Posted by BM on February 14, 2022

“We can beat a bear. 1. Hold through a bear with quality companies: patient retention. 2. Realize that our portfolio of well selected income companies will keep growing (its cash flow) as prices fall. 3. Don’t fret when the price bends a bit. Eventually, with fine firms, CAGR on dividends and price will approach each other. 4. Gradually, we become less dependent on price as a metric, in any case. 5. We knew the bear was coming and winnowed our chaff (weak companies and investment errors).”

-Tom Connolly

The earnings reports for stocks on ‘The List’ this past week were mixed. IFC-T, TFII-T, TIH-T and MGA-N came in well above estimates while T-T, FTS-T and ENB-T were close but slightly missed. IFC-T, TIH-T, ENB-T and MGA-N all raised their dividends.

I’ll go over all our earnings reports in a moment. But first, let’s look at this week’s inflation report coming out of the USA. For January, headline inflation increased by 0.65%.. Over the past year, inflation is up by 7.53%. We are slightly lower in Canada but not by much. That’s the highest year-over-year rate in the United States since February 1982 (that’s 40 years)!

To put this rate of inflation into context, that means that if you have a $1 million portfolio, inflation eats up $75,300 every year.

As dividend growth investors we have built-in inflation protection on our income. The dividend growth from stocks on ‘The List’ is already up 7.3% in 2022 and still growing.

Performance of ‘The List’

The best performers last week on ‘The List’ were TFI International (TFI-T) up 8.7%; Toromont Industries (TIH-T) up 6.5%; Franco Nevada (FNV-N) up 6.0%.

Magna International (MGA-N) was the worst performer this week, down -4.9%.

‘The List’ was down a bit this week with a positive 0.6% YTD price return (capital) and an average of 7.3% in dividend growth (income) added so far for fiscal 2022.

Dividend Increases

There were four companies on ‘The List’ that announced dividend increases this past week and one honorable mention from last year’s list.

Intact Financial (IFC-T) on Tuesday said it increased its 2022 quarterly dividend from $0.91 to $1.00 per share, payable March 31, 2022, to shareholders of record on Mar. 15, 2022.

This represents a dividend increase of 10%, marking the 17th straight year of dividend growth for this growing property and casualty insurance company. This was the second 10% increase in the last three months for IFC-T. IFC-T is another example of a financial company making up for the government-imposed restrictions on raising dividends in 2021.

Toromont Industries (TIH-T) on Wednesday said it increased its 2022 quarterly dividend from $0.35 to $0.39 per share, payable April 4, 2022, to shareholders of record on Mar. 9, 2022.

This represents a dividend increase of 11.4%, marking the 33rd straight year of dividend growth for this Canadian industrial company.

Magna International (MGA-N) on Friday said it increased its 2022 quarterly dividend from $0.43 to $0.45 per share, payable March 11, 2022, to shareholders of record on Feb. 24, 2022.

This represents a dividend increase of 4.7%, marking the 13th straight year of dividend growth for this Canadian auto parts company.

Enbridge (ENB-N) on Friday said it increased its 2022 quarterly dividend from $0.835 to $0.86 per share, payable March 1, 2022, to shareholders of record on Feb. 14, 2022.

This represents a dividend increase of 3%, marking the 27th straight year of dividend growth for this Canadian midstream energy company.

Equitable Group Inc. (EQB-T) on Friday said it increased its 2022 quarterly dividend from $0.185 to $0.28 per share, payable March 31, 2022, to shareholders of record on Mar. 14, 2022.

EQB-T was a good dividend grower from last year’s list but was removed because it did not raise its dividend in 2021 due to government-imposed restrictions. The company has more than made up for last year’s shortfall with this increase on top of a stellar Q4 earnings report. This represents a dividend increase of 51.4%, for this Canadian bank.

Earnings Releases

We had seven earnings reports from companies on ‘The List’ this past week. Let’s start with Intact Financial.

Intact Financial (IFC-T)

The company published these highlights:

- Net operating income per share of $3.78 in Q4-2021 and $12.41 for the full year increased 19% and 25%, respectively, driven by robust underwriting and distribution income, and meaningful accretion from RSA

- EPS growth of 51% in the quarter and 72% in 2021 reflected strong operating results and investment gains

- Operating DPW1 grew 75% in the quarter and 45% in 2021, mainly due to RSA, with healthy organic growth in commercial lines

- Operating combined ratio of 87.8% in Q4-2021 as strong underlying performance outweighed elevated catastrophe losses

- OROE of 17.8% and ROE of 17.0%, with BVPS growth of 40% to $82.34

- Quarterly dividend increased by 10% to $1.00 per common share and initiating share buyback program

Charles Brindamour, Chief Executive Officer, said that IFC-T had a milestone year in 2021 and we would have to agree. The stock was up 5% last week and over 25% in the last year.

