the data.

| SYMBOL | COMPANY | YLD | PRICE | YTD % | DIV | YTD % | STREAK |

|---|---|---|---|---|---|---|---|

| AQN-N | Algonquin Power & Utilities | 5.0% | $14.07 | -2.0% | $0.70 | 5.4% | 11 |

| ATD-T | Alimentation Couche-Tard Inc. | 0.8% | $57.30 | 10.0% | $0.44 | 18.1% | 12 |

| BCE-T | Bell Canada | 5.7% | $63.72 | -3.3% | $3.64 | 4.0% | 13 |

| BIP-N | Brookfield Infrastructure Partners | 3.5% | $41.02 | 0.7% | $1.44 | 5.9% | 14 |

| CCL-B-T | CCL Industries | 1.5% | $63.40 | -6.5% | $0.96 | 14.3% | 20 |

| CNR-T | Canadian National Railway | 1.8% | $164.33 | 6.1% | $2.93 | 19.1% | 26 |

| CTC-A-T | Canadian Tire | 3.5% | $169.53 | -7.5% | $5.85 | 24.5% | 11 |

| CU-T | Canadian Utilities Limited | 4.5% | $39.90 | 9.0% | $1.78 | 1.0% | 50 |

| DOL-T | Dollarama Inc. | 0.3% | $76.01 | 19.9% | $0.22 | 9.2% | 11 |

| EMA-T | Emera | 4.5% | $59.44 | -5.0% | $2.65 | 2.9% | 15 |

| ENB-T | Enbridge Inc. | 6.2% | $55.35 | 11.7% | $3.44 | 3.0% | 26 |

| ENGH-T | Enghouse Systems Limited | 2.2% | $33.24 | -27.5% | $0.72 | 16.3% | 15 |

| FNV-N | Franco Nevada | 1.0% | $128.24 | -5.8% | $1.28 | 10.3% | 14 |

| FTS-T | Fortis | 3.6% | $59.67 | -1.3% | $2.14 | 2.9% | 48 |

| IFC-T | Intact Financial | 2.1% | $191.40 | 16.9% | $4.00 | 17.6% | 17 |

| L-T | Loblaws | 1.3% | $116.52 | 13.4% | $1.54 | 12.4% | 10 |

| MGA-N | Magna | 2.9% | $61.26 | -24.9% | $1.80 | 4.7% | 12 |

| MRU-T | Metro | 1.6% | $70.30 | 4.9% | $1.10 | 12.2% | 27 |

| RY-T | Royal Bank of Canada | 3.9% | $126.47 | -7.6% | $4.96 | 14.8% | 11 |

| SJ-T | Stella-Jones Inc. | 2.1% | $37.77 | -7.2% | $0.80 | 11.1% | 17 |

| STN-T | Stantec Inc. | 1.1% | $62.16 | -11.4% | $0.71 | 6.8% | 10 |

| TD-T | TD Bank | 4.3% | $83.44 | -16.0% | $3.56 | 12.7% | 11 |

| TFII-N | TFI International | 1.0% | $106.24 | -4.1% | $1.08 | 12.5% | 11 |

| TIH-T | Toromont Industries | 1.4% | $107.51 | -5.4% | $1.52 | 15.2% | 32 |

| TRP-T | TC Energy Corp. | 5.6% | $63.55 | 6.4% | $3.57 | 4.4% | 21 |

| T-T | Telus | 4.6% | $28.92 | -2.8% | $1.33 | 6.2% | 18 |

| WCN-N | Waste Connections | 0.7% | $138.33 | 3.2% | $0.92 | 8.9% | 12 |

| Averages | 2.8% | -1.3% | 10.2% | 18 |

MP Market Review – July 29, 2022

Last updated by BM on August 1, 2022

Summary:

- This article is part of our weekly series (MP Market Review) highlighting the performance and activity from the previous week related to the financial markets and Canadian dividend growth companies we follow on ‘The List’.

- Last week, ‘The List’ was up close to 3% with a minus -0.8% YTD price return (capital). Dividend growth of ‘The List’ remains at 10.2% YTD, demonstrating the rise in income over the last year.

- Last week, there were no dividend increases from companies on ‘The List’.

- Last week, there were ten earnings reports from companies on ‘The List’.

- Four companies on ‘The List’ are due to report earnings this week.

- Are you looking for a portfolio of ideas like these? Magic Pants DGI Premium Membership Subscribers get exclusive access to the MP Wealth-Builder Model Portfolio (CDN). Learn More

“Don’t try to buy at the bottom or sell at the top. This can’t be done except by liars.”

– Bernard Baruch

Last week saw the North American stock markets rally off their recent lows. When markets are in a bear market (down 20% or more from their recent high), this short-term rebound amid a longer-term bear market is known as a bear market bounce. This type of rally can be treacherous for investors who think the bear market is over and jump back in prematurely, only to be quickly disappointed as the bear market continues. They then sell into this downturn driving prices down even further.

