Two Stocks from ‘The List’ Announce Double-Digit Dividend Increases

Posted by BM on October 29, 2021

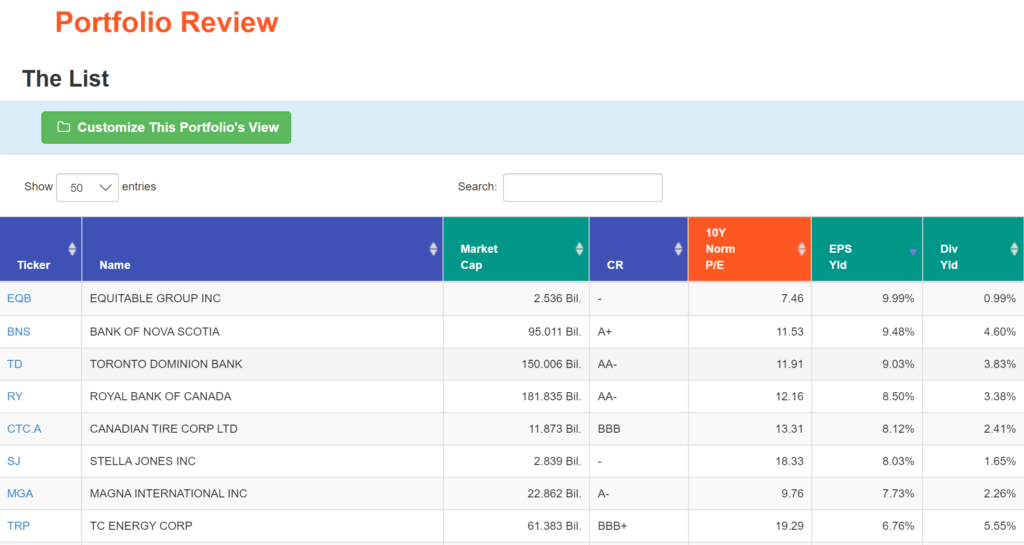

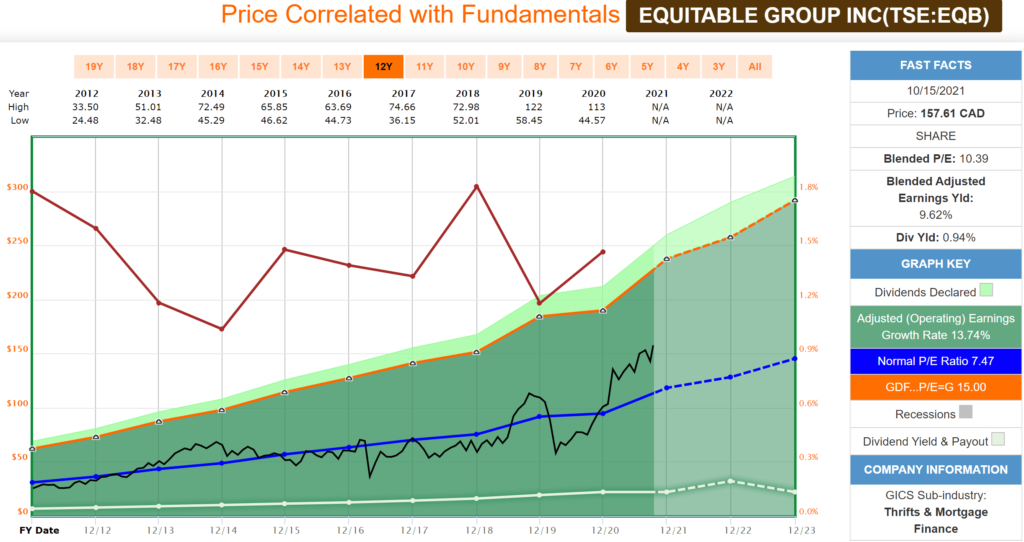

Q3 Earnings season is upon us and the stocks on ‘The List’ continue their stellar performance in 2021.

Waste Connections posts higher Q3 results, lifts full year revenue outlook, raises dividend 12.2%.

05:43 AM EDT, 10/28/2021 (MT Newswires) — Waste Connections (WCN) on Wednesday reported adjusted Q3 net income of $0.89 per share, compared with $0.72 per share a year ago.

Analysts polled by Capital IQ were expecting $0.84 per share.

Revenue totaled $1.60 billion, up from $1.39 billion a year earlier. The consensus estimate was for $1.57 billion.

The waste management company said it now expects 2021 revenue of approximately $6.11 billion, up from its prior projection of $5.98 billion. It expects net income of approximately $633 million and adjusted EBITDA and approximately $1.91 billion, up from its earlier outlook of $1.88 billion.

Waste Connections also announced that the board approved a 12.2% increase in the quarterly dividend to $0.23 per share, payable on Nov. 23 to shareholders of record on Nov. 9.

TFI International reports Q3 adjusted EPS of US $1.46, Hikes dividend by 17%, Announces NCIB

04:38 PM EDT, 10/28/2021 (MT Newswires) — TFI International (TFII.TO) reported (in US$) Q3 2021 net income from continuing operations of $132.8 million, or $1.40 per diluted share, compared with $83.1 million, or $0.90 per diluted share, for the year ago quarter. Operating income from continuing operations grew 65% to $192.8 million from $117 million the prior year period, primarily driven by business acquisitions.

The company reported adjusted income of $138.9 million, or $1.46 per adjusted diluted share. TFI International had recorded adjusted income of $87.4 million or $0.94 per adjusted diluted share for Q3 2020.

Total revenue for the quarter was $2.1 billion, versus $936.1 million for the previous corresponding quarter, a 124% YoY increase. Net of fuel surcharge, total revenue was $1.87 billion, compared with $867 million for the prior year period.

The company said record Q3 results and strong profitability were driven by all four business segments.

The Board approved a $0.27 per share quarterly dividend, a 17% increase over the previous quarterly dividend of $0.23 per share, effective as of the next regular payment, in January.

The TSX has also approved the renewal of TFI International’s normal course issuer bid. TFI International may purchase a maximum of 7 million common shares, representing 7.96% of its public float. The NCIB runs from Nov 2 to Nov 1, next year. Under TFI International’s last NCIB, which expired on Oct 13, the company repurchased 1.15 million common shares at a volume weighted average purchase price of C$98.40 per share.

“During the third quarter, TFI International further built upon this year’s achievements with robust cash flow and strong performance across all business segments, many of which are already surpassing pre-pandemic performance despite ongoing macro disruptions,” stated Alain Bedard, Chairman, President and Chief Executive Officer. “I’m particularly pleased that our strong performance comes at a time when the most compelling benefits from our pivotal acquisition of UPS Freight are still ahead, and yet firmly within grasp as the newly branded TForce Freight continues to exceed expectations under the TFI umbrella.”

When I was still working, I used to listen to the news station on my drive to work every morning. I knew I was going to have a good day when the business update came on and one of my good dividend growers announced a dividend increase. Not only was I getting closer to my retirement goal of replacing my salary with dividend income, I knew that my capital would eventually grow as well.

Waste Connections and TFI International have been two of the three top performers on ‘The List’ in 2021 and they don’t appear to be slowing down based on their recent earnings releases. In our Magic Pants Wealth-Builder portfolio, we were fortunate to enter a position with TFII.TO in September 2020 when the P/E was 13 (today it is 31) unfortunately we never got an opportunity with WCN.TO. The stock price has been on fire since 2015.