TFI International (TFII-T) was one of the top performers on ‘The List’ in 2021 but its stock price had been under a lot of pressure starting out in 2022.

The company published these highlights in their Q4 earnings report:

- Fourth quarter diluted EPS of $1.52 up from $0.91 in Q4 2020, while adjusted diluted EPS1 of $1.57 increased from $0.98

- Fourth quarter operating income of $215.0 million increased from $117.1 million in Q4 2020

- Fourth quarter net cash from operating activities of $190.3 million increased from $164.9 million in Q4 2020

- Full-year diluted EPS of $6.97 up from $3.03 in 2020, while adjusted diluted EPS1 of $5.23 increased from $3.30

Alain Bédard, Chairman, President and Chief Executive Officer called the acquisition of UPS Ground Freight transformational and said that they enter 2022 stronger than ever,

The market must have liked what they read as TFII-T was back on top of ‘The List’ again with an 8.7% jump in it’s share price last week.

Toromont Industries Ltd. (TIH-T)

The company published these Q4 and full year 2021 highlights:

- Revenues in the fourth quarter were $956.0 million, down 4% from the similar period last year. Equipment Group revenues were down 3% on changes in timing of deliveries, inclusive of delays as a result of supply chain disruptions. Revenues at CIMCO were 7% lower on timing of construction projects within the Canadian industrial segment and reduced recreational activity due to pandemic restrictions.

- Revenues increased 12% to $3.9 billion for the year compared to 2020, on improved activity in end markets, reflective of the partial recovery from pandemic restrictions and shutdowns. Deliveries from healthy opening order backlogs(1) and on strong demand in the year generally, drove equipment and packages revenues 18% higher, while product support and rental revenues increased 5% and 8% respectively.

- Operating income increased 17% in the fourth quarter reflecting higher gross margins on strong demand, improved rental fleet utilization, favourable sales mix, cost containment and operational efficiency.

- Operating income increased 28% in 2021, reflecting the higher revenues and higher overall gross margins. Revenue growth exceeded growth in expenses, reflecting continued efforts to focus on cost management and improved efficiencies. Operating income margin increased 150 basis points (“bps”) to 12.2%, compared to 10.7% in 2020.

- Net earnings for the fourth quarter were $105.6 million up 19% and basic EPS (earnings per share) was $1.28, also up 19% from the fourth quarter of 2020.

- For the year, net earnings were $332.7 million, up 31% from 2020, with basic EPS up 30% to $4.03, reflective of the higher activity levels and positive operating leverage.

Included in the earnings report was this statement by management:

“Considering the Company’s strong financial position and long-term outlook, the Board of Directors today increased the quarterly dividend by 11.4% to 39 cents per share. Toromont has paid dividends every year since 1968 and this is the 33rd consecutive year of dividend increases.”

I always pay attention when I am reading earnings reports to hear what management is saying about their dividend policy. It seems management at TIH-T is confident that their impressive dividend growth streak will continue. A recent dividend increase is one of the strongest signals that management can send about their confidence in the business going forward.

Telus (T-T)

The company published these highlights:

- Industry-leading fourth quarter total Mobile and Fixed customer growth of 272,000, our best fourth quarter on record and an increase of 19,000 over last year, driven by robust customer demand for our superior bundled offerings and leading customer loyalty results.

- Total mobile net additions of 193,000, including 112,000 Mobile Phone net additions, an increase of 25,000 over the prior year, and 81,000 Connected Devices.

- Robust wireline net additions of 79,000, our best fourth quarter wireline customer growth on record, including 40,000 Internet customer additions, powered by leading broadband customer experiences over our superior PureFibre network.

- Consolidated Revenue, Net Income, and Adjusted EBITDA grew 20 per cent, 145 per cent, and 7.6 per cent, respectively, excluding the recognized gain on sale of financial solutions business, Revenue and Net Income up 10 per cent and 16 per cent, respectively.

- Strong annual performance in line with guidance, driven by consistent operational execution, leading product offerings, and client service excellence, bolstered by continued strong operating momentum in TELUS International, TELUS Health and TELUS Agriculture.

- Full year consolidated Operating Revenue, Net Income, and Adjusted EBITDA up 9.8 percent, 35 per cent, and 6.4 per cent, respectively, alongside record 960,000 net customer additions

- Targeting 2022 Operating Revenue and Adjusted EBITDA to both increase by 8 to 10 per cent, and Free Cash Flow of $1.0 billion to $1.2 billion

Later in the earnings report I noticed this statement:

“..since 2004, we have returned $21 billion to shareholders, including $15.7 billion in dividends and $5.2 billion in share repurchases, representing over $15 per share. We look forward to updating our dividend growth program for the next three-year period commencing in 2023 at our upcoming AGM in May.”

We will learn in May what dividend growth will look like for the next three years. Knowing that dividends are part of the companies DNA gives us comfort as an investor.

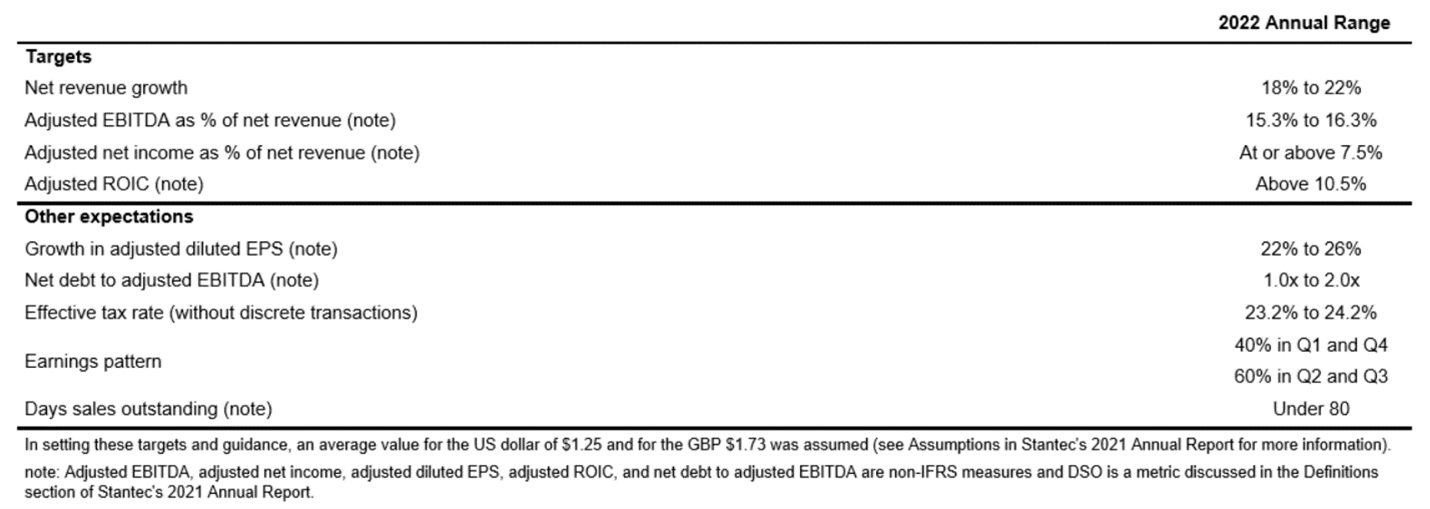

Fortis Inc. (FTS-T)

The company published these highlights in their earnings report:

- Reported annual net earnings of $1,231 million, or $2.61 per common share in 2021

- Adjusted annual net earnings of $1,219 million, or $2.59 per common share

- Deployed capital expenditures of $3.6 billion in 2021 with $600 million invested in cleaner energy infrastructure

- Achieved 20% reduction in Scope 1 emissions through 2021, supporting 75% emissions reduction target by 2035

Fortis expects long-term growth in rate base will support earnings and dividend growth. Fortis is targeting average annual dividend growth of approximately 6% through 2025.

With a 3.5% yield and 6% dividend growth we can expect to earn an annual return close to 10% on this quality dividend grower over time. Provided we buy it at a sensible price.

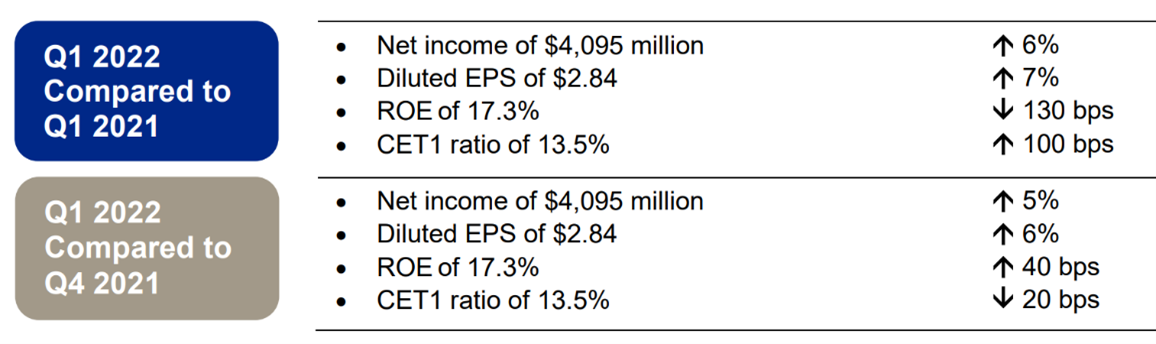

Enbridge Inc. (ENB-T

The company published these highlights:

- Full year GAAP earnings of $5.8 billion or $2.87 per common share, compared with GAAP earnings of $3.0 billion or $1.48 per common share in 2020

- Adjusted earnings* of $5.6 billion or $2.74 per common share*, compared with $4.9 billion or $2.42 per common share* in 2020

- Adjusted earnings before interest, income taxes and depreciation and amortization (EBITDA)* of $14.0 billion, compared with $13.3 billion in 2020

- Cash provided by operating activities of $9.3 billion, compared with $9.8 billion in 2020

- Distributable cash flow (DCF)* of $10.0 billion or $4.96 per common share*, compared with $9.4 billion or $4.67 per common share* in 2020

- Reaffirmed 2022 full year guidance range for EBITDA of $15.0 billion to $15.6 billion and DCF per share of $5.20 to $5.50

- Increased the 2022 quarterly dividend by 3% to $0.86 ($3.44 annually) per share reflecting the 27th consecutive annual increase

- Placed approximately $10 billion of capital projects into service in 2021, which is expected to generate significant EBITDA growth in 2022

- Advanced the current $10 billion secured growth program, which supports the Company’s 5 to 7% DCF per share growth through 2024

- Successfully closed the previously announced US$3.0 billion acquisition of Moda Midstream Operating LLC including the Ingleside Energy Center

- Announced US$0.4 billion Texas Eastern Phase II Modernization program to upgrade and electrify aging compressors increasing safety and reliability and lowering emissions

- Announced US$0.1 billion Appalachia to Market Phase II system expansion, expanding natural gas supply into the U.S. Northeast to meet growing local demand

- Executed pipeline transportation precedent agreement with Texas LNG Brownsville LLC for a US$0.4 billion expansion of the Valley Crossing Pipeline to supply its LNG export terminal

- Entered into a Memorandum of Understanding with Lehigh Cement and announced Letters of Intent with local Indigenous Nations to develop the Open Access Wabamun Carbon Hub

- Advanced ESG priorities by executing on emissions reduction pathways and increasing the diversity of Enbridge’s leadership and Board of Directors

- Announced additional measures to further align the business with our net-zero emissions goals

- Completed the previously announced $1.1 billion sale of Enbridge’s interest in Noverco Inc. (Noverco), providing for additional financial flexibility

- Announced the approval by the Toronto Stock Exchange (TSX) of Enbridge’s normal course issuer bid (NCIB) of up to $1.5 billion

- Issued $750 million of 60-year hybrid debt in the Canadian debt markets with proceeds to be used to redeem the $750 million Enbridge Inc. Preferred Shares – Series 17

ENB-T’s share price seems to be benefitting from higher energy prices in 2022. Dividend growth has slowed considerably so we continue to monitor this company closely.

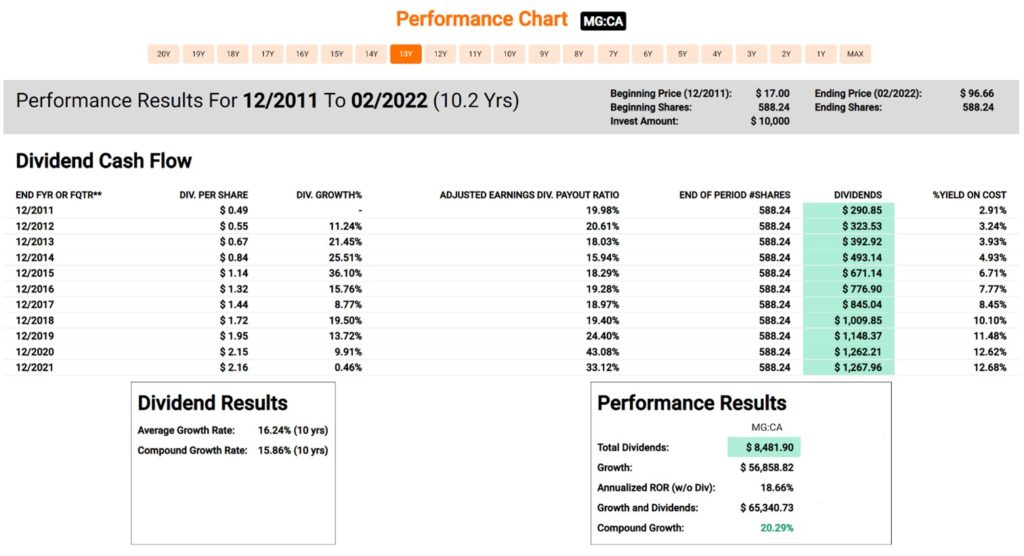

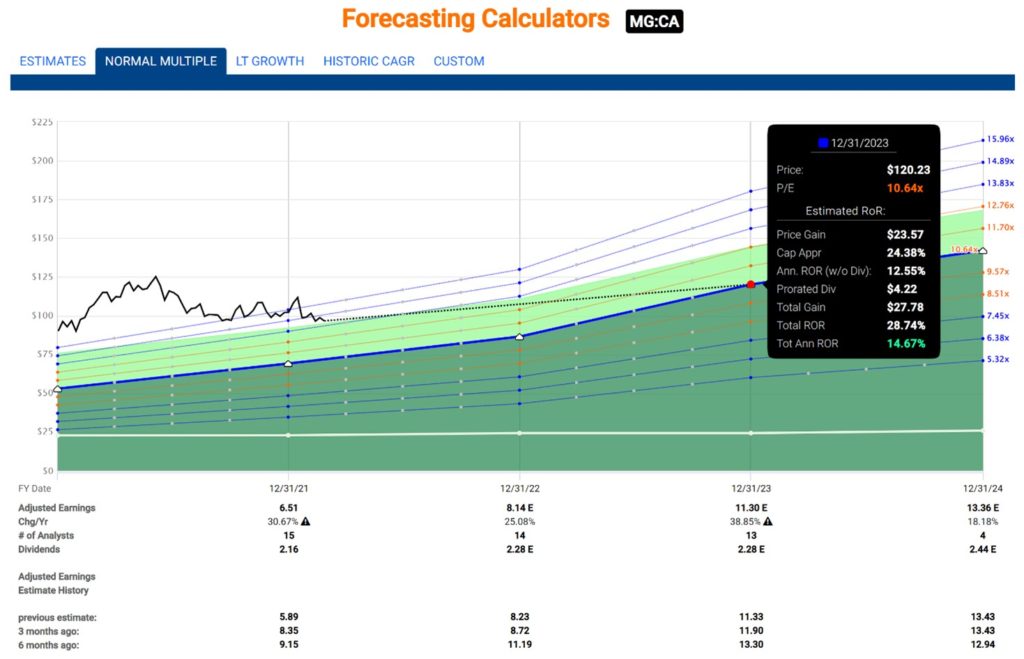

Magna International (MGA-N)

Fourth Quarter 2021 Highlights:

- Sales of $9.1 billion decreased 14%, compared to a 17% decrease in global light vehicle production

- Diluted earnings per share and Adjusted diluted earnings per share of $1.54 and $1.30, respectively, compared to $2.45 and $2.83 last year

- Returned $378 million to shareholders through share repurchases and dividends

- Raised quarterly cash dividend by 5% to $0.45 per share

Full Year 2021 Highlights:

- Sales of $36.2 billion increased 11%, compared to global vehicle production which increased 4%

- Diluted earnings per share and Adjusted diluted earnings per share of $5.00 and $5.13, respectively, compared to $2.52 and $3.95 last year

- Returned over $1 billion to shareholders through share repurchases and dividends

Although Magna beat estimates, year over year comparables were down for many categories. There isn’t a lot in this report to like about MGA-N in the short-term outside of the dividend increase. Things will probably get a little worse before they get better. Keep an eye out for a good buying opportunity in this quality dividend grower in 2022.

Recent News

Here are a few of the companies on ‘The List’ due to report earnings this week:

Emera Inc. (EMA-T) is scheduled to report earnings Monday Feb. 14

TC Energy (TRP-T) is scheduled to report earnings Tuesday Feb. 15

Waste Connections (WCN-T) is scheduled to report earnings after hours Wednesday Feb. 16

Canadian Tire (CTC-T) is scheduled to report earnings Thursday Feb. 17