It is hard to think that a new bull market is just around the corner when interest rates and inflation are rising, the US is in a technical recession (two consecutive quarters of declining GDP), and global markets are sinking fast.

A time-tested investing process will prevent you from getting caught up in bear market bounces. If our good dividend growers are not sensibly priced, we are okay with waiting until they are. We never feel like we are missing out and jump in too soon.

Performance of ‘The List’

Last week, ‘The List’ was up close to 3% with a minus -0.8% YTD price return (capital). Dividend growth of ‘The List’ remains at 10.2% YTD, demonstrating the rise in income over the last year.

The best performers last week on ‘The List’ were TFI International (TFII-N), up 10.74%; Canadian National Railway (CNR-T), up 8.68%; and Intact Financial (IFC-T), up 6.9%.

Canadian Tire (CTC-A-T) was the worst performer last week, down -3.7%.

Recent News

TC Energy’s Coastal GasLink cost estimate jumps nearly 70 per cent (Globe & Mail)

The 670-km Coastal GasLink pipeline is being built to transport natural gas to an LNG Canada facility at the west coast of British Columbia, Canada’s first LNG export terminal.

COVID-related delays, sabotage and rising prices have all contributed to the cost overruns.

FAANGs ain’t what they used to be, so beware the bear-market bounce says this hedge fund manager (Marketwatch)

The S&P 500 index is up 12.6% from its recent low in June of this year and fresh off the best July performance since 1939. This money manager is not convinced the bottom is in just yet.

“He cites three items of what he terms truly bearish news over recent days; the Fed’s 75 basis point interest rate hike; a consecutive negative real GDP print; and “lousy” mega-cap tech earnings.”

Four companies on ‘The List’ are due to report earnings this week.

Waste Connections (WCN-N) will release its second-quarter 2022 results on Tuesday, August 2, 2022, after markets close.

Brookfield Infrastructure Partners (BIP-N) will release its second-quarter 2022 results on Wednesday, August 3, 2002, before markets open.

Bell Canada (BCE-T) will release its second-quarter 2022 results on Thursday, August 4, 2022, before markets open.

Telus (T-T) will release its second-quarter 2022 results on Friday, August 5, 2022, before markets open.

Dividend Increases

Last week, there were no dividend increases from companies on ‘The List’.

Earnings Releases

Last week, more than one-third of the companies on ‘The List’ reported earnings. Let’s get started with Canadian National Railway.

Canadian National Railway (CNR-T)

“I am proud of our team of railroaders and pleased with our solid performance this quarter. Our team has the network running well, demonstrating improvements in service levels to our customers, driving greater velocity and generating strong financial results. We are preparing for a busy fall and are well positioned to achieve our 2022 outlook.” – Tracy Robinson, President and Chief Executive Officer, CN

Highlights:

- Record revenues of C$4,344 million, an increase of C$746 million or 21%.

- Record operating income of C$1,769 million, an increase of 28%, and record adjusted operating income of C$1,781 million, an increase of 29%.

- Diluted EPS of C$1.92, an increase of 32%, and record adjusted diluted EPS of C$1.93, an increase of 30%.

- Operating ratio, defined as operating expenses as a percentage of revenues, of 59.3%, an improvement of 2.3- points, and adjusted operating ratio of 59.0%, an improvement of 2.6-points.

- Free cash flow for the first six months of 2022 was C$1,568 million compared to C$1,280 million for the same period in 2021.

- Injury frequency rate increased by 43% and the accident rate decreased by 24%.

- Car velocity (car miles per day) improved by 2% and through dwell (entire railroad, hours) improved by 6%.

- Fuel efficiency improved by 4% to a record of 0.838 US gallons of locomotive fuel consumed per 1,000 gross ton miles (GTMs).

- For the month of June, origin train performance, defined as the percentage of actual train departure time compared to designed train departure time at selected yards, reached 91%, an improvement of 14% compared to 80% for the same period in 2021.

Outlook:

Reaffirming 2022 financial outlook

CN confirms its 2022 outlook targeting to deliver approximately 15-20% adjusted diluted EPS growth in 2022. CN continues to target an operating ratio below 60% for 2022 as well as a ROIC of approximately 15%. CN maintains its free cash flow target in the range of C$3.7 billion – C$4.0 billion in 2022.

See the full Earnings Release here

Toromont Industries (TIH-T)

“We are pleased with our operating and financial performance. While end market activity levels remain solid, the persistent supply constraint pressures and inflation variables contributed to a fluid and complex operating environment. The Equipment Group reported good activity in rental and product support, while global supply chain challenges persist and continue to impact timing of equipment and parts deliveries. CIMCO revenues decreased in the quarter on timing of project construction schedules, against a strong comparable last year, while product support activity improved. Across the organization, there is continued attention to our operating disciplines, while working closely with our customers and stakeholders to manage through uncertain conditions.”

Highlights: